OfficeMax 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

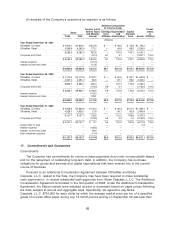

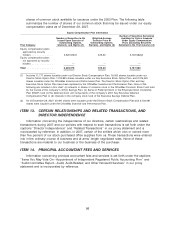

shares of common stock available for issuance under the 2003 Plan. The following table

summarizes the number of shares of our common stock that may be issued under our equity

compensation plans as of December 29, 2007.

Equity Compensation Plan Information

Number of Securities Remaining

Number of Securities to Be Weighted-Average Available for Future Issuance

Issued Upon Exercise of Exercise Price of Under Equity Compensation

Outstanding Options, Outstanding Options, Plans (Excluding Securities

Plan Category Warrants, and Rights (#) Warrants, and Rights ($) Reflected in the First Column) (#)

Equity compensation plans

approved by security

holders ............. 3,320,576(1) $15.30 3,187,582(2)

Equity compensation plans

not approved by security

holders ............. — — —

Total ................ 3,320,576 $15.30 3,187,582

(1) Includes 11,171 shares issuable under our Director Stock Compensation Plan, 19,000 shares issuable under our

Director Stock Option Plan, 1,214,924 shares issuable under our Key Executive Stock Option Plan, and 2,075,481

shares issuable under the OfficeMax Incentive and Performance Plan. The Director Stock Option Plan and Key

Executive Stock Option Plan have been replaced by the OfficeMax Incentive and Performance Plan. None of the

following are included in this chart: (a) interests in shares of common stock in the OfficeMax Common Stock Fund held

by the trustee of the company’s 401(k) Savings Plan, (b) Series D Preferred Stock in the Employee Stock Ownership

Plan (ESOP) fund (c) the deferred stock unit components of the company’s 2001 Key Executive Deferred

Compensation Plan or (d) interests in the company stock fund of the Executive Savings Deferral Plan.

(2) As of December 29, 2007, 53,491 shares were issuable under the Director Stock Compensation Plan and 3,134,091

shares were issuable under the OfficeMax Incentive and Performance Plan.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND

DIRECTOR INDEPENDENCE

Information concerning the independence of our directors, certain relationships and related

transactions during 2007 and our policies with respect to such transactions is set forth under the

captions ‘‘Director Independence’’ and ‘‘Related Transactions’’ in our proxy statement and is

incorporated by reference. In addition, in 2007, certain of the entities which own or owned more

than five percent of our stock purchased office supplies from us. These transactions were entered

into in the ordinary course of business and at arms’ length negotiated rates. None of these

transactions are material to our business or the business of the purchaser.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Information concerning principal accountant fees and services is set forth under the captions

‘‘Items You May Vote On—Appointment of Independent Registered Public Accounting Firm’’ and

‘‘Audit Committee Report—Audit, Audit-Related, and Other Nonaudit Services’’ in our proxy

statement and is incorporated by reference.

98