OfficeMax 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion contains statements about our future financial performance. These

statements are only predictions. Our actual results may differ materially from these predictions. In

evaluating these statements, you should review ‘‘Item 1A, Risk Factors’’ of this Form 10-K, including

‘‘Cautionary and Forward-Looking Statements.’’

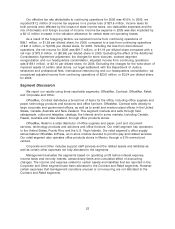

Executive Summary

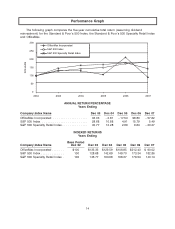

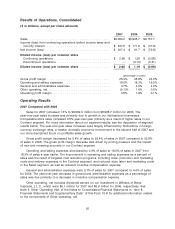

Sales for 2007 were $9.1 billion, compared to $9.0 billion for 2006 and $9.2 billion for 2005.

Net income for 2007 was $207.4 million, or $2.66 per diluted share, compared to $91.7 million, or

$1.19 per diluted share, for 2006 and a net loss of $73.8 million, or $(0.99) per diluted share, for

2005.

Results for the years of 2007, 2006 and 2005 include various items related to the Company’s

previously announced restructuring activities and our transition from a predominately commodity

manufacturing-based company to an independent office products distribution company which are

not expected to be ongoing. Charges and obligations related to many of these items have been

included in our integration activities and facility closures reserve. For more information about these

reserves, see the discussion of ‘‘Integration Activities and Facility Closures’’ below. Some of the

more significant effects of these actions on our results include:

• In 2007, we recognized pre-tax income of $32.5 million and received cash payments from

Boise Cascade L.L.C. of $32.5 million related to the Additional Consideration Agreement that

was entered into in connection with the 2004 sale of our paper, forest products and

timberland assets (the ‘‘Sale’’). This amount was included in Other income (Expense), net

(non-operating). Also, during 2007, we incurred a loss from the sale of OfficeMax, Contract’s

operations in Mexico to Grupo OfficeMax, our 51% owned joint venture, which resulted in a

$1.1 million increase in minority interest, net of income tax. Grupo OfficeMax’s results of

operations are included in our consolidated results of operations.

• In 2006, we recorded pre-tax charges of $89.5 million related to the closing of 109

underperforming, domestic retail stores, $10.3 million primarily related to the reorganization

of our contract segment and $46.4 million primarily related to the consolidation of our

corporate headquarters. These charges were included in Other operating, net in the

Consolidated Statements of Income (Loss) and were reflected in the Retail segment (store

closures), Contract segment (reorganization) and Corporate and Other segment

(headquarters consolidation), respectively. During 2006, we reduced the liability related to the

Additional Consideration Agreement that was entered into in connection with the Sale, which

resulted in a credit to Other income (Expense), net (non-operating) of $48.0 million. We also

recorded an $18.0 million pre-tax charge for the closure of our Elma, Washington

manufacturing facility which was reflected in Discontinued Operations in the Consolidated

Statements of Income (Loss).

• In 2005, we recorded pre-tax charges of $25.0 million related to the consolidation and

relocation of our corporate headquarters, $17.9 million related to the write-down of impaired

assets, primarily as a result of retail store closures, $5.4 million related to the restructuring of

our international operations, and $31.9 million for one-time severance payments, professional

fees and asset write-downs. These charges were reflected in the Retail segment (retail store

impairment), Contract segment (international restructuring) and Corporate and Other

segment (headquarters consolidation, severance, professional fees and asset write-downs),

respectively. In addition, we recognized a $9.8 million pre-tax charge in the Contract segment

17