OfficeMax 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3. Integration Activities and Facility Closures

During 2003, the Company acquired OfficeMax, Inc. for $1.3 billion (the ‘‘Acquisition’’).

Increased scale as a result of the Acquisition allowed management to evaluate the Company’s

combined office products business and to identify opportunities for consolidating operations. Costs

associated with the planned closure and consolidation of acquired OfficeMax, Inc. facilities were

accounted for under EITF Issue No. 95-3, ‘‘Recognition of Liabilities in Connection with a Purchase

Business Combination,’’ and recognized as liabilities in connection with the acquisition and charged

to goodwill. Costs incurred in connection with all other business integration activities have been

recognized in the Consolidated Statement of Income (Loss).

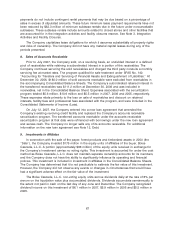

In September 2005, the board of directors approved a plan to relocate and consolidate the

Company’s retail headquarters in Shaker Heights, Ohio and its existing corporate headquarters in

Itasca, Illinois into a new facility in Naperville, Illinois. The Company began the consolidation and

relocation process in the latter half of 2005. The Company has incurred and expensed

approximately $70.9 million of costs related to the headquarters consolidation, including

$45.9 million recognized during 2006 and $25.0 million recognized during the second half of 2005,

all of which were reflected in the Corporate and Other segment. The consolidation and relocation

process was completed during the second half of 2006.

Also in 2005, the Company recorded charges to income of $23.2 million for the write-down of

impaired assets related to underperforming retail stores and the restructuring of its Canadian

operations.

During 2006, the Company announced a reorganization of the Contract segment, and recorded

a pre-tax charge of $7.3 million for employee severance related to the reorganization. The Contract

segment also recorded an additional $3.0 million of costs during 2006 primarily related to a facility

closure and employee severance.

During 2006, the Company closed 109 underperforming domestic retail stores and recorded a

pre-tax charge of $89.5 million, comprised of $11.3 million for employee severance, asset write-off

and impairment and other closure costs and $78.2 million of estimated future lease obligations.

59