OfficeMax 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.related to the headquarters consolidation in our Corporate and Other segment, including

$45.9 million recognized during 2006 and $25.0 million recognized during the second half of 2005.

The consolidation and relocation process was completed during the second half of 2006.

Also in 2005, we recorded charges to income of $23.2 million for the write-down of impaired

assets related to underperforming retail stores and the restructuring of our Canadian operations.

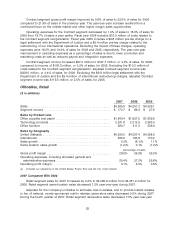

During 2006, we announced the reorganization of our Contract segment and recorded a pre-tax

charge of $7.3 million for employee severance related to the reorganization. The Contract segment

also recorded an additional $3.0 million of costs during 2006, primarily related to a facility closure

and employee severance.

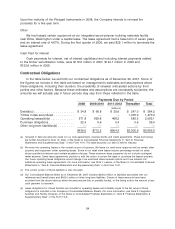

During 2006, we closed 109 underperforming, domestic retail stores and recorded a pre-tax

charge of $89.5 million, comprised of $11.3 million for employee severance, asset write-off and

impairment and other closure costs and $78.2 million of estimated future lease obligations.

We conduct regular reviews of our real estate portfolio to identify underperforming facilities, and

close those facilities that are no longer strategically or economically viable. We record a liability for

the cost associated with a facility closure at its fair value in the period in which the liability is

incurred, which is either the date the lease termination is communicated to the lessor or the

location’s cease-use date. Upon closure, unrecoverable costs are included in facility closure

reserves on the Consolidated Balance Sheets, and include provisions for the present value of future

lease obligations, less contractual or estimated sublease income. Accretion expense is recognized

over the life of the payments.

28