OfficeMax 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

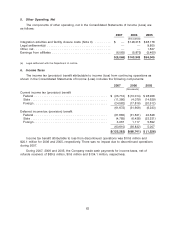

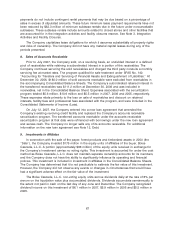

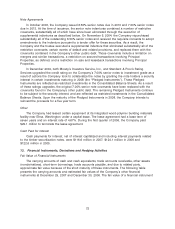

5. Other Operating, Net

The components of other operating, net in the Consolidated Statements of Income (Loss) are

as follows:

2007 2006 2005

(thousands)

Integration activities and facility closure costs (Note 3) ......... $ — $146,216 $ 48,178

Legal settlement(a) ................................... — — 9,800

Other, net .......................................... — — 1,527

Earnings from affiliates ................................ (6,065) (5,873) (5,460)

$(6,065) $140,343 $54,045

(a) Legal settlement with the Department of Justice.

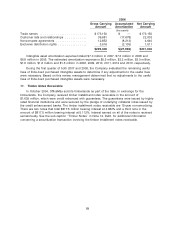

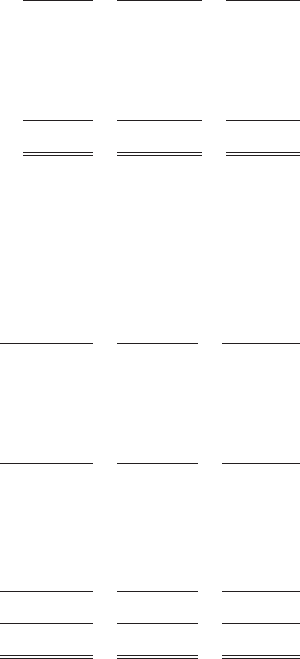

6. Income Taxes

The income tax (provision) benefit attributable to income (loss) from continuing operations as

shown in the Consolidated Statements of Income (Loss) includes the following components:

2007 2006 2005

(thousands)

Current income tax (provision) benefit

Federal ........................................ $ (25,710) $ (10,014) $ 28,908

State .......................................... (11,380) (4,079) (14,629)

Foreign ........................................ (24,582) (17,816) (20,512)

(61,672) (31,909) (6,233)

Deferred income tax (provision) benefit

Federal ........................................ (61,882) (31,521) 22,646

State .......................................... (4,785) (6,428) (23,331)

Foreign ........................................ 3,057 1,117 5,692

(63,610) (36,832) 5,007

$(125,282) $(68,741) $ (1,226)

Income tax benefit attributable to loss from discontinued operations was $10.6 million and

$20.1 million for 2006 and 2005, respectively. There was no impact due to discontinued operations

during 2007.

During 2007, 2006 and 2005, the Company made cash payments for income taxes, net of

refunds received, of $89.5 million, $0.6 million and $134.1 million, respectively.

62