OfficeMax 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ruiz De Luzuriaga, Jane E. Shaw, Carolyn M. Ticknor, Ward W. Woods, Brian C. Cornell, David M.

Szymanski, Richard R. Goodmanson, Donald N. MacDonald, and Frank A. Schrontz. The complaint

also names the following former directors of OfficeMax, Inc. as defendants: Michael Feuer, Lee

Fisher, Edwin J. Holman, Jerry Sue Thornton, Burnett W. Donoho, Michael F. Killeen, Ivan J.

Winfield, and Jacqueline Woods. OfficeMax Incorporated is named as a nominal defendant. The

complaint purports to assert, among other things, various common law derivative claims against the

individual defendants including breach of fiduciary duty and unjust enrichment. The complaint

seeks an award in favor of OfficeMax and against the individual defendants of an unspecified

amount of damages, disgorgement of benefits and compensation, equitable or injunctive relief,

costs, including attorneys’ fees, and such other relief as the court deems just and proper. Pursuant

to provisions of company’s bylaws, fees and other expenses incurred in connection with the

foregoing derivative action are being advanced on behalf of those present and former officers and

directors by the company.

The Company is also involved in other litigation and administrative proceedings arising in the

normal course of business. In the opinion of management, the Company’s recovery, if any, or

liability, if any, under such pending litigation or administrative proceedings would not materially

affect the Company’s financial position, results of operations or cash flows.

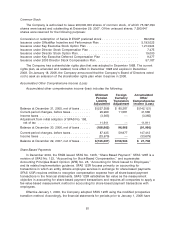

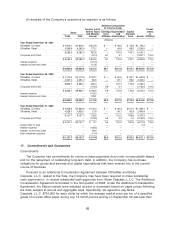

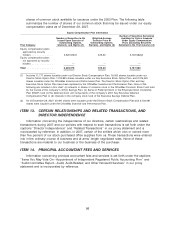

19. Quarterly Results of Operations (unaudited)

Summarized quarterly financial data is as follows:

2007 2006

First(a) Second Third Fourth(b) First(c) Second(d) Third(e) Fourth(f)

(millions, except per-share and stock price information)

Sales .................. $2,436 $2,132 $2,315 $2,199 $2,424 $2,041 $2,244 $2,257

Income (loss) from continuing

operations ............ 59 27 50 71 (14) 27 31 55

Income (loss) from

discontinued operations . . . — — — — (11) — — 4

Net income (loss) ......... 59 27 50 71 (25) 27 31 59

Net income (loss) per

common share from

continuing operations(g)

Basic ................ .77 .35 .65 .93 (.21) .36 .41 .72

Diluted ............... .76 .35 .64 .92 (.21) .35 .41 .71

Net income (loss) per

common share(g)

Basic ................ .77 .35 .65 .93 (.37) .36 .41 .76

Diluted ............... .76 .35 .64 .92 (.37) .35 .41 .76

Common stock dividends

paid per share ......... .15 .15 .15 .15 .15 .15 .15 .15

Common stock prices(h)

High ................. 55.40 54.38 40.16 34.89 31.73 44.73 45.38 51.80

Low................. 47.87 38.64 30.96 20.38 24.72 30.42 38.78 40.26

(a) Includes $1.1 million of charges from the sale of OfficeMax Contract’s operations in Mexico to Grupo OfficeMax, our

51% owned joint venture. This was recorded as an increase in minority interest, net of income tax.

(b) Includes $32.5 million of income from adjustments to the estimated fair value of the Additional Consideration

Agreement we entered into in connection with the sale of our paper, forest products and timberland assets in 2004.

(c) Includes $98.5 million of store closing and impairment charges, $15.7 million of charges related to headquarters

consolidation and $11.0 million of charges for the write-down of impaired assets at the Company’s Elma, Washington

manufacturing facility that is accounted for as a discontinued operation.

91