OfficeMax 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

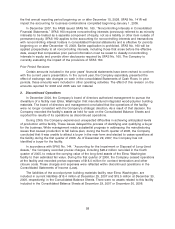

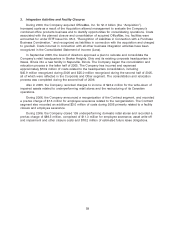

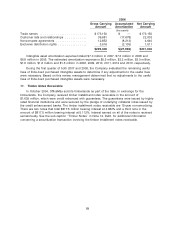

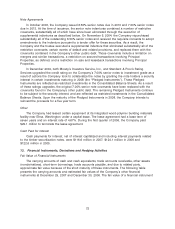

The tax effects of temporary differences that give rise to significant portions of the deferred tax

assets and deferred tax liabilities at year-end are presented below.

2007 2006

(thousands)

Current deferred tax assets (liabilities) attributable to

Accrued expenses ......................................... $ 38,096 $ 40,231

Net operating loss carryforwards ............................... 7,213 43,489

Allowances for receivables and rebates .......................... 29,605 17,998

Compensation and benefits .................................. 23,397 11,657

Inventory ................................................ 3,780 (6,047)

Property and equipment ..................................... 16,754 —

Alternative minimum tax and other credit carryforwards ............... 53,919 —

Other temporary differences .................................. 357 17,124

Contingency reserves ....................................... 11,949 5,044

Total current net deferred tax assets ........................... $ 185,070 $ 129,496

Noncurrent deferred tax assets (liabilities) attributable to

Deferred gain(a) ........................................... (473,838) (473,838)

Alternative minimum tax and other credit carryforwards ............... 188,033 214,590

Compensation and benefits .................................. 103,065 152,221

Net operating loss carryforwards ............................... 40,381 66,849

Reserves ................................................ 24,864 44,445

Investments .............................................. 6,399 10,046

Goodwill ................................................ (30,802) (33,110)

Other non-current liabilities ................................... 5,179 3,010

Undistributed earnings ...................................... (4,955) (4,776)

Deferred charges .......................................... 2,086 2,692

Property and equipment ..................................... 15,505 14,300

Other temporary differences .................................. 21 (4,430)

(124,062) (8,001)

Less: Valuation allowance .................................... (30,300) (30,734)

Total noncurrent net deferred tax assets (liabilities) ............... $(154,362) $ (38,735)

(a) Includes $543.8 million related to the gain on the sale of the Company’s timberlands to affiliates of Boise Cascade,

L.L.C. that was deferred until 2019 for tax purposes.

In assessing the realizability of deferred tax assets, management considers whether it is more

likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate

realization of deferred tax assets is dependent upon the generation of future taxable income during

the periods in which those temporary differences become deductible. Management considers the

scheduled reversal of deferred tax liabilities, projected future taxable income, and tax planning

strategies in making this assessment. Management believes it is more likely than not that the

Company will realize the benefits of these deductible differences, except for certain state net

operating losses as noted below. The amount of the deferred tax assets considered realizable,

however, could be reduced if estimates of future taxable income during the carryforward period are

reduced.

The Company has established a valuation allowance related to net operating loss carryforwards

in jurisdictions where the Company has substantially reduced operations because management

believes it is more likely than not that these items will expire before the Company is able to realize

their benefits. Periodically, the valuation allowance is reviewed and adjusted based on

64