OfficeMax 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the first annual reporting period beginning on or after December 15, 2008. SFAS No. 141R will

impact the accounting for business combinations completed beginning January 1, 2009.

In December 2007, the FASB issued SFAS No. 160, ‘‘Noncontrolling Interests in Consolidated

Financial Statements.’’ SFAS 160 requires noncontrolling interests (previously referred to as minority

interests) to be treated as a separate component of equity, not as a liability or other item outside of

permanent equity. SFAS 160 applies to the accounting for noncontrolling interests and transactions

with noncontrolling interest holders in consolidated financial statements and is effective for periods

beginning on or after December 15, 2008. Earlier application is prohibited. SFAS No. 160 will be

applied prospectively to all noncontrolling interests, including those that arose before the effective

date, except that comparative prior period information must be recast to classify noncontrolling

interests in equity and provide other disclosures required by SFAS No. 160. The Company is

currently evaluating the impact of the provisions of SFAS 160.

Prior Period Revisions

Certain amounts included in the prior years’ financial statements have been revised to conform

with the current year’s presentation. In the current year, the Company separately presented the

effect of exchange rate changes on cash in the consolidated Statements of Cash Flows. In prior

periods, these amounts were included in other operating activities. The effect of this revision on the

amounts reported for 2006 and 2005 was not material.

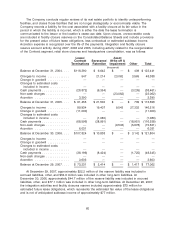

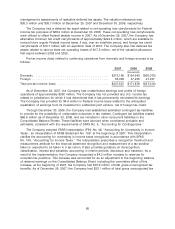

2. Discontinued Operations

In December 2004, the Company’s board of directors authorized management to pursue the

divestiture of a facility near Elma, Washington that manufactured integrated wood-polymer building

materials. The board of directors and management concluded that the operations of the facility

were no longer consistent with the Company’s strategic direction. As a result of that decision, the

Company recorded the facility’s assets as held for sale on the Consolidated Balance Sheets and

reported the results of its operations as discontinued operations.

During 2005, the Company experienced unexpected difficulties in achieving anticipated levels

of production at the facility. These issues delayed the process of identifying and qualifying a buyer

for the business. While management made substantial progress in addressing the manufacturing

issues that caused production to fall below plan, during the fourth quarter of 2005, the Company

concluded that it was unable to attract a buyer in the near term and elected to cease operations at

the facility during the first quarter of 2006. As of December 29, 2007, the Company has not

identified a buyer for the facility.

In accordance with SFAS No. 144, ‘‘Accounting for the Impairment or Disposal of Long-Lived

Assets,’’ the Company recorded pre-tax charges, including $28.2 million recorded in the fourth

quarter of 2005, to reduce the carrying value of the long-lived assets of the Elma, Washington

facility to their estimated fair value. During the first quarter of 2006, the Company ceased operations

at the facility and recorded pre-tax expenses of $18.0 million for contract termination and other

closure costs. These charges and expenses were reflected within discontinued operations in the

Consolidated Statements of Income (Loss).

The liabilities of the wood-polymer building materials facility near Elma, Washington, are

included in current liabilities ($15.4 million at December 29, 2007 and $15.5 million at December 30,

2006, respectively) in the Consolidated Balance Sheets. There were no assets related to this facility

included in the Consolidated Balance Sheets at December 29, 2007 or December 30, 2006.

58