OfficeMax 2007 Annual Report Download - page 89

Download and view the complete annual report

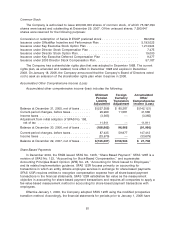

Please find page 89 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The remaining compensation expense to be recognized related to outstanding stock options,

net of estimated forfeitures, is approximately $0.6 million. At December 29, 2007, the aggregate

intrinsic value was $0.2 million for outstanding stock options and exercisable stock options. The

aggregate intrinsic value represents the total pre-tax intrinsic value (i.e. the difference between the

Company’s closing stock price on the last trading day of the fourth quarter of 2007 and the

exercise price, multiplied by the number of in-the-money options at the end of the quarter).

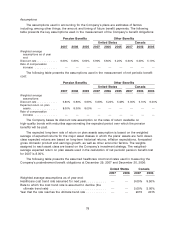

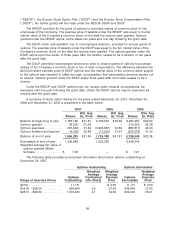

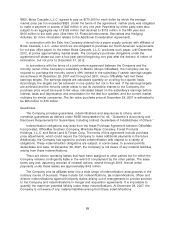

The Company did not grant any stock options during 2006. To calculate stock-based employee

compensation expense under the fair value method as outlined in SFAS 123(R) for 2007 grants and

SFAS 123 for 2005 grants, the Company estimated the fair value of each option award on the date

of grant using the Black-Scholes option pricing model with the following weighted-average

assumptions: risk-free interest rates of 4.5% in 2007 and 4.3% in 2005 (based on the applicable

Treasury bill rate); expected dividends of 60 cents per share in both years (based on actual cash

dividends expected to be paid); expected life of 3.0 years in 2007 and 3.4 years in 2005 (based on

the time period options are expected to be outstanding based on historical experience); and

expected stock price volatility of 35.5% in 2007 and 28% in 2005 (based on the historical volatility of

the Company’s common stock).

Other

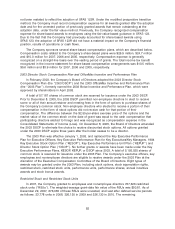

In May 2005, the Company repurchased 23.5 million shares of its common stock and the

associated common stock purchase rights through a modified Dutch auction tender offer at a

purchase price of $775.5 million, or $33.00 per share, plus transaction costs.

In September 1995, the Company’s Board of Directors authorized the purchase of up to

4.3 million shares of the Company’s common stock. As part of this authorization, the Company

repurchased odd-lot shares (fewer than 100 shares) from shareholders wishing to exit their holdings

in the Company’s common stock. Shares repurchased under this program are retired. Since 1995,

the Company has repurchased 50,577 shares of common stock under this authorization, including

907 shares in 2006 and 2,190 shares in 2005. The Company’s Board of Directors terminated the

share repurchase authorization in December 2006.

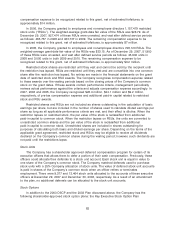

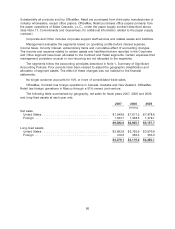

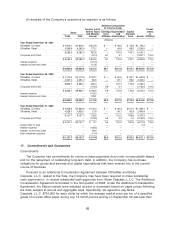

16. Segment Information

The Company manages its business using three reportable segments: OfficeMax, Contract;

OfficeMax, Retail; and Corporate and Other. Management reviews the performance of the Company

based on these segments.

OfficeMax, Contract distributes a broad line of items for the office, including office supplies and

paper, technology products and solutions and office furniture. OfficeMax, Contract sells directly to

large corporate and government offices, as well as small and medium-sized offices in the United

States, Canada, Australia and New Zealand. This segment markets and sells through field

salespeople, outbound telesales, catalogs, the Internet and in some markets, including Canada,

Hawaii, Australia and New Zealand, through office products stores. Substantially all products sold

by OfficeMax, Contract are purchased from third-party manufacturers or industry wholesalers,

except office papers. OfficeMax, Contract purchases office papers primarily from the paper

operations of Boise Cascade, L.L.C., under a 12-year paper supply contract. (See Note 17,

Commitments and Guarantees, for additional information related to the paper supply contract.)

OfficeMax, Retail is a retail distributor of office supplies and paper, print and document

services, technology products and solutions and office furniture. OfficeMax, Retail has operations in

the United States, Puerto Rico and the U.S. Virgin Islands. OfficeMax, Retail office supply stores

feature OfficeMax ImPress, an in-store module devoted to print-for-pay and related services. The

retail segment also operates office supply stores in Mexico through a 51%-owned joint venture.

85