OfficeMax 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.outstanding debt instruments due to changes in interest rates. The Company has from time to time

entered into interest rate swap agreements that effectively convert the interest rate on certain

fixed-rate debt to a variable rate. The Company has designated these interest rate swap

agreements as hedges of the changes in fair value of the underlying debt obligation attributable to

changes in interest rates and accounted for them as fair value hedges. Changes in the fair value of

interest rate swaps designated as hedging instruments that effectively offset the variability in the fair

value of outstanding debt obligations are reported in operations. These amounts offset the gain or

loss (that is, the change in fair value) of the hedged debt instrument that is attributable to changes

in interest rates (that is, the hedged risk) which is also recognized currently in operations. The

Company has also from time to time entered into interest rate swap agreements that effectively

convert floating rate debt to a fixed rate obligation. These swaps have been designated as hedges

of floating interest rate payments attributable to changes in interest rates and accounted for as cash

flow hedges, with changes in the fair value of the swap recorded to accumulated other

comprehensive income (loss) until the hedged transaction occurs, at which time it is reclassified to

operations.

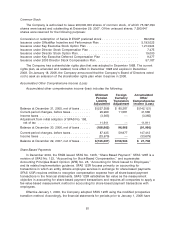

Additional Consideration Agreement

Pursuant to an Additional Consideration Agreement between OfficeMax and Boise Cascade,

L.L.C., the Company may have been required to make substantial cash payments to, or receive

substantial cash payments from, Boise Cascade, L.L.C. As described below, the Additional

Consideration Agreement terminated in the first quarter of 2008. Under the Additional Consideration

Agreement, the Sale proceeds were adjusted upward or downward based on paper prices following

the Sale, subject to annual and aggregate caps. Specifically, the Company agreed to pay Boise

Cascade, L.L.C. $710,000 for each dollar by which the average market price per ton of a specified

benchmark grade of cut-size office paper during any 12-month period ending on September 30 was

less than $800. Boise Cascade, L.L.C. agreed to pay us $710,000 for each dollar by which the

average market price per ton exceeded $920. Under the terms of the agreement, neither party was

obligated to make a payment in excess of $45 million in any one year. Payments by either party

were also subject to an aggregate cap of $125 million that declined to $115 million in the fifth year

and $105 million in the sixth year.

In connection with recording the Sale in 2004, the Company recognized a $42 million projected

future obligation related to the Additional Consideration Agreement based on internal estimates and

published industry paper price projections. The Company recognized accretion expense totaling

approximately $6.0 million in the Consolidated Statements of Income (Loss) in 2006 and 2005.

The Company recorded changes in the fair value of the Additional Consideration Agreement in

net income (loss) in the period they occur; however, any potential payments from Boise Cascade,

L.L.C. to us were not recorded in net income (loss) until all contingencies had been satisfied, which

was generally at the end of a 12-month measurement period ending on September 30. Due to

increases in actual and projected paper prices, the change in fair value of this obligation resulted in

the recognition of non-operating income in our Consolidated Statement of Income (Loss) of

$48.0 million in 2006 and $32.5 million in 2007. Based upon actual and projected paper prices at

December 29, 2007 and December 30, 2006, we did not recognize an asset or liability in our

Consolidated Balance Sheet related to the Additional Consideration Agreement.

In February 2008, Boise Cascade, L.L.C. sold a majority interest in its paper and packaging

and newsprint businesses to Aldabra 2 Acquisition Corp. As a result of this transaction, the

Additional Consideration Agreement terminated and no further payments will be required of either

party.

74