OfficeMax 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

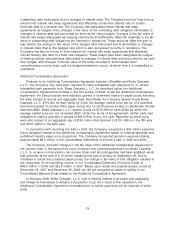

12. Debt

Long-Term Debt

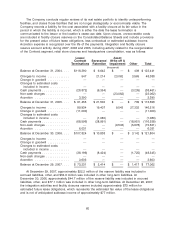

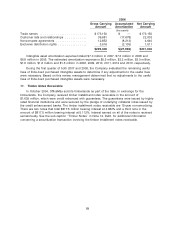

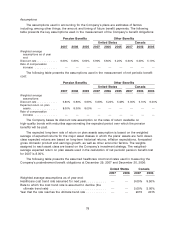

Long-term debt, almost all of which is unsecured, consists of the following at year end:

2007 2006

(thousands)

7.50% notes, due in 2008 .................................. $ 29,656 $ 29,656

9.45% debentures, due in 2009 .............................. 35,707 35,707

6.50% notes, due in 2010 .................................. 13,680 13,680

7.00% notes, due in 2013 .................................. 19,100 19,100

7.35% debentures, due in 2016 .............................. 17,967 17,967

Medium-term notes, Series A, with interest rates averaging 7.8% and

7.7%, due in varying amounts annually through 2013 ............. 56,900 82,300

Revenue bonds, with interest rates averaging 6.4% and 6.4%, due in

varying amounts annually through 2029 ...................... 189,930 189,930

American & Foreign Power Company Inc. 5% debentures, due in 2030 . 18,526 18,526

Other indebtedness, with interest rates averaging 7.1% and 5.5%, due in

varying amounts annually through 2017 ...................... 3,412 3,687

384,878 410,553

Less unamortized discount ................................. 630 673

Less current portion ...................................... 34,827 25,634

349,421 384,246

5.42% securitized timber notes, due in 2019 ..................... 735,000 735,000

5.54% securitized timber notes, due in 2019 ..................... 735,000 735,000

$1,819,421 $1,854,246

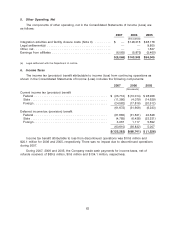

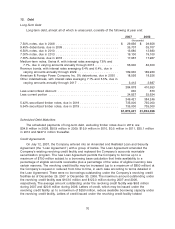

Scheduled Debt Maturities

The scheduled payments of long-term debt, excluding timber notes due in 2019, are

$34.8 million in 2008, $50.9 million in 2009, $15.9 million in 2010, $0.5 million in 2011, $35.1 million

in 2012 and $247.0 million thereafter.

Credit Agreements

On July 12, 2007, the Company entered into an Amended and Restated Loan and Security

Agreement (the ‘‘Loan Agreement’’) with a group of banks. The Loan Agreement amended the

Company’s existing revolving credit facility and replaced the Company’s accounts receivable

securitization program. The new Loan Agreement permits the Company to borrow up to a

maximum of $700 million subject to a borrowing base calculation that limits availability to a

percentage of eligible accounts receivable plus a percentage of the value of eligible inventory less

certain reserves. The revolving credit facility may be increased (up to a maximum of $800 million) at

the Company’s request or reduced from time to time, in each case according to terms detailed in

the Loan Agreement. There were no borrowings outstanding under the Company’s revolving credit

facilities as of December 29, 2007 or December 30, 2006. The maximum amount outstanding under

the revolving credit facility was $103.0 million and $122.0 million during 2007 and 2006,

respectively. The average amount outstanding under the revolving credit facility was $6.8 million

during 2007 and $20.6 million during 2006. Letters of credit, which may be issued under the

revolving credit facility up to a maximum of $250 million, reduce available borrowing capacity under

the revolving credit facility. Letters of credit issued under the revolving credit facility totaled

70