OfficeMax 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

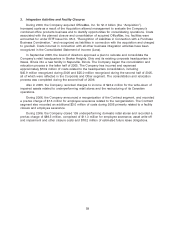

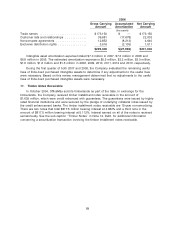

4. Net Income (Loss) Per Common Share

Basic net income (loss) per share is calculated using net earnings available to common

stockholders divided by the weighted-average number of shares of common stock outstanding

during the year. Diluted net income (loss) per share is similar to basic net income (loss) per share

except that the weighted-average number of shares of common stock outstanding is increased to

include the number of additional shares of common stock that would have been outstanding

assuming the issuance of all potentially dilutive shares, such as common stock to be issued upon

exercise of options and non-vested restricted shares, and, if dilutive, the conversion of outstanding

preferred stock. Net income (loss) per common share was determined by dividing net income

(loss), as adjusted, by weighted average shares outstanding as follows:

2007 2006 2005

(thousands, except per-share amounts)

Basic income (loss) per common share:

Income (loss) from continuing operations .................. $207,373 $ 99,054 $ (41,212)

Preferred dividends .................................. (3,961) (4,037) (4,378)

Basic income (loss) from continuing operations ............. 203,412 95,017 (45,590)

Loss from discontinued operations ....................... — (7,333) (32,550)

Basic income (loss) .................................. $203,412 $87,684 $(78,140)

Average shares—basic ............................... 75,274 73,142 78,745

Basic income (loss) per common share:

Continuing operations .............................. $ 2.70 $ 1.30 $ (0.58)

Discontinued operations ............................. — (0.10) (0.41)

Basic income (loss) per common share ................... $ 2.70 $ 1.20 $ (0.99)

Diluted income (loss) per common share:

Basic income (loss) from continuing operations ............. $203,412 $ 95,017 $ (45,590)

Preferred dividends eliminated(a) ........................ — — —

Diluted income (loss) from continuing operations ............ 203,412 95,017 (45,590)

Loss from discontinued operations ....................... — (7,333) (32,550)

Diluted income (loss) ................................ $203,412 $87,684 $(78,140)

Average shares—basic ............................... 75,274 73,142 78,745

Restricted stock, stock options and other .................. 1,100 571 —

Series D Convertible Preferred Stock ..................... —— —

Average shares—diluted(a)(b)(c) ........................ 76,374 73,713 78,745

Diluted income (loss) per common share:

Continuing operations .............................. $ 2.66 $ 1.29 $ (0.58)

Discontinued operations ............................. — (.10) (0.41)

Diluted income (loss) per common share .................. $ 2.66 $ 1.19 $ (0.99)

(a) The assumed conversion of outstanding preferred stock was anti-dilutive in all periods presented, and therefore no

adjustment was required to determine diluted income (loss) from continuing operations or average shares-diluted.

(b) Options to purchase 0.4 million shares of common stock were outstanding during 2007, but were not included in the

computation of diluted income (loss) per common share because the impact would have been anti-dilutive as the

option price is higher than the average market price during the year.

(c) Options to purchase 3.8 million shares of common stock were outstanding during 2005, but were not included in the

computation of diluted income (loss) per common share because the impact would have been anti-dilutive due to the

net loss recognized in the period.

61