OfficeMax 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

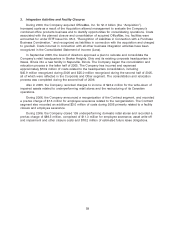

management’s assessments of realizable deferred tax assets. The valuation allowance was

$30.3 million and $30.7 million at December 29, 2007 and December 30, 2006, respectively.

The Company had a deferred tax asset related to net operating loss carryforwards for Federal

income tax purposes of $68.2 million at December 30, 2006. These net operating loss carryforwards

were utilized to offset Federal taxable income in 2007. As of December 29, 2007, the Company has

alternative minimum tax credit carryforwards of approximately $224.8 million, which are available to

reduce future regular Federal income taxes, if any, over an indefinite period, and foreign tax credit

carryforwards of $10.7 million with an expiration date of 2016. The Company also has deferred tax

assets related to various state net operating losses of $17.2 million, net of the valuation allowance,

that expire between 2008 and 2025.

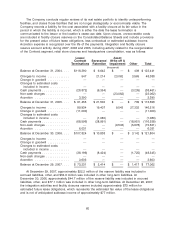

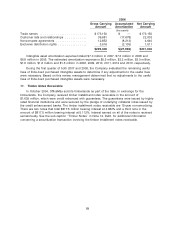

Pre-tax income (loss) related to continuing operations from domestic and foreign sources is as

follows:

2007 2006 2005

(thousands)

Domestic ......................................... $272,169 $124,643 $(65,073)

Foreign .......................................... 65,358 47,235 27,457

Total pre-tax income (loss) ............................ $337,527 $171,878 $(37,616)

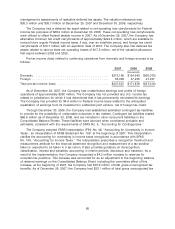

As of December 29, 2007, the Company had undistributed earnings and profits of foreign

operations of approximately $360 million. The Company has not provided any U.S. income tax

related to jurisdictions for which it has determined that it has permanently reinvested its earnings.

The Company has provided for $4.9 million in Federal income taxes related to the anticipated

repatriation of earnings from its investment in a Mexican joint venture, net of foreign tax credit.

Through December 30, 2006, the Company had established estimated contingent tax liabilities

to provide for the possibility of unfavorable outcomes in tax matters. Contingent tax liabilities totaled

$66.6 million as of December 30, 2006, and are included in other noncurrent liabilities in the

Consolidated Balance Sheets. These liabilities were accrued when considered probable and

estimable, consistent with the requirements of SFAS No. 5, ‘‘Accounting for Contingencies.’’

The Company adopted FASB Interpretation (FIN) No. 48, ‘‘Accounting for Uncertainty in Income

Taxes - an interpretation of FASB Statement No. 109’’ at the beginning of 2007. This Interpretation

clarifies the accounting for uncertainty in income taxes recognized in accordance with SFAS

No. 109, ‘‘Accounting for Income Taxes.’’ The Interpretation prescribes a recognition threshold and

measurement attribute for the financial statement recognition and measurement of a tax position

taken or expected to be taken in a tax return. It also provides guidance on derecognition,

classification, interest and penalties, accounting in interim periods, disclosure and transition. As a

result of the implementation, the Company recognized a $4.0 million increase to reserves for

uncertain tax positions. This increase was accounted for as an adjustment to the beginning balance

of retained earnings on the Consolidated Balance Sheet. Including the cumulative effect of this

increase, at the beginning of 2007, the Company had $70.6 million of total gross unrecognized tax

benefits. As of December 29, 2007, the Company had $33.1 million of total gross unrecognized tax

65