Nike 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

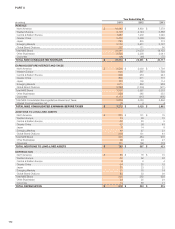

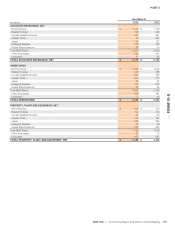

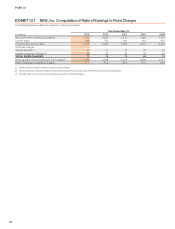

Revenues by Major Product Lines. Revenues to external customers for NIKE Brand products are attributable to sales of footwear, apparel and equipment. Other

revenues to external customers primarily include external sales by Converse, Hurley, and NIKE Golf.

Year Ended May 31,

(In millions) 2013 2012 2011

Footwear $ 14,539 $ 13,428 $ 11,519

Apparel 6,820 6,336 5,516

Equipment 1,405 1,204 1,022

Other 2,549 2,363 2,060

TOTAL NIKE CONSOLIDATED REVENUES $ 25,313 $ 23,331 $ 20,117

Revenues and Long-Lived Assets by

Geographic Area

Geographical area information is similar to what is reflected above under

operating segments with the exception of the Other activity, which has been

allocated to the geographical areas based on the location where the sales

originated. Revenues derived in the United States were $11,385 million,

$9,793 million, and $8,467 million for the years ended May 31, 2013, 2012,

and 2011, respectively. The Company’s largest concentrations of long-lived

assets primarily consist of the Company’s world headquarters and

distribution facilities in the United States and distribution facilities in Japan,

Belgium and China. Long-lived assets attributable to operations in the

United States, which are primarily composed of net property, plant &

equipment, were $1,424 million, $1,204 million, and $1,056 million at May 31,

2013, 2012, and 2011, respectively. Long-lived assets attributable to

operations in Japan were $270 million, $360 million, and $361 million at

May 31, 2013, 2012, and 2011, respectively. Long-lived assets attributable to

operations in Belgium were $157 million, $164 million, and $182 million at

May 31, 2013, 2012, and 2011, respectively. Long-lived assets attributable to

operations in China were $212 million, $188 million, and $175 million at

May 31, 2013, 2012, and 2011, respectively.

Major Customers

No customer accounted for 10% or more of the Company’s net revenues

during the years ended May 31, 2013, 2012, and 2011.

ITEM 9. Changes In and Disagreements with

Accountants on Accounting and Financial

Disclosure

There has been no change of accountants nor any disagreements with accountants on any matter of accounting principles or practices or financial statement

disclosure required to be reported under this Item.

ITEM 9A. Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure

information required to be disclosed in our Exchange Act reports is recorded,

processed, summarized and reported within the time periods specified in the

Securities and Exchange Commission’s rules and forms and that such

information is accumulated and communicated to our management,

including our Chief Executive Officer and Chief Financial Officer, as

appropriate, to allow for timely decisions regarding required disclosure. In

designing and evaluating the disclosure controls and procedures,

management recognizes that any controls and procedures, no matter how

well designed and operated, can provide only reasonable assurance of

achieving the desired control objectives, and management is required to

apply its judgment in evaluating the cost-benefit relationship of possible

controls and procedures.

We carry out a variety of on-going procedures, under the supervision and with

the participation of our management, including our Chief Executive Officer

and Chief Financial Officer, to evaluate the effectiveness of the design and

operation of our disclosure controls and procedures. Based on the foregoing,

our Chief Executive Officer and Chief Financial Officer concluded that our

disclosure controls and procedures were effective at the reasonable

assurance level as of May 31, 2013.

“Management’s Annual Report on Internal Control Over Financial Reporting”

is included in Item 8 of this Report.

There has been no change in our internal control over financial reporting

during our most recent fiscal quarter that has materially affected, or is

reasonable likely to materially affect, our internal control over financial

reporting.

ITEM 9B. Other Information

No disclosure is required under this Item.

114