Nike 2013 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

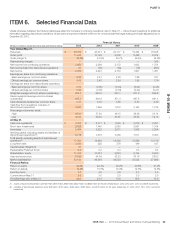

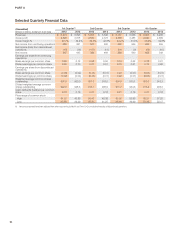

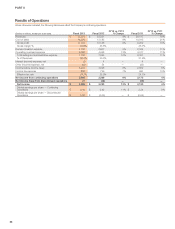

PART II

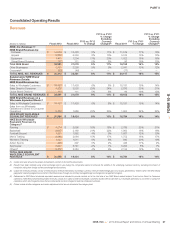

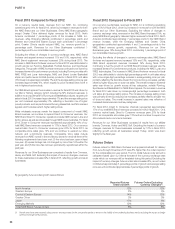

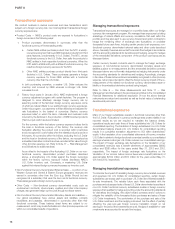

Western Europe

(Dollars in millions) Fiscal 2013 Fiscal 2012

FY13 vs. FY12

% Change

FY13 vs. FY12

% Change

Excluding

Currency

Changes Fiscal 2011

FY12 vs. FY11

% Change

FY12 vs. FY11

% Change

Excluding

Currency

Changes

Revenues by:

Footwear $ 2,646 $ 2,526 5% 10% $ 2,345 8% 5%

Apparel 1,261 1,377 -8% -4% 1,303 6% 2%

Equipment 221 241 -8% -3% 220 10% 5%

TOTAL REVENUES $ 4,128 $ 4,144 0% 5% $ 3,868 7% 4%

Revenues by:

Sales to Wholesale Customers $ 3,416 $ 3,556 -4% 1% $ 3,385 5% 2%

Sales Direct to Consumer 712 588 21% 27% 483 22% 18%

TOTAL REVENUES $ 4,128 $ 4,144 0% 5% $ 3,868 7% 4%

EARNINGS BEFORE INTEREST

AND TAXES $ 640 $ 597 7% $ 730 -18%

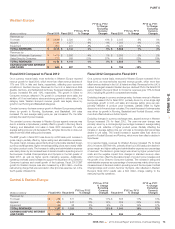

Fiscal 2013 Compared to Fiscal 2012

On a currency neutral basis, most territories in Western Europe reported

revenue growth for fiscal 2013, which more than offset revenue declines of

17% and 18% in Italy and Iberia, respectively, reflecting poor economic

conditions in Southern Europe. Revenues for the U.K. & Ireland and AGS

(Austria, Germany, and Switzerland) territories, the largest markets in Western

Europe, increased 8% and 12%, respectively. The growth in Direct to

Consumer revenues reflected 17% growth in comparable store sales, the

addition of 19 net new factory stores and strong growth in online sales. On a

category basis, Western Europe’s revenue growth was largely driven by

growth in our Running and Basketball categories.

Constant currency footwear revenue growth in Western Europe was primarily

driven by growth in Running, Sportswear, and Basketball. Unit sales

increased 7% and average selling price per pair increased 3%, the latter

primarily the result of price increases.

The constant currency decrease in Western Europe apparel revenues was

due to a decline in Sportswear, partially offset by growth in Running, Men’s

Training, and Basketball. Unit sales in fiscal 2013 decreased 1% while

average selling price per unit decreased 3%, as higher discounts on close-out

sales more than offset selling price increases.

The EBIT growth in fiscal 2013 was driven by a 200 basis point increase in

gross margin, partially offset by higher selling and administrative expenses.

The gross margin increase was primarily driven by favorable standard foreign

currency exchange rates; higher net average selling prices were mostly offset

by higher product costs. The increase in selling and administrative expense

was mainly driven by an increased level of demand creation spending around

the European Football Championships and Olympics in the first quarter of

fiscal 2013, as well as higher sports marketing expense. Additionally,

operating overhead costs increased to support the expansion of our Direct to

Consumer business and overall growth of the business. Fiscal 2013 EBIT

growth for Western Europe was also increased by a $24 million, one-time

restructuring charge that was recorded in other (income) expense, net, in the

fourth quarter of fiscal 2012.

Fiscal 2012 Compared to Fiscal 2011

On a currency neutral basis, revenues for Western Europe increased 4% for

fiscal 2012, as most territories reported revenue growth, which more than

offset revenue declines in the U.K. & Ireland and Italy. Revenues for the U.K. &

Ireland, the largest market in Western Europe, declined 3% for the fiscal 2012

period. Western Europe’s Direct to Consumer revenues grew 18% for fiscal

2012, including 8% growth in comparable store sales.

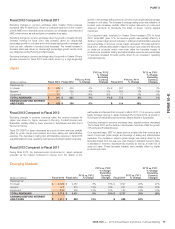

Excluding changes in currency exchange rates, footwear revenue in Western

Europe increased 5% for fiscal 2012, primarily driven by a low-single-digit

percentage growth in both unit sales and average selling price per pair,

primarily reflective of product price increases, partially offset by higher

discounts on in-line and close-out sales. The overall increase in footwear sales

was driven by growth in Running, Basketball and Football (Soccer), which

more than offset a decline in Action Sports.

Excluding changes in currency exchange rates, apparel revenue in Western

Europe increased 2% for fiscal 2012. The year-over-year change was

primarily driven by a mid-single-digit percentage increase in average selling

price per unit, reflective of higher product prices. Partially offsetting the

increase in average selling price per unit was a mid-single-digit percentage

decline in unit sales. The overall increase in apparel sales was driven by

growth in Football (Soccer) and Running, which more than offset a decline in

Sportswear.

On a reported basis, revenues for Western Europe increased 7% for fiscal

2012. However, EBIT fell 18%, primarily driven by a 350 basis point decline in

gross margin and higher selling and administrative expense as a percentage

of revenues. The decline in gross margin was driven by higher product input

costs and the negative impact from changes in standard currency rates,

which more than offset the favorable impact of product price increases and

the growth of our Direct to Consumer business. The increase in selling and

administrative expense as a percentage of revenues was mainly driven by an

increased level of demand creation spending around the European Football

Championships and London Summer Olympics. Also reflected in Western

Europe’s fiscal 2012 results was a $24 million charge relating to the

restructuring of its operations.

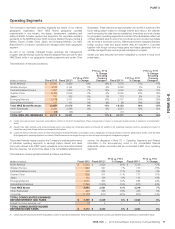

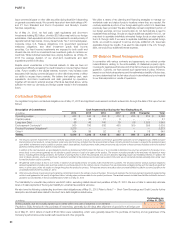

Central & Eastern Europe

(Dollars in millions) Fiscal 2013 Fiscal 2012

FY13 vs. FY12

% Change

FY13 vs. FY12

% Change

Excluding

Currency

Changes Fiscal 2011

FY12 vs. FY11

% Change

FY12 vs. FY11

% Change

Excluding

Currency

Changes

Revenues by:

Footwear $ 714 $ 671 6% 11% $ 605 11% 13%

Apparel 483 441 10% 14% 359 23% 24%

Equipment 90 88 2% 9% 76 16% 17%

TOTAL REVENUES $ 1,287 $ 1,200 7% 12% $ 1,040 15% 17%

EARNINGS BEFORE INTEREST

AND TAXES $ 259 $ 234 11% $ 244 -4%

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 73

FORM 10-K