Nike 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

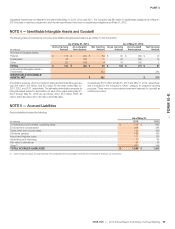

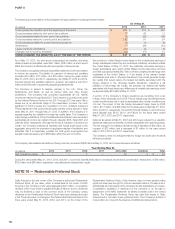

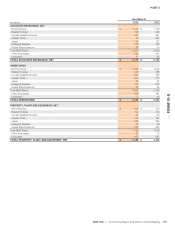

NOTE 14 — Accumulated Other Comprehensive Income

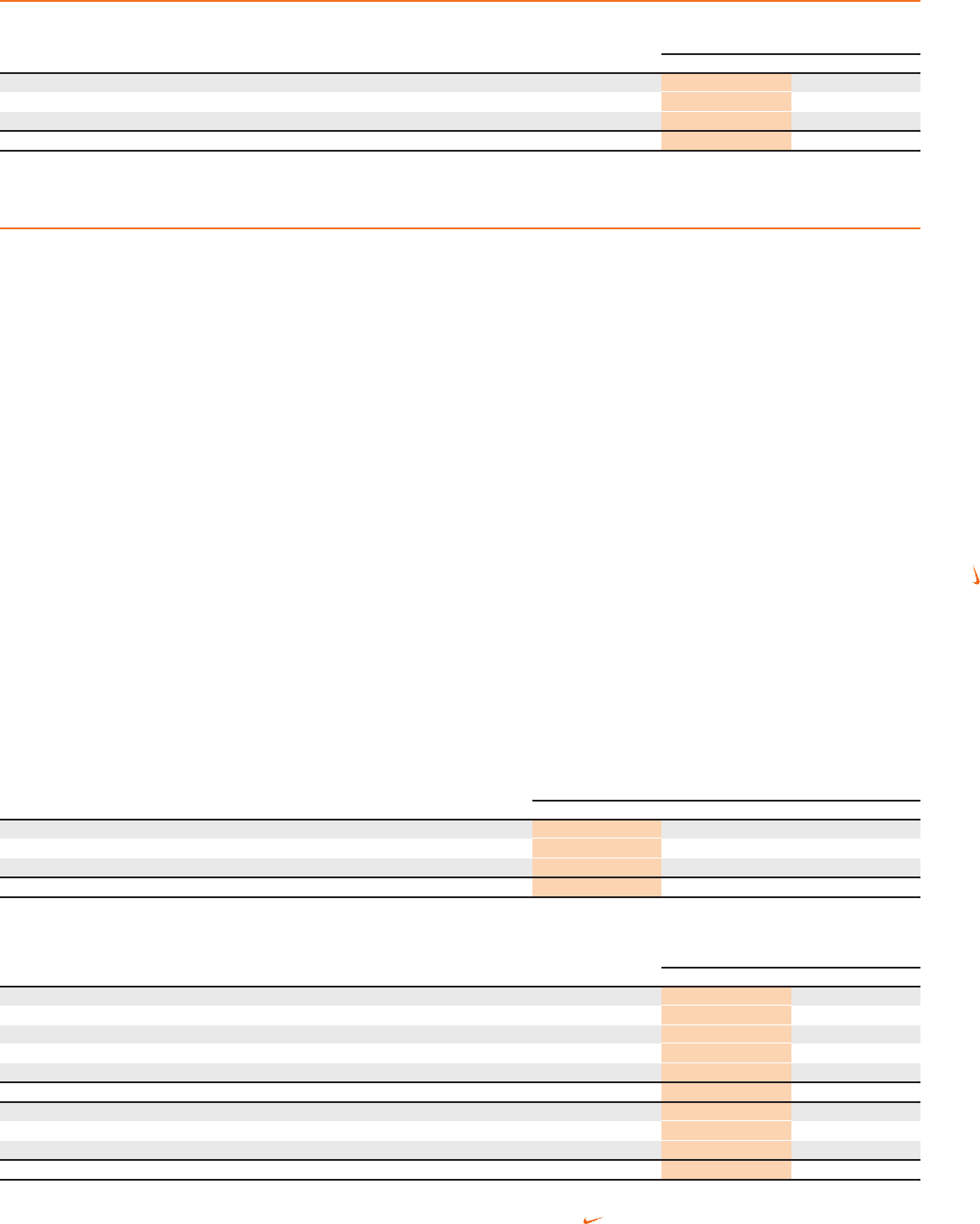

The components of accumulated other comprehensive income, net of tax, are as follows:

May 31

(In millions) 2013 2012

Cumulative translation adjustment and other $ (14) $ (127)

Net deferred gain on cash flow hedge derivatives 193 181

Net deferred gain on net investment hedge derivatives 95 95

ACCUMULATED OTHER COMPREHENSIVE INCOME $ 274 $ 149

Refer to Note 17 — Risk Management and Derivatives for more information on the Company’s risk management program and derivatives.

NOTE 15 — Discontinued Operations

The Company continually evaluates its existing portfolio of businesses to

ensure resources are invested in those businesses that are accretive to the

NIKE Brand and represent the largest growth potential and highest returns.

During the year, the Company divested of Umbro and Cole Haan, allowing it

to focus its resources on driving growth in the NIKE, Jordan, Converse and

Hurley brands.

On February 1, 2013, the Company completed the sale of Cole Haan to Apax

Partners for an agreed upon purchase price of $570 million and received at

closing $561 million, net of $9 million of purchase price adjustments. The

transaction resulted in a gain on sale of $231 million, net of $137 million in tax

expense; this gain is included in the net income (loss) from discontinued

operations line item on the consolidated statements of income. There were no

adjustments to these recorded amounts as of May 31, 2013. Beginning

November 30, 2012, the Company classified the Cole Haan disposal group

as held-for-sale and presented the results of Cole Haan’s operations in the

net income (loss) from discontinued operations line item on the consolidated

statements of income. From this date until the sale, the assets and liabilities of

Cole Haan were recorded in the assets of discontinued operations and

liabilities of discontinued operations line items on the consolidated balance

sheets, respectively. Previously, these amounts were reported in the

Company’s segment presentation as “Other Businesses.”

Under the sale agreement, the Company agreed to provide certain transition

services to Cole Haan for an expected period of 3 to 9 months from the date

of sale. The Company will also license NIKE proprietary Air and Lunar

technologies to Cole Haan for a transition period. The continuing cash flows

related to these items are not expected to be significant to Cole Haan and the

Company will have no significant continuing involvement with Cole Haan

beyond the transition services. Additionally, preexisting guarantees of certain

Cole Haan lease payments remain in place after the sale; the maximum

exposure under the guarantees is $44 million at May 31, 2013. The fair value

of the guarantees is not material.

On November 30, 2012, the Company completed the sale of certain assets of

Umbro to Iconix Brand Group (“Iconix”) for $225 million. The Umbro disposal

group was classified as held-for-sale as of November 30, 2012 and the

results of Umbro’s operations are presented in the net income (loss) from

discontinued operations line item on the consolidated statements of income.

The remaining liabilities of Umbro are recorded in the liabilities of discontinued

operations line items on the consolidated balance sheets. Previously, these

amounts were reported in the Company’s segment presentation as “Other

Businesses.” Upon meeting the held-for-sale criteria, the Company recorded

a loss of $107 million, net of tax, on the sale of Umbro and the loss is included

in the net income (loss) from discontinued operations line item on the

consolidated statements of income. The loss on sale was calculated as the

net sales price less Umbro assets of $248 million, including intangibles,

goodwill, and fixed assets, other miscellaneous charges of $22 million, and

the release of the associated cumulative translation adjustment of $129

million. The tax benefit on the loss was $67 million. There were no

adjustments to these recorded amounts as of May 31, 2013.

Under the sale agreement, the Company provided transition services to Iconix

while certain markets were transitioned to Iconix-designated licensees. These

transition services are complete and the Company has wound down the

remaining operations of Umbro.

For the year ended May 31, 2013, net income (loss) from discontinued

operations included, for both businesses, the net gain or loss on sale, net

operating losses, tax expenses, and approximately $20 million in wind down

costs.

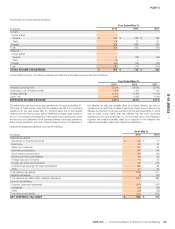

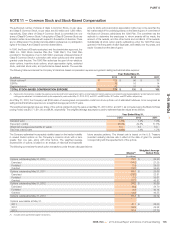

Summarized results of the Company’s discontinued operations are as follows:

Year Ended May 31,

(In millions) 2013 2012 2011

Revenues $ 523 $ 796 $ 746

Income (loss) before income taxes 108 (43) (18)

Income tax expense (benefit) 87 3 21

Net income (loss) from discontinued operations $ 21 $ (46) $ (39)

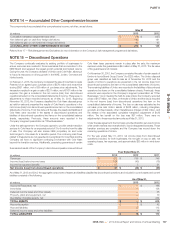

As of May 31, 2013 and 2012, the aggregate components of assets and liabilities classified as discontinued operations and included in current assets and current

liabilities consisted of the following:

As of May 31,

(In millions) 2013 2012

Accounts Receivable, net $ — $ 148

Inventories — 128

Deferred income taxes and other assets —35

Property, plant and equipment, net —70

Identifiable intangible assets, net — 234

TOTAL ASSETS $ — $ 615

Accounts payable $1$42

Accrued liabilities 17 112

Deferred income taxes and other liabilities —16

TOTAL LIABILITIES $ 18 $ 170

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 107

FORM 10-K