Nike 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

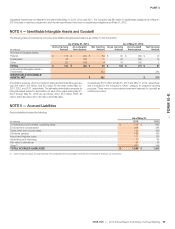

The market valuation approach indicates the fair value of the business based

on a comparison of the reporting unit to comparable publicly traded

companies in similar lines of business. Significant estimates in the market

valuation approach model include identifying similar companies with

comparable business factors such as size, growth, profitability, risk and return

on investment, and assessing comparable revenue and operating income

multiples in estimating the fair value of the reporting unit.

Indefinite-lived intangible assets primarily consist of acquired trade names and

trademarks. The Company may first perform a qualitative assessment to

determine whether it is more likely than not that an indefinite-lived intangible

asset is impaired. If, after assessing the totality of events and circumstances,

the Company determines that it is more likely than not that the indefinite-lived

intangible asset is not impaired, no quantitative fair value measurement is

necessary. If a quantitative fair value measurement calculation is required for

these intangible assets, the Company utilizes the relief-from-royalty method.

This method assumes that trade names and trademarks have value to the

extent that their owner is relieved of the obligation to pay royalties for the

benefits received from them. This method requires the Company to estimate

the future revenue for the related brands, the appropriate royalty rate and the

weighted average cost of capital.

Operating Leases

The Company leases retail store space, certain distribution and warehouse

facilities, office space, and other non-real estate assets under operating

leases. Operating lease agreements may contain rent escalation clauses, rent

holidays or certain landlord incentives, including tenant improvement

allowances. Rent expense for non-cancelable operating leases with

scheduled rent increases or landlord incentives are recognized on a straight-

line basis over the lease term, beginning with the effective lease

commencement date, which is generally the date in which the Company

takes possession of or controls the physical use of the property. Certain

leases also provide for contingent rents, which are determined as a

percentage of sales in excess of specified levels. A contingent rent liability is

recognized together with the corresponding rent expense when specified

levels have been achieved or when the Company determines that achieving

the specified levels during the period is probable.

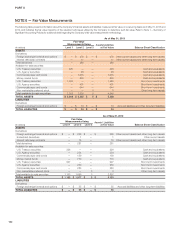

Fair Value Measurements

The Company measures certain financial assets and liabilities at fair value on a

recurring basis, including derivatives and available-for-sale securities. Fair

value is the price the Company would receive to sell an asset or pay to transfer

a liability in an orderly transaction with a market participant at the

measurement date. The Company uses a three-level hierarchy established by

the Financial Accounting Standards Board (“FASB”) that prioritizes fair value

measurements based on the types of inputs used for the various valuation

techniques (market approach, income approach, and cost approach).

The levels of hierarchy are described below:

•Level 1: Observable inputs such as quoted prices in active markets for

identical assets or liabilities.

•Level 2: Inputs other than quoted prices that are observable for the asset or

liability, either directly or indirectly; these include quoted prices for similar

assets or liabilities in active markets and quoted prices for identical or similar

assets or liabilities in markets that are not active.

•Level 3: Unobservable inputs for which there is little or no market data

available, which require the reporting entity to develop its own assumptions.

The Company’s assessment of the significance of a particular input to the fair

value measurement in its entirety requires judgment and considers factors

specific to the asset or liability. Financial assets and liabilities are classified in

their entirety based on the most conservative level of input that is significant to

the fair value measurement.

Pricing vendors are utilized for certain Level 1 and Level 2 investments. These

vendors either provide a quoted market price in an active market or use

observable inputs without applying significant adjustments in their pricing.

Observable inputs include broker quotes, interest rates and yield curves

observable at commonly quoted intervals, volatilities and credit risks. The

Company’s fair value processes include controls that are designed to ensure

appropriate fair values are recorded. These controls include an analysis of

period-over-period fluctuations and comparison to another independent

pricing vendor.

Refer to Note 6 — Fair Value Measurements for additional information.

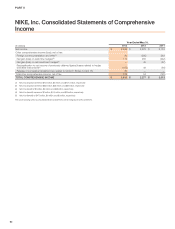

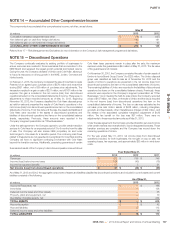

Foreign Currency Translation and Foreign

Currency Transactions

Adjustments resulting from translating foreign functional currency financial

statements into U.S. Dollars are included in the foreign currency translation

adjustment, a component of accumulated other comprehensive income in

shareholders’ equity.

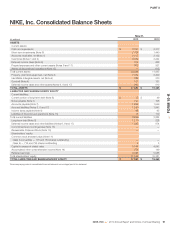

The Company’s global subsidiaries have various assets and liabilities,

primarily receivables and payables, which are denominated in currencies

other than their functional currency. These balance sheet items are subject to

remeasurement, the impact of which is recorded in other (income) expense,

net, within the consolidated statements of income.

Accounting for Derivatives and Hedging

Activities

The Company uses derivative financial instruments to reduce its exposure to

changes in foreign currency exchange rates and interest rates. All derivatives

are recorded at fair value on the balance sheet and changes in the fair value of

derivative financial instruments are either recognized in other comprehensive

income (a component of shareholders’ equity), debt or net income depending

on the nature of the underlying exposure, whether the derivative is formally

designated as a hedge, and, if designated, the extent to which the hedge is

effective. The Company classifies the cash flows at settlement from

derivatives in the same category as the cash flows from the related hedged

items. For undesignated hedges and designated cash flow hedges, this is

within the cash provided by operations component of the consolidated

statements of cash flows. For designated net investment hedges, this is

generally within the cash provided or used by investing activities component

of the cash flow statement. As our fair value hedges are receive-fixed, pay-

variable interest rate swaps, the cash flows associated with these derivative

instruments are periodic interest payments while the swaps are outstanding.

These cash flows are reflected within the cash provided by operations

component of the cash flow statement.

RefertoNote17—RiskManagementand Derivatives for more information

on the Company’s risk management program and derivatives.

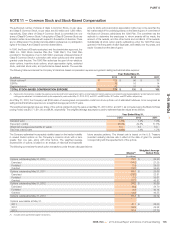

Stock-Based Compensation

The Company estimates the fair value of options and stock appreciation rights

granted under the NIKE, Inc. 1990 Stock Incentive Plan (the “1990 Plan”) and

employees’ purchase rights under the Employee Stock Purchase Plans

(“ESPPs”) using the Black-Scholes option pricing model. The Company

recognizes this fair value, net of estimated forfeitures, as selling and

administrative expense in the consolidated statements of income over the

vesting period using the straight-line method.

Refer to Note 11 — Common Stock and Stock-Based Compensation for

more information on the Company’s stock programs.

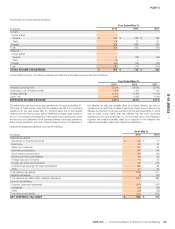

Income Taxes

The Company accounts for income taxes using the asset and liability method.

This approach requires the recognition of deferred tax assets and liabilities for

the expected future tax consequences of temporary differences between the

carrying amounts and the tax basis of assets and liabilities. The Company

records a valuation allowance to reduce deferred tax assets to the amount

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 97

FORM 10-K