Nike 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

NOTE 11 — Common Stock and Stock-Based Compensation

The authorized number of shares of Class A Common Stock, no par value,

and Class B Common Stock, no par value, are 200 million and 1,200 million,

respectively. Each share of Class A Common Stock is convertible into one

share of Class B Common Stock. Voting rights of Class B Common Stock are

limited in certain circumstances with respect to the election of directors. There

are no differences in the dividend and liquidation preferences or participation

rights of the Class A and Class B common shareholders.

In 1990, the Board of Directors adopted, and the shareholders approved, the

NIKE, Inc. 1990 Stock Incentive Plan (the “1990 Plan”). The 1990 Plan

provides for the issuance of up to 326 million previously unissued shares of

Class B Common Stock in connection with stock options and other awards

granted under the plan. The 1990 Plan authorizes the grant of non-statutory

stock options, incentive stock options, stock appreciation rights, restricted

stock, restricted stock units, and performance-based awards. The exercise

price for stock options and stock appreciation rights may not be less than the

fair market value of the underlying shares on the date of grant. A committee of

the Board of Directors administers the 1990 Plan. The committee has the

authority to determine the employees to whom awards will be made, the

amount of the awards, and the other terms and conditions of the awards.

Substantially all stock option grants outstanding under the 1990 Plan were

granted in the first quarter of each fiscal year, vest ratably over four years, and

expire 10 years from the date of grant.

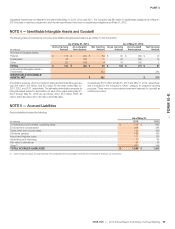

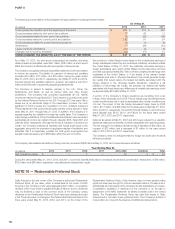

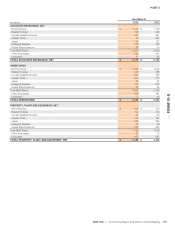

The following table summarizes the Company’s total stock-based compensation expense recognized in selling and administrative expense:

Year Ended May 31,

(In millions) 2013 2012 2011

Stock options(1) $ 123 $ 96 $ 77

ESPPs 19 16 14

Restricted stock 32 18 14

TOTAL STOCK-BASED COMPENSATION EXPENSE $ 174 $ 130 $ 105

(1) Expense for stock options includes the expense associated with stock appreciation rights. Accelerated stock option expense is recorded for employees eligible for accelerated stock option

vesting upon retirement. Accelerated stock option expense for years ended May 31, 2013, 2012, and 2011 was $22 million, $17 million, and $12 million, respectively.

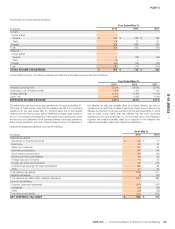

As of May 31, 2013, the Company had $199 million of unrecognized compensation costs from stock options, net of estimated forfeitures, to be recognized as

selling and administrative expense over a weighted average period of 2.3 years.

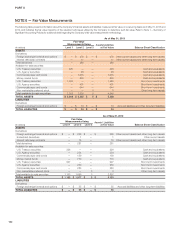

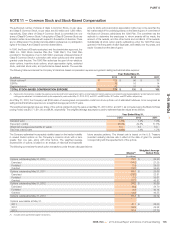

The weighted average fair value per share of the options granted during the years ended May 31, 2013, 2012, and 2011, as computed using the Black-Scholes

pricing model, was $12.71, $11.08, and $8.84, respectively. The weighted average assumptions used to estimate these fair values are as follows:

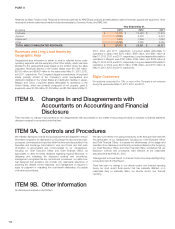

Year Ended May 31,

2013 2012 2011

Dividend yield 1.5% 1.4% 1.6%

Expected volatility 35.0% 29.5% 31.5%

Weighted average expected life (in years) 5.3 5.0 5.0

Risk-free interest rate 0.6% 1.4% 1.7%

The Company estimates the expected volatility based on the implied volatility

in market traded options on the Company’s common stock with a term

greater than one year, along with other factors. The weighted average

expected life of options is based on an analysis of historical and expected

future exercise patterns. The interest rate is based on the U.S. Treasury

(constant maturity) risk-free rate in effect at the date of grant for periods

corresponding with the expected term of the options.

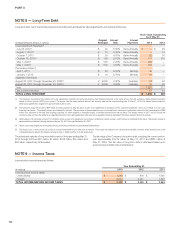

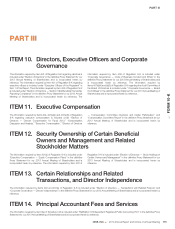

The following summarizes the stock option transactions under the plan discussed above:

Shares(1)

Weighted Average

Option Price

(In millions)

Options outstanding May 31, 2010 72.2 $ 23.30

Exercised (14.0) 21.35

Forfeited (1.3) 29.03

Granted 12.7 34.60

Options outstanding May 31, 2011 69.6 $ 25.65

Exercised (18.0) 22.81

Forfeited (1.0) 35.61

Granted 13.7 45.87

Options outstanding May 31, 2012 64.3 $ 30.59

Exercised (9.9) 24.70

Forfeited (1.3) 40.14

Granted 14.6 46.55

Options outstanding May 31, 2013 67.7 $ 34.72

Options exercisable at May 31,

2011 40.1 $ 22.03

2012 33.9 24.38

2013 35.9 27.70

(1) Includes stock appreciation rights transactions.

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 105

FORM 10-K