Nike 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

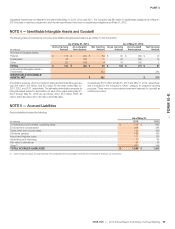

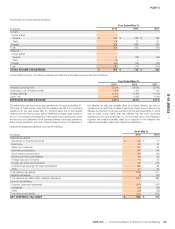

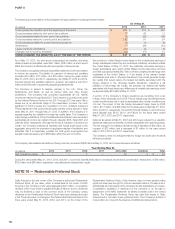

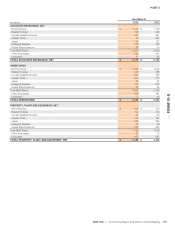

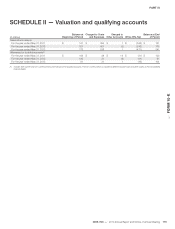

The following tables present the amounts affecting the consolidated statements of income for years ended May 31, 2013, 2012 and 2011:

(In millions)

Amount of Gain (Loss)

Recognized in Other

Comprehensive Income

on Derivatives(1)

Amount of Gain (Loss)

Reclassified From Accumulated

Other Comprehensive Income into Income(1)

Year Ended May 31, Location of Gain (Loss)

Reclassified From Accumulated

Other Comprehensive Income

Into Income(1)

Year Ended May 31,

2013 2012 2011 2013 2012 2011

Derivatives designated as cash flow hedges:

Foreign exchange forwards and options $ 42 $ (29) $ (87) Revenue $ (19) $ 5 $ (30)

Foreign exchange forwards and options 67 253 (152) Cost of sales 113 (57) 103

Foreign exchange forwards and options (3) 3 (4) Selling and administrative expense 2 (2) 1

Foreign exchange forwards and options 33 36 (65) Other (income) expense, net 9 (9) 34

Total designated cash flow hedges $ 139 $ 263 $ (308) $ 105 $ (63) $ 108

Derivatives designated as net investment hedges:

Foreign exchange forwards and options $ — $ 45 $ (85) Other (income) expense, net $ — $ — $ —

(1) For the years ended May 31, 2013, 2012, and 2011, the amounts recorded in other (income) expense, net as a result of hedge ineffectiveness and the discontinuance of cash flow hedges

because the forecasted transactions were no longer probable of occurring were immaterial.

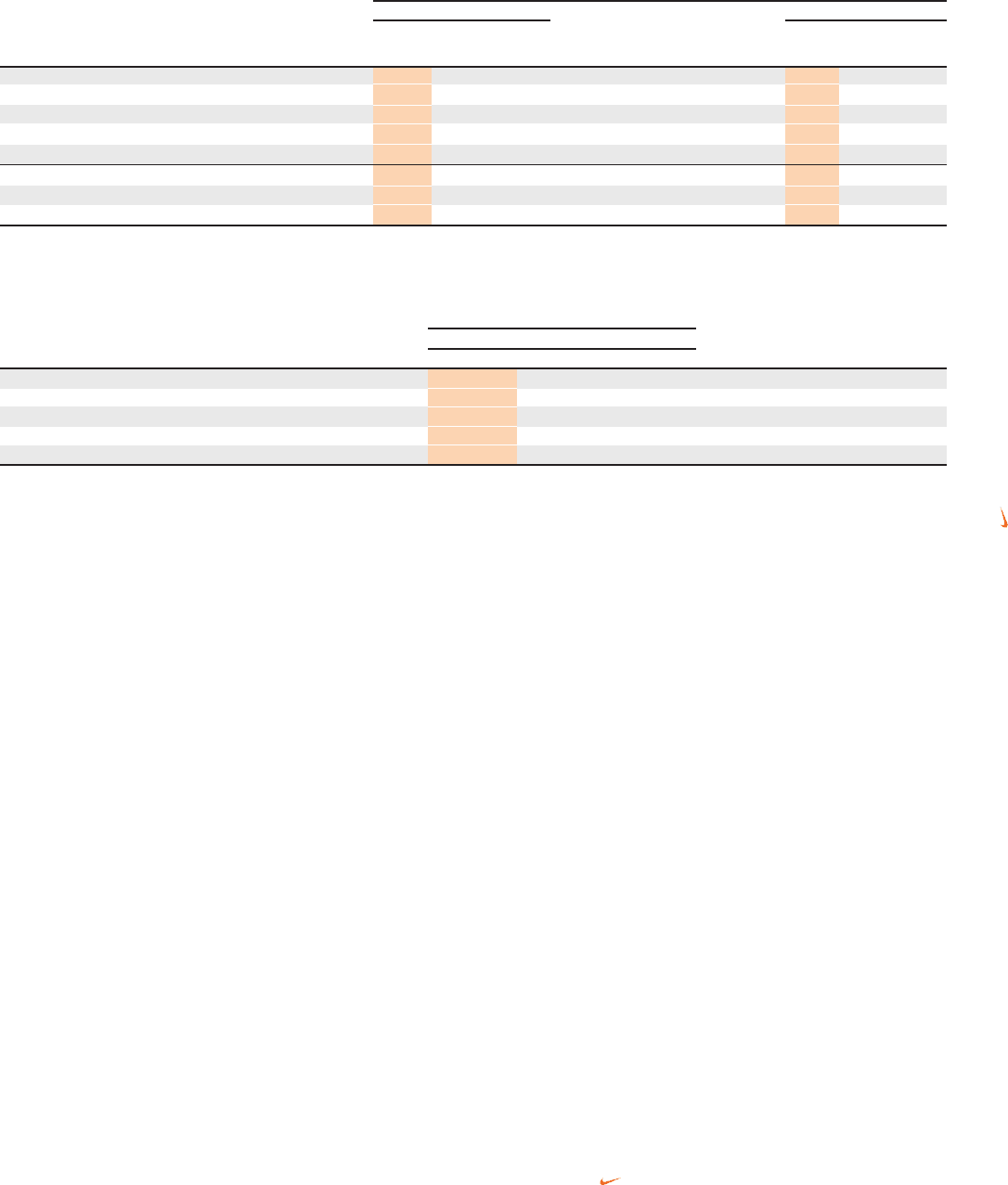

Amount of Gain (Loss) Recognized in

Income on Derivatives

Location of Gain (Loss) Recognized

in Income on Derivatives

Year Ended May 31,

(In millions) 2013 2012 2011

Derivatives designated as fair value hedges:

Interest rate swaps(1) $ 5 $ 6 $ 6 Interest (income) expense, net

Derivatives not designated as hedging instruments:

Foreign exchange forwards and options 51 64 (30) Other (income) expense, net

Embedded derivatives $ (4) $ 1 $ — Other (income) expense, net

(1) All interest rate swap agreements meet the shortcut method requirements under the accounting standards for derivatives and hedging. Accordingly, changes in the fair values of the

interest rate swap agreements are considered to exactly offset changes in the fair value of the underlying long-term debt. Refer to “Fair Value Hedges” in this note for additional detail.

Refer to Note 5 — Accrued Liabilities for derivative instruments recorded in

accrued liabilities, Note 6 — Fair Value Measurements for a description of how

the above financial instruments are valued, Note 14 — Accumulated Other

Comprehensive Income and the consolidated statements of shareholders’

equity for additional information on changes in other comprehensive income

for the years ended May 31, 2013, 2012 and 2011.

Cash Flow Hedges

The purpose of the Company’s foreign currency hedging activities is to

protect the Company from the risk that the eventual cash flows resulting from

transactions in foreign currencies will be adversely affected by changes in

exchange rates. Foreign currency exposures that the Company may elect to

hedge in this manner include product cost exposures, non-functional

currency denominated external and intercompany revenues, selling and

administrative expenses, investments in U.S. Dollar-denominated available-

for-sale debt securities and certain other intercompany transactions.

Product cost exposures are primarily generated through non-functional

currency denominated product purchases and the foreign currency

adjustment program described below. NIKE entities primarily purchase

products in two ways: (1) Certain NIKE entities purchase product from the

NIKE Trading Company (“NTC”), a wholly-owned sourcing hub that buys

NIKE branded products from third party factories, predominantly in U.S.

Dollars. The NTC, whose functional currency is the U.S. Dollar, then sells the

products to NIKE entities in their respective functional currencies. When the

NTC sells to a NIKE entity with a different functional currency, the result is a

foreign currency exposure for the NTC; (2) Other NIKE entities purchase

product directly from third party factories in U.S. Dollars. These purchases

generate a foreign currency exposure for those NIKE entities with a functional

currency other than the U.S. Dollar.

In January 2012, the Company implemented a foreign currency adjustment

program with certain factories. The program is designed to more effectively

manage foreign currency risk by assuming certain of the factories’ foreign

currency exposures, some of which are natural offsets to our existing foreign

currency exposures. Under this program, the Company’s payments to these

factories are adjusted for rate fluctuations in the basket of currencies (“factory

currency exposure index”) in which the labor, materials and overhead costs

incurred by the factories in the production of NIKE branded products (“factory

input costs”) are denominated. For the portion of the indices denominated in

the local or functional currency of the factory, the Company may elect to place

formally designated cash flow hedges. For all currencies within the indices,

excluding the U.S. Dollar and the local or functional currency of the factory, an

embedded derivative contract is created upon the factory’s acceptance of

NIKE’s purchase order. Embedded derivative contracts are separated from

the related purchase order and their accounting treatment is described further

below.

The Company’s policy permits the utilization of derivatives to reduce its

foreign currency exposures where internal netting or other strategies cannot

be effectively employed. Hedged transactions are denominated primarily in

Euros, British Pounds and Japanese Yen. The Company may enter into

hedge contracts typically starting up to 12 to 18 months in advance of the

forecasted transaction and may place incremental hedges for up to 100% of

the exposure by the time the forecasted transaction occurs.

All changes in fair value of derivatives designated as cash flow hedges,

excluding any ineffective portion, are recorded in other comprehensive

income until net income is affected by the variability of cash flows of the

hedged transaction. In most cases, amounts recorded in other

comprehensive income will be released to net income some time after the

maturity of the related derivative. Effective hedge results are classified within

the consolidated statements of income in the same manner as the underlying

exposure, with the results of hedges of non-functional currency denominated

revenues and product cost exposures, excluding embedded derivatives as

described below, recorded in revenues or cost of sales, when the underlying

hedged transaction affects consolidated net income. Results of hedges of

selling and administrative expense are recorded together with those costs

when the related expense is recorded. Results of hedges of anticipated

purchases and sales of U.S. Dollar-denominated available-for-sale securities

are recorded in other (income) expense, net when the securities are sold.

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 109

FORM 10-K