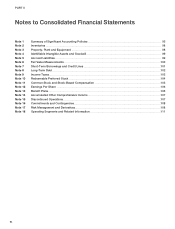

Nike 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

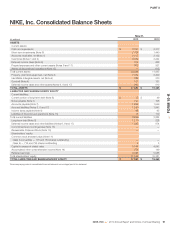

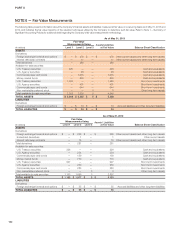

Short-Term Investments

Short-term investments consist of highly liquid investments, including

commercial paper, U.S. treasury, U.S. agency, and corporate debt securities,

with maturities over three months from the date of purchase. Debt securities

that the Company has the ability and positive intent to hold to maturity are

carried at amortized cost. At May 31, 2013 and 2012, the Company did not

hold any short-term investments that were classified as trading or held-to-

maturity.

At May 31, 2013 and 2012, short-term investments consisted of available-

for-sale securities. Available-for-sale securities are recorded at fair value with

unrealized gains and losses reported, net of tax, in other comprehensive

income, unless unrealized losses are determined to be other than temporary.

Realized gains and losses on the sale of securities are determined by specific

identification. The Company considers all available-for-sale securities,

including those with maturity dates beyond 12 months, as available to

support current operational liquidity needs and therefore classifies all

securities with maturity dates beyond three months at the date of purchase as

current assets within short-term investments on the consolidated balance

sheets.

Refer to Note 6 — Fair Value Measurements for more information on the

Company’s short-term investments.

Allowance for Uncollectible Accounts

Receivable

Accounts receivable consists primarily of amounts receivable from

customers. The Company makes ongoing estimates relating to the

collectability of its accounts receivable and maintains an allowance for

estimated losses resulting from the inability of its customers to make required

payments. In determining the amount of the allowance, the Company

considers historical levels of credit losses and makes judgments about the

creditworthiness of significant customers based on ongoing credit

evaluations. Accounts receivable with anticipated collection dates greater

than 12 months from the balance sheet date and related allowances are

considered non-current and recorded in other assets. The allowance for

uncollectible accounts receivable was $104 million and $91 million at May 31,

2013 and 2012, respectively, of which $54 million and $45 million,

respectively, was classified as long-term and recorded in other assets.

Inventory Valuation

Inventories are stated at lower of cost or market and valued primarily on an

average cost basis. Inventory costs primarily consist of product cost from our

suppliers, as well as freight, import duties, taxes, insurance and logistics and

other handling fees.

Property, Plant and Equipment and

Depreciation

Property, plant and equipment are recorded at cost. Depreciation for financial

reporting purposes is determined on a straight-line basis for buildings and

leasehold improvements over 2 to 40 years and for machinery and equipment

over2to15years.

Depreciation and amortization of assets used in manufacturing, warehousing

and product distribution are recorded in cost of sales. Depreciation and

amortization of other assets are recorded in selling and administrative

expense.

Software Development Costs

Internal Use Software. Expenditures for major software purchases and

software developed for internal use are capitalized and amortized over a 2 to

10 year period on a straight-line basis. The Company’s policy provides for the

capitalization of external direct costs of materials and services associated with

developing or obtaining internal use computer software. In addition, the

Company also capitalizes certain payroll and payroll-related costs for

employees who are directly associated with internal use computer software

projects. The amount of capitalizable payroll costs with respect to these

employees is limited to the time directly spent on such projects. Costs

associated with preliminary project stage activities, training, maintenance and

all other post-implementation stage activities are expensed as incurred.

Computer Software to be Sold, Leased or Otherwise Marketed. Development

costs of computer software to be sold, leased, or otherwise marketed as an

integral part of a product are subject to capitalization beginning when a

product’s technological feasibility has been established and ending when a

product is available for general release to customers. In most instances, the

Company’s products are released soon after technological feasibility has

been established. Therefore, costs incurred subsequent to achievement of

technological feasibility are usually not significant, and generally most software

development costs have been expensed as incurred.

Impairment of Long-Lived Assets

The Company reviews the carrying value of long-lived assets or asset groups

to be used in operations whenever events or changes in circumstances

indicate that the carrying amount of the assets might not be recoverable.

Factors that would necessitate an impairment assessment include a

significant adverse change in the extent or manner in which an asset is used,

a significant adverse change in legal factors or the business climate that could

affect the value of the asset, or a significant decline in the observable market

value of an asset, among others. If such facts indicate a potential impairment,

the Company would assess the recoverability of an asset group by

determining if the carrying value of the asset group exceeds the sum of the

projected undiscounted cash flows expected to result from the use and

eventual disposition of the assets over the remaining economic life of the

primary asset in the asset group. If the recoverability test indicates that the

carrying value of the asset group is not recoverable, the Company will

estimate the fair value of the asset group using appropriate valuation

methodologies, which would typically include an estimate of discounted cash

flows. Any impairment would be measured as the difference between the

asset group’s carrying amount and its estimated fair value.

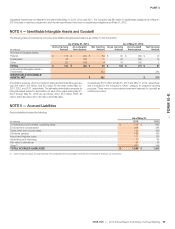

Identifiable Intangible Assets and Goodwill

The Company performs annual impairment tests on goodwill and intangible

assets with indefinite lives in the fourth quarter of each fiscal year, or when

events occur or circumstances change that would, more likely than not,

reduce the fair value of a reporting unit or an intangible asset with an indefinite

life below its carrying value. Events or changes in circumstances that may

trigger interim impairment reviews include significant changes in business

climate, operating results, planned investments in the reporting unit, planned

divestitures or an expectation that the carrying amount may not be

recoverable, among other factors. The Company may first assess qualitative

factors to determine whether it is more likely than not that the fair value of a

reporting unit is less than its carrying amount. If, after assessing the totality of

events and circumstances, the Company determines that it is more likely than

not that the fair value of the reporting unit is greater than its carrying amount,

the two-step impairment test is unnecessary. The two-step impairment test

first requires the Company to estimate the fair value of its reporting units. If the

carrying value of a reporting unit exceeds its fair value, the goodwill of that

reporting unit is potentially impaired and the Company proceeds to step two

of the impairment analysis. In step two of the analysis, the Company

measures and records an impairment loss equal to the excess of the carrying

value of the reporting unit’s goodwill over its implied fair value, if any.

The Company generally bases its measurement of the fair value of a reporting

unit on a blended analysis of the present value of future discounted cash flows

and the market valuation approach. The discounted cash flows model

indicates the fair value of the reporting unit based on the present value of the

cash flows that the Company expects the reporting unit to generate in the

future. The Company’s significant estimates in the discounted cash flows

model include: its weighted average cost of capital; long-term rate of growth

and profitability of the reporting unit’s business; and working capital effects.

96