Nike 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Capitalized interest was not material for the years ended May 31, 2013, 2012, and 2011. The Company had $81 million in capital lease obligations as of May 31,

2013 included in machinery, equipment, and internal-use software; there were no capital lease obligations as of May 31, 2012.

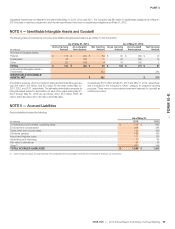

NOTE 4 — Identifiable Intangible Assets and Goodwill

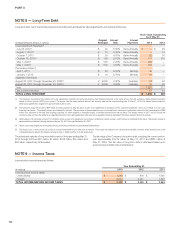

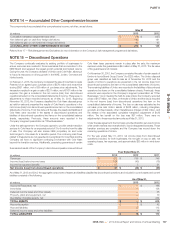

The following table summarizes the Company’s identifiable intangible asset balances as of May 31, 2013 and 2012:

As of May 31, 2013 As of May 31, 2012

(In millions)

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Amortized intangible assets:

Patents $ 119 $ (35) $ 84 $ 99 $ (29) $ 70

Trademarks 43 (32) 11 40 (26) 14

Other 20 (16) 4 19 (16) 3

TOTAL $ 182 $ (83) $ 99 $ 158 $ (71) $ 87

Unamortized intangible assets —

Trademarks 283 283

IDENTIFIABLE INTANGIBLE

ASSETS, NET $ 382 $ 370

Amortization expense, which is included in selling and administrative expense,

was $14 million, $14 million, and $13 million for the years ended May 31,

2013, 2012, and 2011, respectively. The estimated amortization expense for

intangible assets subject to amortization for each of the years ending May 31,

2014 through May 31, 2018 are as follows: 2014: $13 million; 2015: $9

million; 2016: $9 million; 2017: $7 million; 2018: $6 million.

Goodwill was $131 million at May 31, 2013 and May 31, 2012, respectively,

and is included in the Company’s “Other” category for segment reporting

purposes. There were no accumulated impairment balances for goodwill as

of either period end.

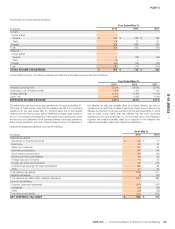

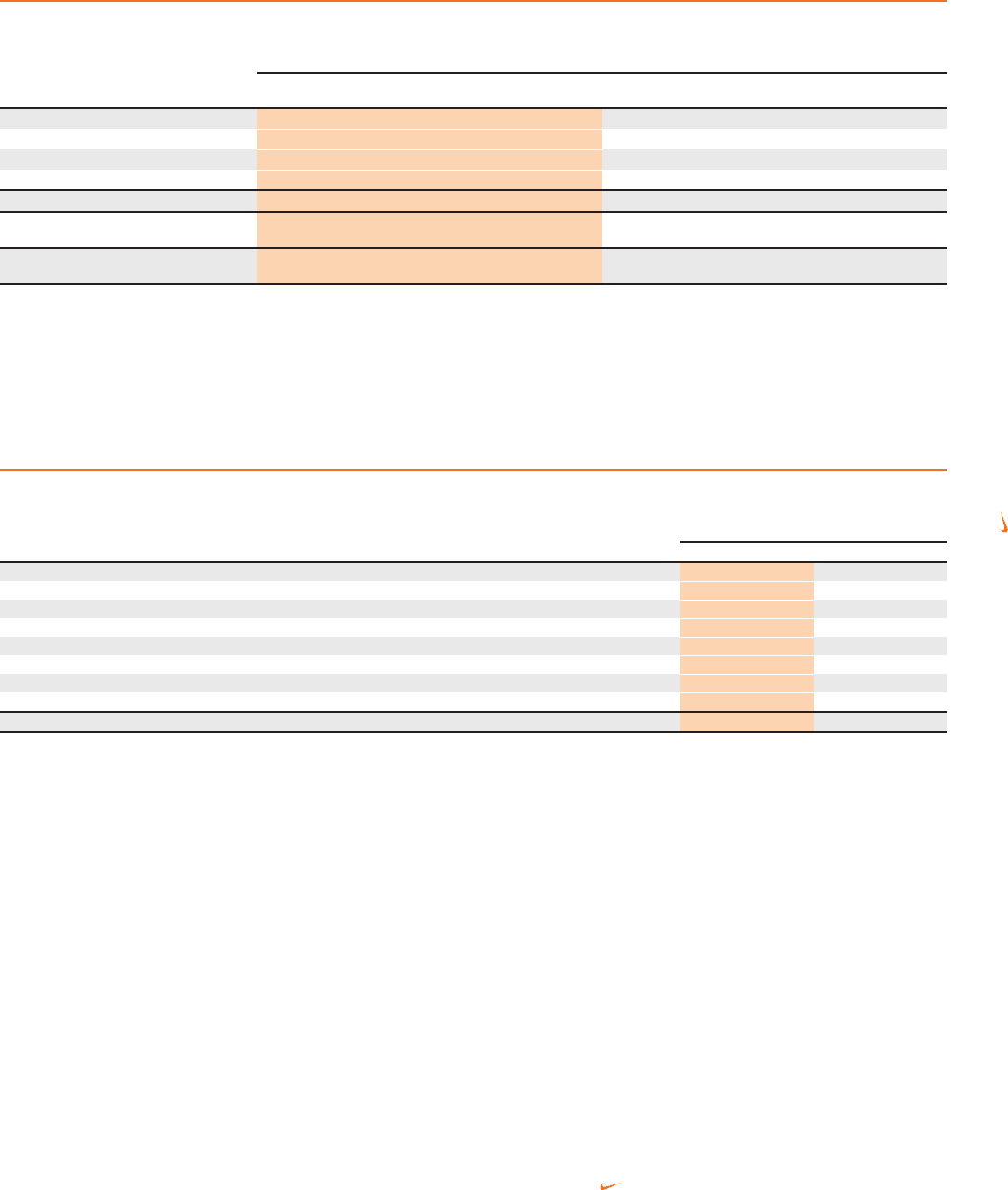

NOTE 5 — Accrued Liabilities

Accrued liabilities included the following:

As of May 31,

(In millions) 2013 2012

Compensation and benefits, excluding taxes $ 713 $ 691

Endorsement compensation 264 288

Taxes other than income taxes 192 169

Dividends payable 188 165

Import and logistics costs 111 133

Advertising and marketing 77 94

Fair value of derivatives 34 55

Other(1) 407 346

TOTAL ACCRUED LIABILITIES $ 1,986 $ 1,941

(1) Other consists of various accrued expenses with no individual item accounting for more than 5% of the balance at May 31, 2013 and 2012.

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 99

FORM 10-K