Nike 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

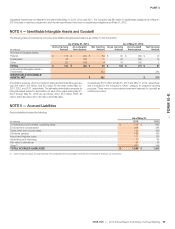

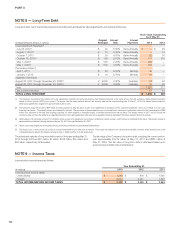

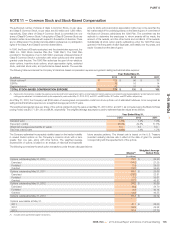

NOTE 8 — Long-Term Debt

Long-term debt, net of unamortized premiums and discounts and swap fair value adjustments, comprises the following:

Book Value Outstanding

As of May 31,

Scheduled Maturity (Dollars in millions)

Original

Principal

Interest

Rate

Interest

Payments 2013 2012

Corporate Bond Payables:(4)

July 23, 2012(1) $ 25 5.66% Semi-Annually $ — $ 25

August 7, 2012(1) $ 15 5.40% Semi-Annually — 15

October 1, 2013 $ 50 4.70% Semi-Annually 50 50

October 15, 2015(1) $ 100 5.15% Semi-Annually 111 115

May 1, 2023(5) $ 500 2.25% Semi-Annually 499 —

May 1, 2043(5) $ 500 3.63% Semi-Annually 499 —

Promissory Notes:(2)

April 1, 2017 $ 40 6.20% Monthly 40 —

January 1, 2018 $ 19 6.79% Monthly 19 —

Japanese Yen Notes:

August 20, 2001 through November 20, 2020(3) ¥ 9,000 2.60% Quarterly 34 50

August 20, 2001 through November 20, 2020(3) ¥ 4,000 2.00% Quarterly 15 22

Total 1,267 277

Less current maturities 57 49

TOTAL LONG-TERM DEBT $ 1,210 $ 228

(1) The Company has entered into interest rate swap agreements whereby the Company receives fixed interest payments at the same rate as the note and pays variable interest payments

based on the six-month LIBOR plus a spread. The swaps have the same notional amount and maturity date as the corresponding note. At May 31, 2013, the interest rates payable on

these swap agreements ranged from approximately 0.3% to 0.4%.

(2) The Company assumed a total of $59 million in bonds payable on May 30, 2013 as part of its agreement to purchase certain Corporate properties, which was treated as a non-cash

financing transaction. The property serves as collateral for the debt. The purchase of these properties was accounted for as a business combination where the total consideration of $85

million was allocated to the land and buildings acquired; no other tangible or intangible assets or liabilities resulted from the purchase. The bonds mature in 2017 and 2018 and the

Company does not have the ability to re-negotiate the terms of the debt agreements and would incur significant financial penalties if the notes are paid off prior to maturity.

(3) NIKE Logistics YK assumed a total of ¥13.0 billion in loans as part of its agreement to purchase a distribution center in Japan, which serves as collateral for the loans. These loans mature in

equal quarterly installments during the period August 20, 2001 through November 20, 2020.

(4) Senior unsecured obligations rank equally with our other unsecured and unsubordinated indebtedness.

(5) The bonds carry a make whole call provision and are redeemable at any time prior to maturity. The bonds also feature a par call provision payable 3 months and 6 months prior to the

scheduled maturity date for the bonds maturing on May 1, 2023 and May 1, 2043, respectively.

The scheduled maturity of long-term debt in each of the years ending May 31,

2014 through 2018 are $57 million, $7 million, $108 million, $45 million and

$25 million, respectively, at face value.

The fair value of the Company’s long-term debt, including the current portion,

was approximately $1,219 million at May 31, 2013 and $283 million at

May 31, 2012. The fair value of long-term debt is estimated based upon

quoted prices of similar instruments (level 2).

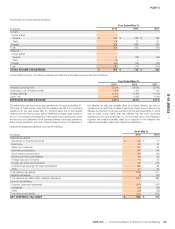

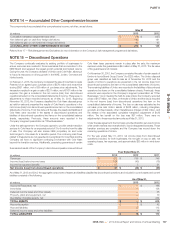

NOTE 9 — Income Taxes

Incomebeforeincometaxesisasfollows:

Year Ended May 31,

(In millions) 2013 2012 2011

Income before income taxes:

United States $ 1,240 $ 804 $ 1,040

Foreign 2,032 2,221 1,822

TOTAL INCOME BEFORE INCOME TAXES $ 3,272 $ 3,025 $ 2,862

102