Nike 2013 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations

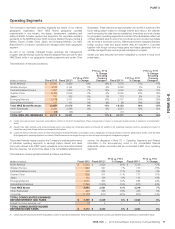

NIKE designs, develops, markets and sells athletic footwear, apparel,

equipment, accessories and services worldwide. We are the largest seller of

athletic footwear and apparel in the world. We sell our products to retail

accounts, through NIKE-owned retail stores and internet websites, which we

refer to as our “Direct to Consumer” operations, and through a mix of

independent distributors, licensees and sales representatives in virtually all

countries around the world. Our goal is to deliver value to our shareholders by

building a profitable global portfolio of branded footwear, apparel, equipment,

accessories and service businesses. Our strategy is to achieve long-term

revenue growth by creating innovative, “must have” products, building deep

personal consumer connections with our brands, and delivering compelling

consumer experiences at retail and online.

In addition to achieving long-term, sustainable revenue growth, we continue

to strive to deliver shareholder value by driving operational excellence in

several key areas:

• Expanding gross margin by:

– Making our supply chain a competitive advantage;

– Reducing product costs through a continued focus on manufacturing

efficiency, product design and innovation; and

– Delivering innovative, premium products that command higher prices

while maintaining a strong consumer price-to-value proposition.

• Improving selling and administrative expense productivity by focusing on

investments that drive economic returns in the form of incremental revenue

and gross profit, and leveraging existing infrastructure across our portfolio of

businesses to eliminate duplicative costs;

• Improving working capital efficiency; and

• Deploying capital effectively.

Through execution of this strategy, our long-term financial goals continue to

be:

• High single-digit revenue growth,

• Mid-teens earnings per share growth,

• Increased return on invested capital and accelerated cash flows, and

• Consistent results through effective management of our diversified portfolio

of businesses.

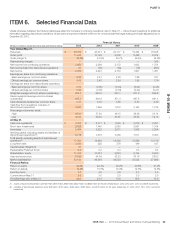

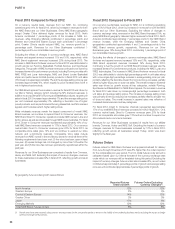

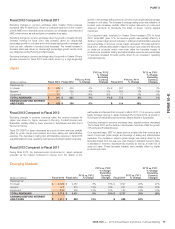

Over the past ten years, we have achieved or exceeded all of these financial

goals. During this time, revenues and earnings per share for NIKE, Inc.,

inclusive of both continuing and discontinued operations, have grown 9% and

15%, respectively, on an annual compounded basis. Our return on invested

capital has increased from 18% to 24% and we expanded gross margins by

approximately 260 basis points.

On November 15, 2012, we announced a two-for-one stock split of both

Class A and Class B Common shares. The stock split was in the form of a 100

percent stock dividend payable on December 24, 2012 to shareholders of

record at the close of business December 10, 2012. Common stock began

trading at the split-adjusted price on December 26, 2012. All share numbers

and per share amounts presented reflect the stock split.

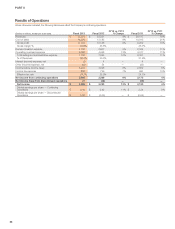

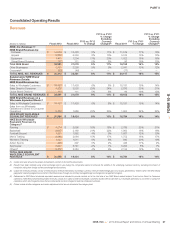

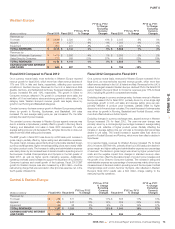

Our fiscal 2013 results from continuing operations demonstrated the power of

the NIKE, Inc. portfolio to deliver consistent growth in revenues, earnings, and

cash returns to shareholders, while investing for long-term growth. Despite

the ongoing challenges in the global economy, we delivered record revenues

and earnings per share in fiscal 2013. Our revenues grew 8% to $25.3 billion,

net income from continuing operations increased 9% to $2.5 billion, and we

delivered diluted earnings per share of $2.69, an 11% increase from fiscal

2012.

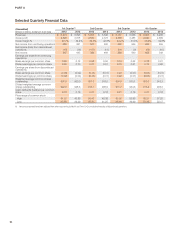

Earnings before interest and income taxes for continuing operations

increased 8% for fiscal 2013, driven by revenue growth and improved gross

margin, which more than offset higher selling and administrative expense as a

percentage of revenue. The increase in revenues was driven by growth

across most NIKE Brand geographies, key categories and product types.

This growth was primarily fueled by:

• Innovative performance and sportswear products, incorporating proprietary

technology platforms such as NIKE Air, Lunar, Shox, FREE, Flywire, Dri-

F.I.T, FlyKnit, NIKE +, and NIKE Fuel;

• Deep brand connections to consumers through a category lens, reinforced

by investments in endorsements by high profile athletes and teams (such as

the NFL, FC Barcelona, Michael Jordan), high impact marketing around

global sporting events (such as the Olympics, European Football

Championships and NBA Finals) and digital marketing; and

• Strong category retail presentation online and at NIKE owned and retail

partner stores.

Revenues also improved for each of our Other Businesses (Converse, NIKE

Golf and Hurley).

Our gross margins improved largely due to the positive impact of higher

average selling prices, partially offset by higher product input costs, primarily

labor cost inflation, and foreign currency headwinds.

For fiscal 2013, the growth of our net income from continuing operations was

positively affected by a year-over-year decrease in our effective tax rate. In

addition, diluted earnings per share grew at a higher rate than net income due

to a 2% decrease in the weighted average number of diluted common shares

outstanding, as a result of share repurchases during fiscal 2013.

On May 31, 2012, we announced our intention to divest of the Cole Haan and

Umbro businesses, which would allow us to better focus our resources on

driving growth in the NIKE, Jordan, Converse and Hurley brands. During the

second quarter of fiscal 2013 we completed the sale of certain assets of the

Umbro brand and recorded a loss on the sale of these assets of $107 million,

net of tax. During the third quarter of fiscal 2013 we completed the sale of

Cole Haan and recorded a gain on sale of $231 million, net of tax. As of

May 31, 2013 the Company had substantially completed all transition

services related to the sale of both businesses. Unless otherwise indicated,

the following disclosures reflect the Company’s continuing operations; refer to

our “Discontinued Operations” section for additional information regarding our

discontinued operations.

While we expect to face continued macroeconomic uncertainties in the global

economy, we continue to see opportunities to drive future growth and remain

committed to effectively managing our business to achieve our financial goals

over the long-term, by executing against the operational strategies outlined

above.

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 65

FORM 10-K