Nike 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

NOTE 16 — Commitments and Contingencies

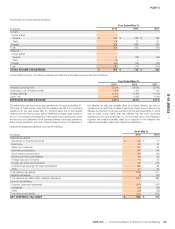

The Company leases space for certain of its offices, warehouses and retail

stores under leases expiring from 1 to 21 years after May 31, 2013. Rent

expense was $482 million, $431 million, and $386 million for the years ended

May 31, 2013, 2012 and 2011, respectively. Amounts of minimum future

annual rental commitments under non-cancelable operating leases in each of

the five years ending May 31, 2014 through 2018 are $403 million, $340

million, $304 million, $272 million, $225 million, respectively, and $816 million

in later years. Amounts of minimum future annual commitments under non-

cancelable capital leases in each of the four years ending May 31, 2014

through 2017 are $23 million, $28 million, $21 million, and $9 million,

respectively; the Company has no capital lease obligations beyond the year

ending May 31, 2017.

As of May 31, 2013 and 2012, the Company had letters of credit outstanding

totaling $149 million and $137 million, respectively. These letters of credit

were generally issued for the purchase of inventory and guarantees of the

Company’s performance under certain self-insurance and other programs.

In connection with various contracts and agreements, the Company provides

routine indemnifications relating to the enforceability of intellectual property

rights, coverage for legal issues that arise and other items where the

Company is acting as the guarantor. Currently, the Company has several

such agreements in place. However, based on the Company’s historical

experience and the estimated probability of future loss, the Company has

determined that the fair value of such indemnifications is not material to the

Company’s financial position or results of operations.

In the ordinary course of its business, the Company is involved in various legal

proceedings involving contractual and employment relationships, product

liability claims, trademark rights, and a variety of other matters. While the

Company cannot predict the outcome of its pending legal matters with

certainty, the Company does not believe any currently identified claim,

proceeding or litigation, either individually or in aggregate, will have a material

impact on the Company’s results of operations, financial position or cash

flows.

NOTE 17 — Risk Management and Derivatives

The Company is exposed to global market risks, including the effect of

changes in foreign currency exchange rates and interest rates, and uses

derivatives to manage financial exposures that occur in the normal course of

business. The Company does not hold or issue derivatives for trading or

speculative purposes.

The Company may elect to designate certain derivatives as hedging

instruments under the accounting standards for derivatives and hedging. The

Company formally documents all relationships between designated hedging

instruments and hedged items as well as its risk management objective and

strategy for undertaking hedge transactions. This process includes linking all

derivatives designated as hedges to either recognized assets or liabilities or

forecasted transactions.

The majority of derivatives outstanding as of May 31, 2013 are designated as

cash flow or fair value hedges. All derivatives are recognized on the balance

sheet at fair value and classified based on the instrument’s maturity date. The

total notional amount of outstanding derivatives as of May 31, 2013 was

approximately $9 billion, which primarily comprises cash flow hedges for

Euro/U.S. Dollar, British Pound/Euro, and Japanese Yen/U.S. Dollar currency

pairs. As of May 31, 2013, there were outstanding currency forward contracts

with maturities up to 24 months.

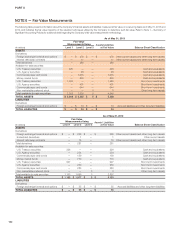

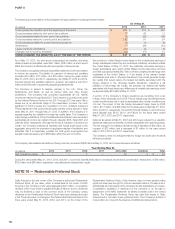

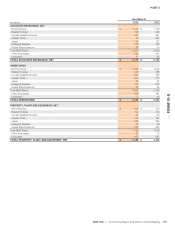

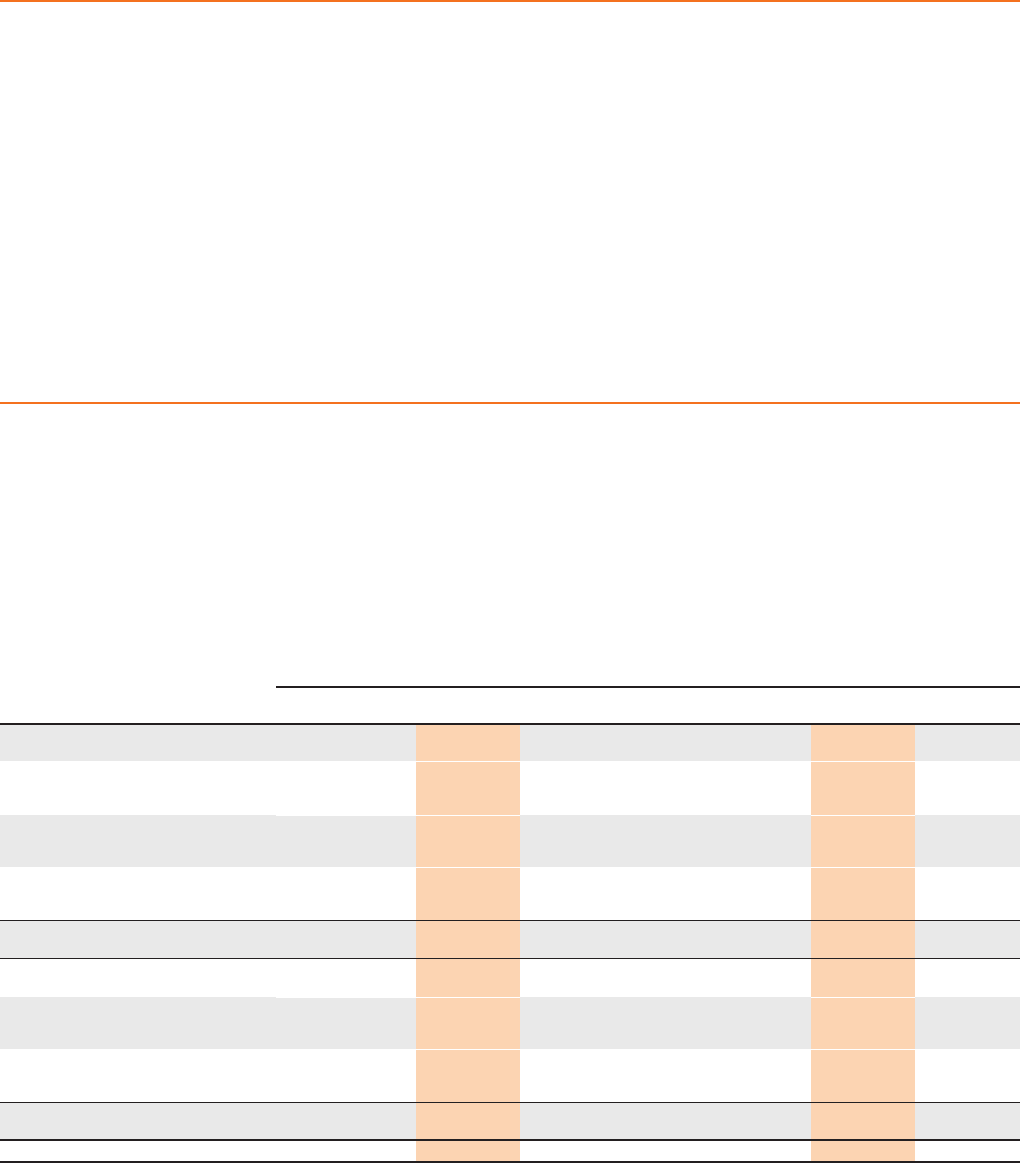

The following table presents the fair values of derivative instruments included within the consolidated balance sheets as of May 31, 2013 and 2012:

Asset Derivatives Liability Derivatives

(In millions)

Balance Sheet

Location 2013 2012 Balance Sheet Location 2013 2012

Derivatives formally designated as

hedging instruments:

Foreign exchange forwards and

options Prepaid expenses

and other

current assets $ 141 $ 203 Accrued liabilities $ 12 $ 35

Foreign exchange forwards and

options Deferred income

taxes and other

long-term assets 79 7

Deferred income

taxes and other

long-term liabilities — —

Interest rate swap contracts Deferred income

taxes and other

long-term assets 11 15

Deferred income

taxes and other

long-term liabilities — —

Total derivatives formally designated as

hedging instruments $ 231 $ 225 $ 12 $ 35

Derivatives not designated as hedging

instruments:

Foreign exchange forwards and

options Prepaid expenses

and other

current assets $ 58 $ 55 Accrued liabilities $ 22 $ 20

Embedded derivatives Prepaid expenses

and other

current assets — 1 Accrued liabilities — —

Total derivatives not designated as

hedging instruments 58 56 22 20

TOTAL DERIVATIVES $ 289 $ 281 $ 34 $ 55

108