Nike 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Refer to Note 6 — Fair Value Measurements and Note 17 — Risk

Management and Derivatives in the accompanying Notes to the Consolidated

Financial Statements for additional description of how the above financial

instruments are valued and recorded as well as the fair value of outstanding

derivatives at period end.

We estimate the combination of translation of foreign currency-denominated

profits from our international businesses and the year-over-year change in

foreign currency related gains and losses included in other (income) expense,

net had an unfavorable impact of approximately $56 million on our income

before income taxes for the year ended May 31, 2013 and had an insignificant

impact for the year ended May 31, 2012.

Net investments in foreign subsidiaries

We are also exposed to the impact of foreign exchange fluctuations on our

investments in wholly-owned foreign subsidiaries denominated in a currency

other than the U.S. Dollar, which could adversely impact the U.S. Dollar value

of these investments and therefore the value of future repatriated earnings.

We have hedged and may, in the future, hedge net investment positions in

certain foreign subsidiaries to mitigate the effects of foreign exchange

fluctuations on these net investments. In accordance with the accounting

standards for derivatives and hedging, the effective portion of the change in

fair value of the forward contracts designated as net investment hedges is

recorded in the cumulative translation adjustment component of accumulated

other comprehensive income. Any ineffective portion is immediately

recognized in earnings as a component of other (income) expense, net. The

impact of ineffective hedges was not material for any period presented. To

minimize credit risk, we have structured these net investment hedges to be

generally less than six months in duration. Upon maturity, the hedges are

settled based on the current fair value of the forward contracts with the

realized gain or loss remaining in OCI. There were no outstanding net

investment hedges as of May 31, 2013 and 2012. Cash flows from net

investment hedge settlements totaled $22 million for the year ended May 31,

2012.

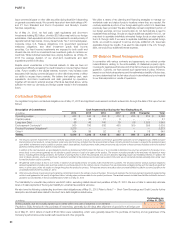

Liquidity and Capital Resources

Cash Flow Activity

Cash provided by operations was $3.0 billion for fiscal 2013 compared to

$1.9 billion for fiscal 2012. Our primary source of operating cash flow for fiscal

2013 was net income of $2.5 billion. Our fiscal 2013 change in working capital

was a net cash outflow of $42 million, which is exclusive of working capital

amounts sold as part of the divestitures of Umbro and Cole Haan, as

compared to a net cash outflow of $799 million for fiscal 2012. Our

investments in working capital decreased due to slowing growth in inventory

and reductions in accounts receivable compared to the prior year. During

fiscal 2013, inventory for continuing operations increased 7% compared to a

23% increase for fiscal 2012; the slowing growth was driven by our continued

focus on increasing inventory productivity. The reduction in accounts

receivable was primarily driven by the collection of receivables related to

discontinued operations.

Cash used by investing activities was $1,067 million during fiscal 2013,

compared to a $514 million source of cash for fiscal 2012. A major driver of

the change was the swing from net sales/maturities of short-term investments

in fiscal 2012 to net purchases of short-term investments in fiscal 2013,

reflective of the additional purchases of short-term investments made with the

proceeds from the issuance of long term debt in April 2013. In fiscal 2012,

there were $1,124 million of net sales/maturities of short-term investments

(net of purchases), while in fiscal 2013 we made $1,203 million in net

purchases of short-term investments (net of sales/maturities). This impact

was partially offset by $786 million in proceeds from the sale of Umbro and

Cole Haan in fiscal 2013.

Cash used by financing activities was $1,040 million for fiscal 2013 compared

to $2,118 million for fiscal 2012. The decrease in cash used by financing

activities was primarily due to $986 million in proceeds from the issuance of

long-term debt in April 2013. Also contributing to the decrease were lower

payments of long-term debt and notes payable and lower repurchases of

common stock, which were partially offset by a reduction in the proceeds

from the exercise of stock options.

In fiscal 2013, we purchased 33.5 million shares of NIKE’s class B common

stock for $1.7 billion, an average price of $49.50. During the year, we

completed the four-year, $5 billion share repurchase program approved by

our Board of Directors in September 2008. Under that program, we

purchased a total of 118.8 million shares at an average price of $42.08.

Subsequently, we began repurchases under a four-year, $8 billion program

approved by the Board in September 2012. As of the end of fiscal 2013, we

had repurchased 15.3 million shares at a cost of $789 million under this

current program. We continue to expect funding of share repurchases will

come from operating cash flow, excess cash, and/or debt. The timing and the

amount of shares purchased will be dictated by our capital needs and stock

market conditions.

Capital Resources

On April 23, 2013, we filed a shelf registration statement (the “Shelf”) with the

SEC which permits us to issue an unlimited amount of debt securities. The

Shelf expires on April 23, 2017. On April 23, 2013, we issued $1.0 billion of

senior notes with tranches maturing in 2023 and 2043. The 2023 senior notes

were issued in an initial aggregate principal amount of $500 million at a 2.25%

fixed, annual interest rate and will mature on May 1, 2023. The 2043 senior

notes were issued in an initial aggregate principal amount of $500 million at a

3.625% fixed, annual interest rate and will mature on May 1, 2043. Interest on

the senior notes is payable semi-annually on May 1 and November 1 of each

year. The issuance resulted in gross proceeds before expenses of $998

million. We will use the net proceeds for general corporate purposes, which

may include, but are not limited to, discharging or refinancing debt, working

capital, capital expenditures, share repurchases, as yet unplanned

acquisitions of assets or businesses and investments in subsidiaries.

On November 1, 2011, we entered into a committed credit facility agreement

with a syndicate of banks which provides for up to $1 billion of borrowings

with the option to increase borrowings to $1.5 billion with lender approval. The

facility matures November 1, 2016, with a one-year extension option prior to

both the second and third anniversary of the closing date, provided that

extensions shall not extend beyond November 1, 2018. As of and for the year

ended May 31, 2013, we had no amounts outstanding under our committed

credit facility.

We currently have long-term debt ratings of A+ and A1 from Standard and

Poor’s Corporation and Moody’s Investor Services, respectively. If our long-

term debt rating were to decline, the facility fee and interest rate under our

committed credit facility would increase. Conversely, if our long-term debt

rating were to improve, the facility fee and interest rate would decrease.

Changes in our long-term debt rating would not trigger acceleration of

maturity of any then-outstanding borrowings or any future borrowings under

the committed credit facility. Under this committed revolving credit facility, we

have agreed to various covenants. These covenants include limits on our

disposal of fixed assets, the amount of debt secured by liens we may incur, as

well as a minimum capitalization ratio. In the event we were to have any

borrowings outstanding under this facility and failed to meet any covenant,

and were unable to obtain a waiver from a majority of the banks in the

syndicate, any borrowings would become immediately due and payable. As

of May 31, 2013, we were in full compliance with each of these covenants

and believe it is unlikely we will fail to meet any of these covenants in the

foreseeable future.

Liquidity is also provided by our $1 billion commercial paper program. During

the year ended May 31, 2013, we issued and subsequently repaid

commercial paper borrowings of $505 million. As of May 31, 2013, there

were no outstanding borrowings under this program. We may continue to

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 79

FORM 10-K