Nike 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

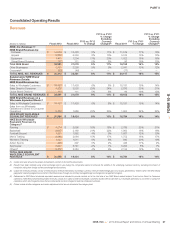

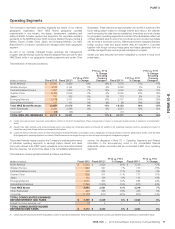

PART II

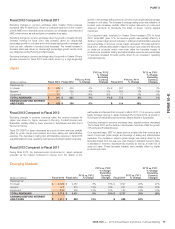

Fiscal 2012 Compared to Fiscal 2011

For fiscal 2012, revenues for our Other Businesses increased 12%, reflecting

growth across most businesses, led by Converse. The revenue growth at

Converse was primarily driven by increased sales in North America and China,

as well as increased revenues in the U.K. as we transitioned that market to

direct distribution in the second half of fiscal 2011. Excluding changes in

currency exchange rates, revenues for NIKE Golf increased 9% for fiscal

2012, driven by double-digit percentage growth in our apparel business,

partially offset by a single-digit percentage decline in our club business.

On a reported basis, revenues for our Other Businesses increased 13% for

fiscal 2012, while EBIT grew 9%, as earnings growth at Converse was

partially off-set by losses at Hurley. Higher selling and administrative expense

as a percentage of revenues negatively affected profitability and lower gross

margins contributed to the decline in Hurley’s earnings.

Corporate

(Dollars in millions) Fiscal 2013 Fiscal 2012

FY13 vs. FY12

% Change Fiscal 2011

FY12 vs. FY11

% Change

Revenues $ (68) $ (46) — $ (77) —

(Loss) Before Interest and Taxes (1,177) (917) 28% (805) 14%

Corporate revenues primarily consist of certain intercompany revenue

eliminations and foreign currency hedge gains and losses related to revenues

generated by entities within the NIKE Brand geographic operating segments

and certain Other Businesses but managed through our central foreign

exchange risk management program.

Corporate loss before interest and taxes consists largely of unallocated

general and administrative expenses, including expenses associated with

centrally managed departments; depreciation and amortization related to our

corporate headquarters; unallocated insurance, benefit and compensation

programs, including stock-based compensation; certain foreign currency

gains and losses, including certain hedge gains and losses; certain

intercompany eliminations and other items.

In addition to the foreign currency gains and losses recognized in Corporate

revenues, foreign currency results included in gross margin are gains and

losses resulting from the difference between actual foreign currency rates and

standard rates used to record non-functional currency denominated product

purchases within the NIKE Brand geographic operating segments and certain

Other Businesses and related foreign currency hedge results. All other foreign

currency related results, including conversion gains and losses arising from

re-measurement of monetary assets and liabilities in non-functional

currencies and certain foreign currency derivative instruments, are included in

other (income) expense, net.

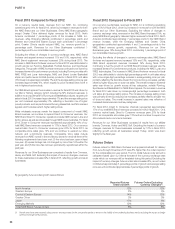

Fiscal 2013 Compared to Fiscal 2012

For fiscal 2013, Corporate’s loss before interest and taxes increased by $260

million primarily due to the following:

• A $165 million increase in foreign exchange losses related to the difference

between actual foreign currency exchange rates and standard foreign

currency exchange rates assigned to the NIKE Brand geographic operating

segments and certain Other Businesses, net of hedge gains; these losses

are reported as a component of consolidated gross margin.

• A $48 million decrease in foreign currency net losses, reported as a

component of consolidated other (income) expense, net.

• A $143 million increase in corporate overhead expense related to corporate

initiatives to support the growth of the business and performance-based

compensation.

Fiscal 2012 Compared to Fiscal 2011

For fiscal 2012, Corporate’s loss before interest and taxes grew $112 million,

mainly due to an increase of $49 million in performance-based compensation

and a year-over-year net increase of $73 million from foreign currency

impacts. These foreign currency impacts were driven by a year-over-year

increase in foreign currency net losses, arising from certain Euro/U.S. Dollar

foreign currency hedges and the re-measurement of monetary assets and

liabilities in various non-functional currencies, net of related undesignated

forward instruments, as a variety of foreign currencies weakened against the

U.S. Dollar year-over-year. The above impacts were partially offset by a slight

decrease in centrally managed operating overhead expenses.

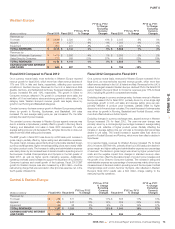

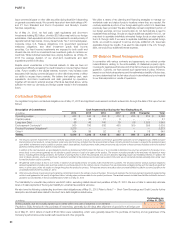

Foreign Currency Exposures and Hedging Practices

Overview

As a global company with significant operations outside the United States, in

the normal course of business we are exposed to risk arising from changes in

currency exchange rates. Our primary foreign currency exposures arise from

the recording of transactions denominated in non-functional currencies and

the translation of foreign currency denominated results of operations, financial

position and cash flows into U.S. Dollars.

Our foreign exchange risk management program is intended to lessen both

the positive and negative effects of currency fluctuations on our consolidated

results of operations, financial position and cash flows. We manage global

foreign exchange risk centrally on a portfolio basis to address those risks that

are material to NIKE, Inc. We manage these exposures by taking advantage

of natural offsets and currency correlations that exist within the portfolio and

where practical and material, by hedging a portion of the remaining exposures

using derivative instruments such as forward contracts and options. As

described below, the implementation of the NIKE Trading Company (“NTC”)

and our foreign currency adjustment program enhanced our ability to manage

our foreign exchange risk by increasing the natural offsets and currency

correlation benefits that exist within our portfolio of foreign exchange

exposures. Our hedging policy is designed to partially or entirely offset the

impact of exchange rate changes on the underlying net exposures being

hedged. Where exposures are hedged, our program has the effect of

delaying the impact of exchange rate movements on our consolidated

financial statements; the length of the delay is dependent upon hedge

horizons. We do not hold or issue derivative instruments for trading or

speculative purposes.

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 77

FORM 10-K