Nike 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

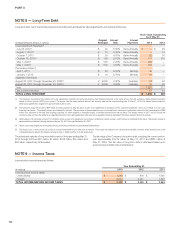

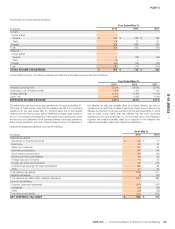

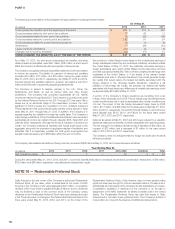

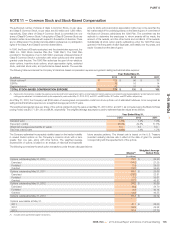

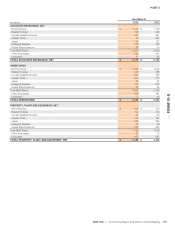

NOTE 18 — Operating Segments and Related Information

Operating Segments. The Company’s operating segments are evidence of

the structure of the Company’s internal organization. The major segments are

defined by geographic regions for operations participating in NIKE Brand

sales activity excluding NIKE Golf. Each NIKE Brand geographic segment

operates predominantly in one industry: the design, development, marketing

and selling of athletic footwear, apparel, and equipment. The Company’s

reportable operating segments for the NIKE Brand are: North America,

Western Europe, Central & Eastern Europe, Greater China, Japan, and

Emerging Markets. The Company’s NIKE Brand Direct to Consumer

operations are managed within each geographic segment.

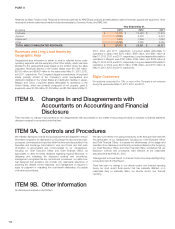

The Company’s “Other” category is broken into two components for

presentation purposes to align with the way management views the

Company. The “Global Brand Divisions” category primarily represents NIKE

Brand licensing businesses that are not part of a geographic operating

segment, demand creation and operating overhead expenses that are

centrally managed for the NIKE Brand, and costs associated with product

development and supply chain operations. The “Other Businesses” category

consists of the activities of Converse Inc., Hurley International LLC, and NIKE

Golf. Activities represented in the “Other” category are considered immaterial

for individual disclosure.

Corporate consists largely of unallocated general and administrative

expenses, including expenses associated with centrally managed

departments, depreciation and amortization related to the Company’s

headquarters, unallocated insurance and benefit programs, including stock-

based compensation, certain foreign currency gains and losses, including

certain hedge gains and losses, certain corporate eliminations and other

items.

The primary financial measure used by the Company to evaluate performance

of individual operating segments is earnings before interest and taxes

(commonly referred to as “EBIT”), which represents net income before interest

(income) expense, net and income taxes in the consolidated statements of

income. Reconciling items for EBIT represent corporate expense items that

are not allocated to the operating segments for management reporting.

As part of our centrally managed foreign exchange risk management

program, standard foreign currency rates are assigned twice per year to each

NIKE Brand entity in our geographic operating segments and certain Other

Businesses. These rates are set approximately nine months in advance of the

future selling season based on average market spot rates in the calendar

month preceding the date they are established. Inventories and cost of sales

for geographic operating segments and certain Other Businesses reflect use

of these standard rates to record non-functional currency product purchases

in the entity’s functional currency. Differences between assigned standard

foreign currency rates and actual market rates are included in Corporate,

together with foreign currency hedge gains and losses generated from our

centrally managed foreign exchange risk management program and other

conversion gains and losses.

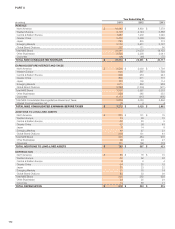

Accounts receivable, inventories and property, plant and equipment for

operating segments are regularly reviewed by management and are therefore

provided below. Additions to long-lived assets as presented in the following

table represent capital expenditures.

Certain prior year amounts have been reclassified to conform to fiscal 2013

presentation.

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 111

FORM 10-K