Nike 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

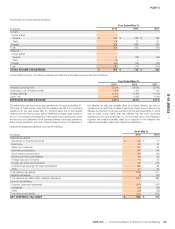

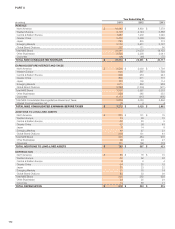

The provision for income taxes is as follows:

Year Ended May 31,

(In millions) 2013 2012 2011

Current:

United States

Federal $ 434 $ 289 $ 298

State 69 51 57

Foreign 398 488 435

Total 901 828 790

Deferred:

United States

Federal 1 (48) (62)

State (4) 5 —

Foreign (90) (29) (38)

Total (93) (72) (100)

TOTAL INCOME TAX EXPENSE $ 808 $ 756 $ 690

A reconciliation from the U.S. statutory federal income tax rate to the effective income tax rate is as follows:

Year Ended May 31,

2013 2012 2011

Federal income tax rate 35.0% 35.0% 35.0%

State taxes, net of federal benefit 1.4% 1.3% 1.3%

Foreign earnings -11.8% -11.9% -11.4%

Other, net 0.1% 0.6% -0.8%

EFFECTIVE INCOME TAX RATE 24.7% 25.0% 24.1%

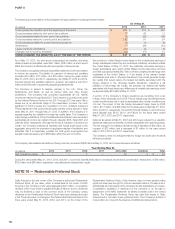

The effective tax rate from continuing operations for the year ended May 31,

2013 was 30 basis points lower than the effective tax rate from continuing

operations for the year ended May 31, 2012 primarily due to tax benefits

received from the intercompany sale of intellectual property rights outside of

the U.S., the retroactive reinstatement of the research and development credit

and the intra-period allocation of tax expense between continuing operations,

discontinued operations, and other comprehensive income. The decrease in

the effective tax rate was partially offset by a higher effective tax rate on

operations as a result of an increase in earnings in higher tax jurisdictions. The

effective tax rate from continuing operations for the year ended May 31, 2012

was 90 basis points higher than the effective tax rate from continuing

operations for the year ended May 31, 2011 primarily due to the changes in

uncertain tax positions partially offset by a reduction in the effective rate

related to a decrease in earnings in higher tax jurisdictions.

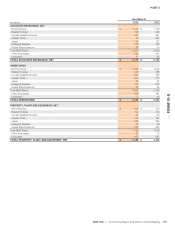

Deferred tax assets and (liabilities) comprise the following:

As of May 31,

(In millions) 2013 2012

Deferred tax assets:

Allowance for doubtful accounts $20$17

Inventories 40 37

Sales return reserves 101 84

Deferred compensation 197 186

Stock-based compensation 140 126

Reserves and accrued liabilities 66 66

Foreign loss carry-forwards 19 35

Foreign tax credit carry-forwards 106 216

Undistributed earnings of foreign subsidiaries 162 82

Other 47 62

Total deferred tax assets 898 911

Valuation allowance (5) (27)

Total deferred tax assets after valuation allowance 893 884

Deferred tax liabilities:

Property, plant and equipment (241) (191)

Intangibles (96) (98)

Other (20) (22)

Total deferred tax liability (357) (311)

NET DEFERRED TAX ASSET $ 536 $ 573

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 103

FORM 10-K