Nike 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

issue commercial paper or other debt securities during fiscal 2014 depending

on general corporate needs. We currently have short-term debt ratings of A1

and P1 from Standard and Poor’s Corporation and Moody’s Investor

Services, respectively.

As of May 31, 2013, we had cash, cash equivalents and short-term

investments totaling $6.0 billion, of which $3.5 billion was held by our foreign

subsidiaries. Cash equivalents and short-term investments consist primarily of

deposits held at major banks, money market funds, Tier-1 commercial paper,

corporate notes, U.S. Treasury obligations, U.S. government sponsored

enterprise obligations, and other investment grade fixed income

securities. Our fixed income investments are exposed to both credit and

interest rate risk. All of our investments are investment grade to minimize our

credit risk. While individual securities have varying durations, as of May 31,

2013 the average duration of our short-term investments and cash

equivalents portfolio is 98 days.

Despite recent uncertainties in the financial markets, to date we have not

experienced difficulty accessing the credit markets or incurred higher interest

costs. Future volatility in the capital markets, however, may increase costs

associated with issuing commercial paper or other debt instruments or affect

our ability to access those markets. We believe that existing cash, cash

equivalents, short-term investments and cash generated by operations,

together with access to external sources of funds as described above, will be

sufficient to meet our domestic and foreign capital needs in the foreseeable

future.

We utilize a variety of tax planning and financing strategies to manage our

worldwide cash and deploy funds to locations where they are needed. We

routinely repatriate a portion of our foreign earnings for which U.S. taxes have

previously been provided. We also indefinitely reinvest a significant portion of

our foreign earnings, and our current plans do not demonstrate a need to

repatriate these earnings. Should we require additional capital in the U.S., we

may elect to repatriate indefinitely reinvested foreign funds or raise capital in

the U.S. through debt. If we were to repatriate indefinitely reinvested foreign

funds, we would be required to accrue and pay additional U.S. taxes less

applicable foreign tax credits. If we elect to raise capital in the U.S. through

debt, we would incur additional interest expense.

Off-Balance Sheet Arrangements

In connection with various contracts and agreements, we routinely provide

indemnifications relating to the enforceability of intellectual property rights,

coverage for legal issues that arise and other items where we are acting as the

guarantor. Currently, we have several such agreements in place. However,

based on our historical experience and the estimated probability of future loss,

we have determined that the fair value of such indemnifications is not material

to our financial position or results of operations.

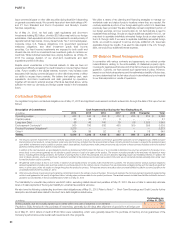

Contractual Obligations

Our significant long-term contractual obligations as of May 31, 2013 and significant endorsement contracts entered into through the date of this report are as

follows:

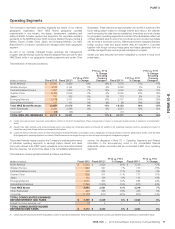

Description of Commitment Cash Payments Due During the Year Ending May 31,

(In millions) 2014 2015 2016 2017 2018 Thereafter Total

Operating Leases $ 403 $ 340 $ 304 $ 272 $ 225 $ 816 $ 2,360

Capital Leases 23 28 21 9 — — 81

Long-term Debt 98 46 145 79 56 1,525 1,949

Endorsement Contracts(1) 909 790 586 450 309 559 3,603

Product Purchase Obligations(2) 3,273 —————3,273

Other(3) 304 89 52 82 4 18 549

TOTAL $ 5,010 $ 1,293 $ 1,108 $ 892 $ 594 $ 2,918 $ 11,815

(1) The amounts listed for endorsement contracts represent approximate amounts of base compensation and minimum guaranteed royalty fees we are obligated to pay athlete and sport

team endorsers of our products. Actual payments under some contracts may be higher than the amounts listed as these contracts provide for bonuses to be paid to the endorsers based

upon athletic achievements and/or royalties on product sales in future periods. Actual payments under some contracts may also be lower as these contracts include provisions for reduced

payments if athletic performance declines in future periods.

In addition to the cash payments, we are obligated to furnish our endorsers with NIKE product for their use. It is not possible to determine how much we will spend on this product on an

annual basis as the contracts generally do not stipulate a specific amount of cash to be spent on the product. The amount of product provided to the endorsers will depend on many

factors, including general playing conditions, the number of sporting events in which they participate, and our own decisions regarding product and marketing initiatives. In addition, the

costs to design, develop, source, and purchase the products furnished to the endorsers are incurred over a period of time and are not necessarily tracked separately from similar costs

incurred for products sold to customers.

(2) We generally order product at least 4 to 5 months in advance of sale based primarily on futures orders received from customers. The amounts listed for product purchase obligations

represent agreements (including open purchase orders) to purchase products in the ordinary course of business that are enforceable and legally binding and that specify all significant

terms. In some cases, prices are subject to change throughout the production process. The reported amounts exclude product purchase liabilities included in accounts payable on the

consolidated balance sheet as of May 31, 2013.

(3) Other amounts primarily include service and marketing commitments made in the ordinary course of business. The amounts represent the minimum payments required by legally binding

contracts and agreements that specify all significant terms, including open purchase orders for non-product purchases. The reported amounts exclude those liabilities included in accounts

payable or accrued liabilities on the consolidated balance sheet as of May 31, 2013.

The total liability for uncertain tax positions was $447 million, excluding related interest and penalties, at May 31, 2013. We are not able to reasonably estimate

when or if cash payments of the long-term liability for uncertain tax positions will occur.

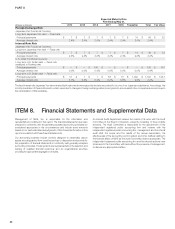

We also have the following outstanding short-term debt obligations as of May 31, 2013. Refer to Note 7 — Short-Term Borrowings and Credit Lines for further

description and interest rates related to the short-term debt obligations listed below.

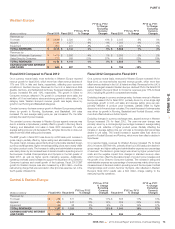

(In millions)

Outstanding as

of May 31, 2013

Notes payable, due at mutually agreed-upon dates within one year of issuance or on demand $ 121

Payable to Sojitz America for the purchase of inventories, generally due 60 days after shipment of goods from a foreign port 55

As of May 31, 2013, letters of credit of $149 million were outstanding, which were generally issued for the purchase of inventory and as guarantees of the

Company’s performance under certain self-insurance and other programs.

80