Nike 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

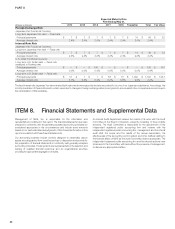

PART II

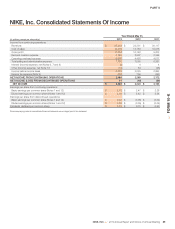

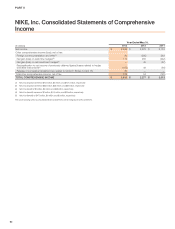

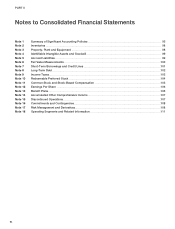

NOTE 1 — Summary of Significant Accounting Policies

Description of Business

NIKE, Inc. is a worldwide leader in the design, development and worldwide

marketing and selling of athletic footwear, apparel, equipment, accessories

and services. Wholly-owned NIKE, Inc. subsidiaries include Converse Inc.,

which designs, markets and distributes casual footwear, apparel and

accessories and Hurley International LLC, which designs, markets and

distributes action sports and youth lifestyle footwear, apparel and

accessories.

Basis of Consolidation

The consolidated financial statements include the accounts of NIKE, Inc. and

its subsidiaries (the “Company”). All significant intercompany transactions and

balances have been eliminated.

The Company completed the sale of Cole Haan during the third quarter

ended February 28, 2013 and completed the sale of Umbro during the

second quarter ended November 30, 2012. As a result, the Company reports

the operating results of Cole Haan and Umbro in the net income (loss) from

discontinued operations line in the consolidated statements of income for all

periods presented. In addition, the assets and liabilities associated with these

businesses are reported as assets of discontinued operations and liabilities

of discontinued operations, as appropriate, in the consolidated balance

sheets (refer to Note 15 — Discontinued Operations). Unless otherwise

indicated, the disclosures accompanying the consolidated financial

statements reflect the Company’s continuing operations.

On November 15, 2012, the Company announced a two-for-one split of both

NIKE Class A and Class B Common shares. The stock split was a 100

percent stock dividend payable on December 24, 2012 to shareholders of

record at the close of business December 10, 2012. Common stock began

trading at the split-adjusted price on December 26, 2012. All share numbers

and per share amounts presented reflect the stock split.

Recognition of Revenues

Wholesale revenues are recognized when title and the risks and rewards of

ownership have passed to the customer, based on the terms of sale. This

occurs upon shipment or upon receipt by the customer depending on the

country of the sale and the agreement with the customer. Retail store

revenues are recorded at the time of sale. Provisions for post-invoice sales

discounts, returns and miscellaneous claims from customers are estimated

and recorded as a reduction to revenue at the time of sale. Post-invoice sales

discounts consist of contractual programs with certain customers or

discretionary discounts that are expected to be granted to certain customers

at a later date. Estimates of discretionary discounts, returns and claims are

based on historical rates, specific identification of outstanding claims and

outstanding returns not yet received from customers, and estimated

discounts, returns and claims expected but not yet finalized with

customers. As of May 31, 2013 and 2012, the Company’s reserve balances

for post-invoice sales discounts, returns and miscellaneous claims were $531

million and $455 million, respectively.

Cost of Sales

Cost of sales consists primarily of inventory costs, as well as warehousing

costs (including the cost of warehouse labor), third party royalties, certain

foreign currency hedge gains and losses, and research, design and

development costs.

Shipping and Handling Costs

Shipping and handling costs are expensed as incurred and included in cost of

sales.

Operating Overhead Expense

Operating overhead expense consists primarily of payroll and benefit related

costs, rent, depreciation and amortization, professional services, and

meetings and travel.

Demand Creation Expense

Demand creation expense consists of advertising and promotion costs,

including costs of endorsement contracts, television, digital and print

advertising, brand events, and retail brand presentation. Advertising

production costs are expensed the first time an advertisement is run.

Advertising placement costs are expensed in the month the advertising

appears, while costs related to brand events are expensed when the event

occurs. Costs related to retail brand presentation are expensed when the

presentation is completed and delivered.

A significant amount of the Company’s promotional expenses result from

payments under endorsement contracts. Accounting for endorsement

payments is based upon specific contract provisions. Generally,

endorsement payments are expensed on a straight-line basis over the term of

the contract after giving recognition to periodic performance compliance

provisions of the contracts. Prepayments made under contracts are included

in prepaid expenses or other assets depending on the period to which the

prepayment applies.

Some of the contracts provide for contingent payments to endorsers based

upon specific achievements in their sports (e.g., winning a championship).

The Company records selling and administrative expense for these amounts

when the endorser achieves the specific goal.

Some of the contracts provide for payments based upon endorsers

maintaining a level of performance in their sport over an extended period of

time (e.g., maintaining a top ranking in a sport for a year). These amounts are

recorded in selling and administrative expense when the Company

determines that it is probable that the specified level of performance will be

maintained throughout the period. In these instances, to the extent that actual

payments to the endorser differ from our estimate due to changes in the

endorser’s athletic performance, increased or decreased selling and

administrative expense may be recorded in a future period.

Some of the contracts provide for royalty payments to endorsers based upon

a predetermined percentage of sales of particular products. The Company

expenses these payments in cost of sales as the related sales occur. In

certain contracts, the Company offers minimum guaranteed royalty

payments. For contractual obligations for which the Company estimates it will

not meet the minimum guaranteed amount of royalty fees through sales of

product, the Company records the amount of the guaranteed payment in

excess of that earned through sales of product in selling and administrative

expense uniformly over the remaining guarantee period.

Through cooperative advertising programs, the Company reimburses retail

customers for certain costs of advertising the Company’s products. The

Company records these costs in selling and administrative expense at the

point in time when it is obligated to its customers for the costs, which is when

the related revenues are recognized. This obligation may arise prior to the

related advertisement being run.

Total advertising and promotion expenses were $2,745 million, $2,607

million, and $2,344 million for the years ended May 31, 2013, 2012 and 2011,

respectively. Prepaid advertising and promotion expenses recorded in

prepaid expenses and other current assets totaled $386 million and $281

million at May 31, 2013 and 2012, respectively.

Cash and Equivalents

Cash and equivalents represent cash and short-term, highly liquid investments,

including commercial paper, U.S. treasury, U.S. agency, and corporate debt

securities with maturities of three months or less at date of purchase.

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 95

FORM 10-K