Nike 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

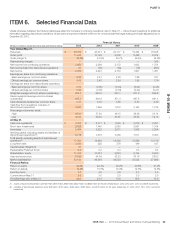

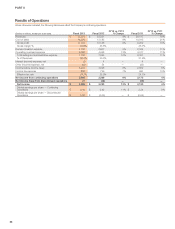

Results of Operations

Unless otherwise indicated, the following disclosures reflect the Company’s continuing operations.

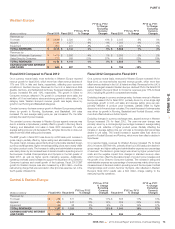

(Dollars in millions, except per share data) Fiscal 2013 Fiscal 2012

FY13 vs. FY12

% Change Fiscal 2011

FY12 vs. FY11

% Change

Revenues $ 25,313 $ 23,331 8% $ 20,117 16%

Cost of sales 14,279 13,183 8% 10,915 21%

Gross profit 11,034 10,148 9% 9,202 10%

Gross margin % 43.6% 43.5% 45.7%

Demand creation expense 2,745 2,607 5% 2,344 11%

Operating overhead expense 5,035 4,458 13% 4,017 11%

Total selling and administrative expense 7,780 7,065 10% 6,361 11%

% of Revenues 30.7% 30.3% 31.6%

Interest (income) expense, net (3) 4 — 4 —

Other (income) expense, net (15) 54 — (25) —

Income before income taxes 3,272 3,025 8% 2,862 6%

Income tax expense 808 756 7% 690 10%

Effective tax rate 24.7% 25.0% 24.1%

Net income from continuing operations 2,464 2,269 9% 2,172 4%

Net income (loss) from discontinued operations 21 (46) — (39) —

Net income $ 2,485 $ 2,223 12% $ 2,133 4%

Diluted earnings per share — Continuing

Operations $ 2.69 $ 2.42 11% $ 2.24 8%

Diluted earnings per share — Discontinued

Operations $ 0.02 $ (0.05) — $ (0.04) —

66