Nike 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

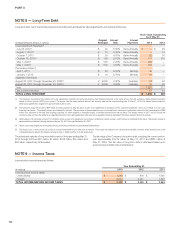

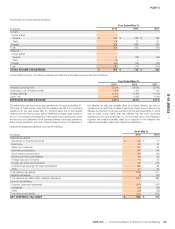

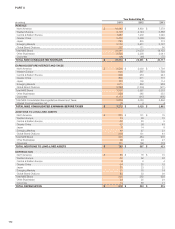

The following is a reconciliation of the changes in the gross balance of unrecognized tax benefits:

As of May 31,

(In millions) 2013 2012 2011

Unrecognized tax benefits, as of the beginning of the period $ 285 $ 212 $ 282

Gross increases related to prior period tax positions 77 48 13

Gross decreases related to prior period tax positions (3) (25) (98)

Gross increases related to current period tax positions 130 91 59

Gross decreases related to current period tax positions (9) (1) (6)

Settlements — (20) (43)

Lapse of statute of limitations (21) (9) (8)

Changes due to currency translation (12) (11) 13

UNRECOGNIZED TAX BENEFITS, AS OF THE END OF THE PERIOD $ 447 $ 285 $ 212

As of May 31, 2013, the total gross unrecognized tax benefits, excluding

related interest and penalties, were $447 million, $281 million of which would

affect the Company’s effective tax rate if recognized in future periods.

The Company recognizes interest and penalties related to income tax matters

in income tax expense. The liability for payment of interest and penalties

increased $4 million, $17 million, and $10 million during the years ended

May 31, 2013, 2012, and 2011, respectively. As of May 31, 2013 and 2012,

accrued interest and penalties related to uncertain tax positions was $112

million and $108 million, respectively (excluding federal benefit).

The Company is subject to taxation primarily in the U.S., China, the

Netherlands, and Brazil, as well as various state and other foreign

jurisdictions. The Company has concluded substantially all U.S. federal

income tax matters through fiscal 2010. The Company is currently under audit

by the Internal Revenue Service for the 2011 through 2013 tax years. Many

issues are at an advanced stage in the examination process, the most

significant of which includes the negotiation of a U.S. Unilateral Advanced

Pricing Agreement that covers intercompany transfer pricing issues for fiscal

years May 31, 2011 through May 31, 2015. In addition, the Company is in

appeals regarding the validation of foreign tax credits taken. The Company’s

major foreign jurisdictions, China, the Netherlands and Brazil, have concluded

substantially all income tax matters through calendar 2005, fiscal 2007 and

calendar 2006, respectively. Although the timing of resolution of audits is not

certain, the Company evaluates all domestic and foreign audit issues in the

aggregate, along with the expiration of applicable statutes of limitations, and

estimates that it is reasonably possible the total gross unrecognized tax

benefits could decrease by up to $86 million within the next 12 months.

We provide for United States income taxes on the undistributed earnings of

foreign subsidiaries unless they are considered indefinitely reinvested outside

the United States. At May 31, 2013, the indefinitely reinvested earnings in

foreign subsidiaries upon which United States income taxes have not been

provided was approximately $6.7 billion. If these undistributed earnings were

repatriated to the United States, or if the shares of the relevant foreign

subsidiaries were sold or otherwise transferred, they would generate foreign

tax credits that would reduce the federal tax liability associated with the

foreign dividend or the otherwise taxable transaction. Assuming a full

utilization of the foreign tax credits, the potential net deferred tax liability

associated with these temporary differences of undistributed earnings would

be approximately $2.2 billion at May 31, 2013.

A portion of the Company’s foreign operations are benefiting from a tax

holiday, which will phase out in 2019. This tax holiday may be extended when

certain conditions are met or may be terminated early if certain conditions are

not met. The impact of this tax holiday decreased foreign taxes by $108

million, $117 million, and $36 million for the fiscal years ended May 31, 2013,

2012, and 2011, respectively. The benefit of the tax holiday on net income per

share (diluted) was $0.12, $0.12, and $0.04 for the fiscal years ended

May 31, 2013, 2012, and 2011, respectively.

Deferred tax assets at May 31, 2013 and 2012 were reduced by a valuation

allowance relating to tax benefits of certain subsidiaries with operating losses.

The net change in the valuation allowance was a decrease of $22 million, an

increase of $23 million, and a decrease of $1 million for the years ended

May 31, 2013, 2012, and 2011, respectively.

The Company does not anticipate that any foreign tax credit carry-forwards

will expire unutilized.

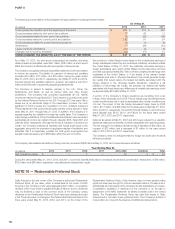

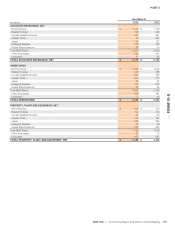

The Company has available domestic and foreign loss carry-forwards of $58 million at May 31, 2013. Such losses will expire as follows:

Year Ending May 31,

(In millions) 2014 2015 2016 2017 2018-2032 Indefinite Total

Net Operating Losses $ — — 2 — 52 4 $ 58

During the years ended May 31, 2013, 2012, and 2011, income tax benefits attributable to employee stock-based compensation transactions of $76 million,

$120 million, and $68 million, respectively, were allocated to shareholders’ equity.

NOTE 10 — Redeemable Preferred Stock

Sojitz America is the sole owner of the Company’s authorized Redeemable

Preferred Stock, $1 par value, which is redeemable at the option of Sojitz

America or the Company at par value aggregating $0.3 million. A cumulative

dividend of $0.10 per share is payable annually on May 31 and no dividends

may be declared or paid on the common stock of the Company unless

dividends on the Redeemable Preferred Stock have been declared and paid

in full. There have been no changes in the Redeemable Preferred Stock in the

three years ended May 31, 2013, 2012, and 2011. As the holder of the

Redeemable Preferred Stock, Sojitz America does not have general voting

rights but does have the right to vote as a separate class on the sale of all or

substantially all of the assets of the Company and its subsidiaries, on merger,

consolidation, liquidation or dissolution of the Company or on the sale or

assignment of the NIKE trademark for athletic footwear sold in the United

States. The Redeemable Preferred Stock has been fully issued to Sojitz

America and is not blank check preferred stock. The Company’s articles of

incorporation do not permit the issuance of additional preferred stock.

104