Nike 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

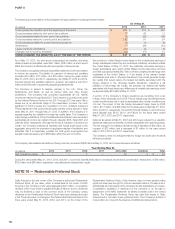

The weighted average contractual life remaining for options outstanding and

options exercisable at May 31, 2013 was 6.3 years and 4.7 years,

respectively. The aggregate intrinsic value for options outstanding and

exercisable at May 31, 2013 was $1,823 million and $1,218 million,

respectively. The aggregate intrinsic value was the amount by which the

market value of the underlying stock exceeded the exercise price of the

options. The total intrinsic value of the options exercised during the years

ended May 31, 2013, 2012, and 2011 was $293 million, $453 million, and

$267 million, respectively.

In addition to the 1990 Plan, the Company gives employees the right to

purchase shares at a discount to the market price under employee stock

purchase plans (“ESPPs”). Employees are eligible to participate through

payroll deductions of up to 10% of their compensation. At the end of each six-

month offering period, shares are purchased by the participants at 85% of the

lower of the fair market value at the beginning or the end of the offering period.

Employees purchased 1.6 million, 1.7 million, and 1.6 million shares during

each of the three years ended May 31, 2013, 2012 and 2011, respectively.

From time to time, the Company grants restricted stock units and restricted

stock to key employees under the 1990 Plan. The number of shares

underlying such awards granted to employees during the years ended

May 31, 2013, 2012, and 2011 were 1.6 million, 0.7 million, and 0.4 million

with weighted average values per share of $46.86, $49.49, and $35.11,

respectively. Recipients of restricted stock are entitled to cash dividends and

to vote their respective shares throughout the period of restriction. Recipients

of restricted stock units are entitled to dividend equivalent cash payments

upon vesting. The value of all grants of restricted stock and restricted stock

units was established by the market price on the date of grant. During the

years ended May 31, 2013, 2012, and 2011, the aggregate fair value of

restricted stock and restricted stock units vested was $25 million, $22 million,

and $15 million, respectively, determined as of the date of vesting.

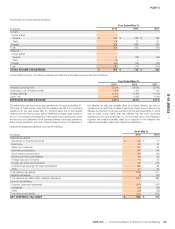

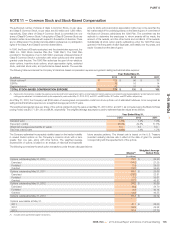

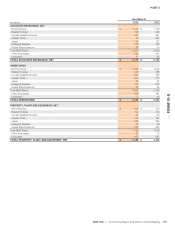

NOTE 12 — Earnings Per Share

The following is a reconciliation from basic earnings per share to diluted earnings per share. Options to purchase an additional 0.1 million, 0.2 million, and

0.3 million shares of common stock were outstanding at May 31, 2013, 2012, and 2011 respectively, but were not included in the computation of diluted earnings

per share because the options were anti-dilutive.

Year Ended May 31,

(In millions, except per share data) 2013 2012 2011

Determination of shares:

Weighted average common shares outstanding 897.3 920.0 951.1

Assumed conversion of dilutive stock options and awards 19.1 19.6 20.2

DILUTED WEIGHTED AVERAGE COMMON SHARES OUTSTANDING 916.4 939.6 971.3

Earnings per share from continuing operations:

Basic earnings per common share $ 2.75 $ 2.47 $ 2.28

Diluted earnings per common share $ 2.69 $ 2.42 $ 2.24

Earnings per share from discontinued operations:

Basic earnings per common share $ 0.02 $ (0.05) $ (0.04)

Diluted earnings per common share $ 0.02 $ (0.05) $ (0.04)

Basic earnings per common share for NIKE, Inc. $ 2.77 $ 2.42 $ 2.24

Diluted earnings per common share for NIKE, Inc. $ 2.71 $ 2.37 $ 2.20

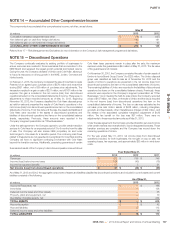

NOTE 13 — Benefit Plans

The Company has a profit sharing plan available to most U.S.-based

employees. The terms of the plan call for annual contributions by the

Company as determined by the Board of Directors. A subsidiary of the

Company also had a profit sharing plan available to its U.S.-based employees

prior to fiscal 2012. The terms of the plan called for annual contributions as

determined by the subsidiary’s executive management. Contributions of $47

million, $40 million, and $39 million were made to the plans and are included

in selling and administrative expense for the years ended May 31, 2013,

2012, and 2011, respectively. The Company has various 401(k) employee

savings plans available to U.S.-based employees. The Company matches a

portion of employee contributions. Company contributions to the savings

plans were $46 million, $42 million, and $38 million for the years ended

May 31, 2013, 2012, and 2011, respectively, and are included in selling and

administrative expense.

The Company also has a Long-Term Incentive Plan (“LTIP”) that was adopted

by the Board of Directors and approved by shareholders in September 1997

and later amended in fiscal 2007. The Company recognized $50 million, $51

million, and $31 million of selling and administrative expense related to cash

awards under the LTIP during the years ended May 31, 2013, 2012, and

2011, respectively.

The Company has pension plans in various countries worldwide. The pension

plans are only available to local employees and are generally government

mandated. The liability related to the unfunded pension liabilities of the plans

was $104 million and $113 million at May 31, 2013 and May 31, 2012,

respectively, which was primarily classified as long-term in other liabilities.

106