Nike 2013 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

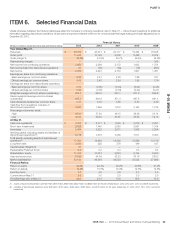

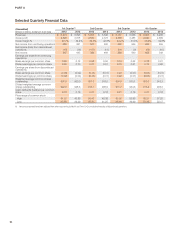

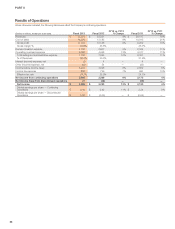

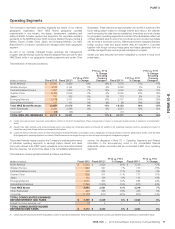

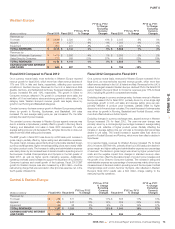

Fiscal 2013 Compared to Fiscal 2012

On a currency neutral basis, revenues from our NIKE, Inc. continuing

operations grew 11% for fiscal 2013, driven by increases in revenues for both

the NIKE Brand and our Other Businesses. Every NIKE Brand geography

except Greater China delivered higher revenues for fiscal 2013. North

America contributed 7 percentage points of the increase in NIKE, Inc.

revenues, while Emerging Markets contributed 2 percentage points and

Western and Central and Eastern Europe each contributed 1 percentage

point. Greater China’s results reduced NIKE, Inc. revenue growth by 1

percentage point. Revenues for our Other Businesses contributed 1

percentage point to our consolidated revenue growth.

Excluding the effects of changes in currency exchange rates, NIKE Brand

footwear and apparel revenue increased 11% and 10%, respectively, while

NIKE Brand equipment revenues increased 20% during fiscal 2013. The

increase in NIKE Brand footwear revenue for fiscal 2013 was attributable to

growth across our Running, Basketball, Football (Soccer), and Sportswear

categories. The growth of NIKE footwear revenues continued to be fueled by

increased demand for performance products, including Running models with

NIKE FREE and Lunar technologies, NIKE and Brand Jordan Basketball

styles, and performance Football (soccer) products. In fiscal 2013, unit sales

of footwear increased approximately 7% and the average selling price per pair

increased approximately 4%, driven equally by price increases and a shift in

mix to higher priced products.

For NIKE Brand apparel, the increase in revenue for fiscal 2013 was driven by

our Men’s Training category (which includes the NFL licensed business), in

addition to strong demand for Running and Basketball products. Apparel unit

sales in fiscal 2013 increased approximately 7% and the average selling price

per unit increased approximately 3%, reflecting a favorable mix of higher

priced products, such as performance Running, Basketball, and NFL licensed

apparel, and to a lesser extent, higher selling prices.

While wholesale revenues remain the largest component of overall NIKE

Brand revenues, we continue to expand Direct to Consumer revenues. Our

NIKE Brand Direct to Consumer operations include NIKE owned in-line and

factory stores, as well as online sales through NIKE owned websites. For fiscal

2013, Direct to Consumer revenues represented approximately 19% of our

total NIKE Brand revenues compared to 17% in fiscal 2012. On a currency

neutral basis, Direct to Consumer revenues grew 24% for fiscal 2013, as

comparable store sales grew 14% and we continue to expand our store

network and e-commerce business. Comparable store sales include

revenues from NIKE owned in-line and factory stores for which all three of the

following requirements have been met: (1) the store has been open at least

one year, (2) square footage has not changed by more than 15% within the

past year, and (3) the store has not been permanently repositioned within the

past year.

Revenues for our Other Businesses are comprised of results from Converse,

Hurley and NIKE Golf. Excluding the impact of currency changes, revenues

for these businesses increased 9% in fiscal 2013, reflecting growth across all

businesses.

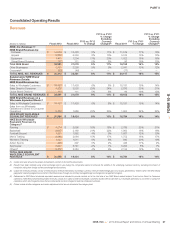

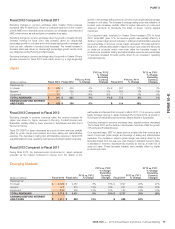

Fiscal 2012 Compared to Fiscal 2011

On a currency neutral basis, revenues for NIKE, Inc.’s continuing operations

grew 15% for fiscal 2012, driven by increases in revenues for both the NIKE

Brand and our Other Businesses. Excluding the effects of changes in

currency exchange rates, revenues for the NIKE Brand increased 15%, as

every NIKE Brand geography delivered higher revenues for fiscal 2012. North

America contributed approximately 7 percentage points to the NIKE Brand

revenue increase, while the Emerging Markets and Greater China

geographies contributed approximately 4 and 2 percentage points to the

NIKE Brand revenue growth, respectively. Revenues for our Other

Businesses grew 12% during fiscal 2012, contributing 1 percentage point of

our consolidated revenue growth.

Excluding the effects of changes in currency exchange rates, NIKE Brand

footwear and apparel revenue increased 15% and 13%, respectively, while

NIKE Brand equipment revenues increased 16% during fiscal 2012.

Continuing to fuel the growth of our NIKE Brand footwear business was the

increased demand for performance products, including the NIKE Lunar and

FREE technologies. The increase in NIKE Brand footwear revenue for fiscal

2012 was attributable to double-digit percentage growth in unit sales along

with a low-single-digit percentage increase in average selling price per pair,

primarily reflecting the favorable impact from product price increases, partially

offset by higher discounts on close-out sales. The overall increase in footwear

sales was driven by growth across all key categories, notably Running,

Sportswear and Basketball. For NIKE Brand apparel, the increase in revenue

for fiscal 2012 was driven by mid-single-digit percentage increases in both

unit sales and average selling prices. The increase in average selling prices

was primarily driven by product price increases, partially offset by a higher mix

of close-out sales. The overall increase in apparel sales was reflective of

increased demand across most key categories.

For fiscal 2012, Direct to Consumer channels represented approximately

17% of our total NIKE Brand revenues compared to 16% in fiscal 2011. On a

currency neutral basis, Direct to Consumer revenues grew 21% for fiscal

2012, as comparable store sales grew 13% and we continue to expand our

store network and e-commerce business.

Revenues for our Other Businesses consisted of results from our affiliate

brands; Converse, Hurley and NIKE Golf. Excluding the impact of currency

changes, revenues for these businesses increased by 12% in fiscal 2012,

reflecting growth across all businesses except Hurley, which was down

slightly for the fiscal year.

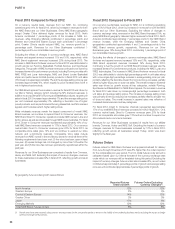

Futures Orders

Futures orders for NIKE Brand footwear and apparel scheduled for delivery

from June through November 2013 were 8% higher than the orders reported

for the comparable prior year period. The U.S. Dollar futures order amount is

calculated based upon our internal forecast of the currency exchange rates

under which our revenues will be translated during this period. Excluding the

impact of currency changes, futures orders also increased 8%, as unit orders

contributed approximately 5 percentage points of growth and average selling

price per unit contributed approximately 3 percentage points of growth.

By geography, futures orders growth was as follows:

Reported Futures

Orders Growth Futures Orders Excluding

Currency Changes(1)

North America 12% 12%

Western Europe 2% 0%

Central & Eastern Europe 14% 12%

Greater China 3% 0%

Japan -17% 6%

Emerging Markets 12% 12%

Total NIKE Brand Futures Orders 8% 8%

(1) Growth rates have been restated using constant exchange rates for the comparative period to enhance the visibility of the underlying business trends excluding the impact of foreign

currency exchange rate fluctuations.

68