Nike 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

larger allowance might be required. In the event we determine that a smaller

or larger allowance is appropriate, we would record a credit or a charge to

selling and administrative expense in the period in which such a determination

is made.

Inventory Reserves

We also make ongoing estimates relating to the net realizable value of

inventories based upon our assumptions about future demand and market

conditions. If we estimate that the net realizable value of our inventory is less

than the cost of the inventory recorded on our books, we record a reserve

equal to the difference between the cost of the inventory and the estimated

net realizable value. This reserve is recorded as a charge to cost of sales. If

changes in market conditions result in reductions in the estimated net

realizable value of our inventory below our previous estimate, we would

increase our reserve in the period in which we made such a determination and

record a charge to cost of sales.

Contingent Payments under Endorsement

Contracts

A significant portion of our demand creation expense relates to payments

under endorsement contracts. In general, endorsement payments are

expensed uniformly over the term of the contract. However, certain contract

elements may be accounted for differently, based upon the facts and

circumstances of each individual contract.

Some of the contracts provide for contingent payments to endorsers based

upon specific achievements in their sports (e.g., winning a championship). We

record selling and administrative expense for these amounts when the

endorser achieves the specific goal.

Some of the contracts provide for payments based upon endorsers

maintaining a level of performance in their sport over an extended period of

time (e.g., maintaining a top ranking in a sport for a year). These amounts are

reported in selling and administrative expense when we determine that it is

probable that the specified level of performance will be maintained throughout

the period. In these instances, to the extent that actual payments to the

endorser differ from our estimate due to changes in the endorser’s athletic

performance, increased or decreased selling and administrative expense may

be reported in a future period.

Some of the contracts provide for royalty payments to endorsers based upon

a predetermined percentage of sales of particular products. We expense

these payments in cost of sales as the related sales occur. In certain

contracts, we offer minimum guaranteed royalty payments. For contractual

obligations for which we estimate we will not meet the minimum guaranteed

amount of royalty fees through sales of product, we record the amount of the

guaranteed payment in excess of that earned through sales of product in

selling and administrative expense uniformly over the remaining guarantee

period.

Property, Plant and Equipment and Definite-

Lived Assets

Property, plant and equipment, including buildings, equipment, and

computer hardware and software are recorded at cost (including, in some

cases, the cost of internal labor) and are depreciated over the estimated

useful life. Changes in circumstances (such as technological advances or

changes to our business operations) can result in differences between the

actual and estimated useful lives. In those cases where we determine that the

useful life of a long-lived asset should be shortened, we increase depreciation

expense over the remaining useful life to depreciate the asset’s net book value

to its salvage value.

We review the carrying value of long-lived assets or asset groups to be used

in operations whenever events or changes in circumstances indicate that the

carrying amount of the assets might not be recoverable. Factors that would

necessitate an impairment assessment include a significant adverse change

in the extent or manner in which an asset is used, a significant adverse

change in legal factors or the business climate that could affect the value of

the asset, or a significant decline in the observable market value of an asset,

among others. If such facts indicate a potential impairment, we would assess

the recoverability of an asset group by determining if the carrying value of the

asset group exceeds the sum of the projected undiscounted cash flows

expected to result from the use and eventual disposition of the assets over the

remaining economic life of the primary asset in the asset group. If the

recoverability test indicates that the carrying value of the asset group is not

recoverable, we will estimate the fair value of the asset group using

appropriate valuation methodologies that would typically include an estimate

of discounted cash flows. Any impairment would be measured as the

difference between the asset group’s carrying amount and its estimated fair

value.

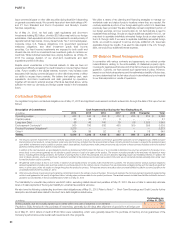

Goodwill and Indefinite-Lived Intangible Assets

We perform annual impairment tests on goodwill and intangible assets with

indefinite lives in the fourth quarter of each fiscal year, or when events occur or

circumstances change that would, more likely than not, reduce the fair value

of a reporting unit or an intangible asset with an indefinite life below its carrying

value. Events or changes in circumstances that may trigger interim

impairment reviews include significant changes in business climate, operating

results, planned investments in the reporting unit, planned divestitures or an

expectation that the carrying amount may not be recoverable, among other

factors. We may first assess qualitative factors to determine whether it is more

likely than not that the fair value of a reporting unit is less than its carrying

amount. If, after assessing the totality of events and circumstances, we

determine that it is more likely than not that the fair value of the reporting unit is

greater than its carrying amount, the two-step impairment test is

unnecessary. The two-step impairment test requires us to estimate the fair

value of our reporting units. If the carrying value of a reporting unit exceeds its

fair value, the goodwill of that reporting unit is potentially impaired and we

proceed to step two of the impairment analysis. In step two of the analysis, we

measure and record an impairment loss equal to the excess of the carrying

value of the reporting unit’s goodwill over its implied fair value, if any.

We generally base our measurement of the fair value of a reporting unit on a

blended analysis of the present value of future discounted cash flows and the

market valuation approach. The discounted cash flows model indicates the

fair value of the reporting unit based on the present value of the cash flows

that we expect the reporting unit to generate in the future. Our significant

estimates in the discounted cash flows model include: our weighted average

cost of capital; long-term rate of growth and profitability of the reporting unit’s

business; and working capital effects. The market valuation approach

indicates the fair value of the business based on a comparison of the reporting

unit to comparable publicly traded companies in similar lines of business.

Significant estimates in the market valuation approach model include

identifying similar companies with comparable business factors such as size,

growth, profitability, risk and return on investment, and assessing comparable

revenue and operating income multiples in estimating the fair value of the

reporting unit.

Indefinite-lived intangible assets primarily consist of acquired trade names and

trademarks. We may first perform a qualitative assessment to determine

whether it is more likely than not that an indefinite-lived intangible asset is

impaired. If, after assessing the totality of events and circumstances, we

determine that it is more likely than not that the indefinite-lived intangible asset

is not impaired, no quantitative fair value measurement is necessary. If a

quantitative fair value measurement calculation is required for these intangible

assets, we utilize the relief-from-royalty method. This method assumes that

trade names and trademarks have value to the extent that their owner is

relieved of the obligation to pay royalties for the benefits received from them.

This method requires us to estimate the future revenue for the related brands,

the appropriate royalty rate and the weighted average cost of capital.

Fair Value Measurements

For financial assets and liabilities measured at fair value on a recurring basis,

fair value is the price we would receive to sell an asset or pay to transfer a

82