Nike 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

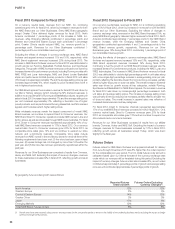

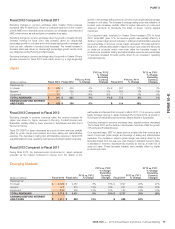

Fiscal 2013 Compared to Fiscal 2012

On a currency neutral basis, Central & Eastern Europe revenues for fiscal

2013 were driven by growth across most territories, particularly Russia and

Turkey, which grew 28% and 19%, respectively. Revenue growth in Central &

Eastern Europe was driven by growth in all key categories, most notably

Running, Football (Soccer), and Sportswear.

Constant currency footwear revenue growth in fiscal 2013 was primarily

driven by growth in Running, Football (Soccer), and Basketball, partially offset

by lower revenues in Sportswear. Unit sales increased 6% while average

selling price per pair increased 5%, primarily driven by price increases.

Constant currency apparel revenue growth in fiscal 2013 was driven by

growth in nearly all categories, most notably Sportswear, Football (Soccer),

and Running. Unit sales increased 16%, while average selling price per unit

decreased 2%, as an unfavorable mix of lower priced products more than off-

set higher selling prices.

EBIT for Central & Eastern Europe grew faster than revenue primarily due to

gross margin improvement and selling and administrative expense leverage.

Gross margin increased 30 basis points, largely driven by price increases and

the favorable impact of our higher margin Direct to Consumer business, more

than offsetting higher product costs and unfavorable standard foreign

currency exchange rates.

Fiscal 2012 Compared to Fiscal 2011

Excluding the changes in currency exchange rates, revenues for Central &

Eastern Europe increased 17% for fiscal 2012, driven by growth across most

territories, including double-digit growth in Russia and Turkey, which more

than offset lower revenues in Greece.

Excluding changes in currency exchange rates, Central & Eastern Europe’s

footwear revenue grew 13%, primarily driven by double-digit percentage

growth in unit sales and a low-single-digit percentage increase in average

selling price per pair. The increase in average selling price per pair was

reflective of product price increases which more than offset the negative

impact of higher discounts on in-line and close-out sales. The overall increase

in footwear sales was driven by growth across all key categories, most

notably Running, Sportswear and Football (Soccer).

Excluding changes in currency exchange rates, Central & Eastern Europe’s

apparel revenues grew 24%, mainly driven by double-digit percentage

growth in unit sales, offset by a slight decrease in average price per unit,

mainly due to less favorable product mix and higher discounts on in-line sales,

which more than offset the impact from product price increases. The overall

increase in apparel sales was primarily driven by growth in Football (Soccer),

Sportswear and Running.

On a reported basis, revenues for Central & Eastern Europe increased 15%

for fiscal 2012. However, EBIT fell 4%, primarily driven by a 420 basis point

decline in gross margin. The decline in gross margin was primarily due to

higher product input costs as well as higher discounts on in-line and close-out

products, which more than offset the favorable impact from product price

increases. Selling and administrative expense as a percentage of revenues

remained relatively flat compared to the prior period.

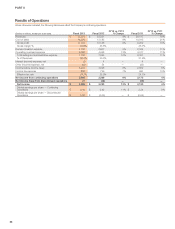

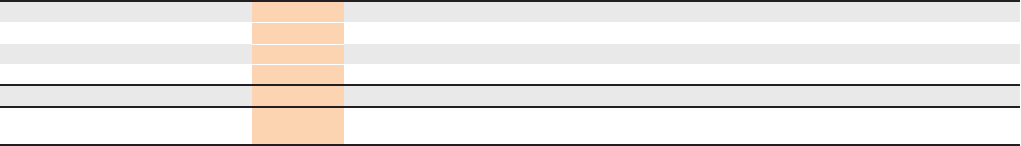

Greater China

(Dollars in millions) Fiscal 2013 Fiscal 2012

FY13 vs. FY12

% Change

FY13 vs. FY12

% Change

Excluding

Currency

Changes Fiscal 2011

FY12 vs. FY11

% Change

FY12 vs. FY11

% Change

Excluding

Currency

Changes

Revenues by:

Footwear $ 1,493 $ 1,518 -2% -3% $ 1,164 30% 25%

Apparel 829 896 -7% -9% 789 14% 9%

Equipment 131 125 5% 3% 107 17% 12%

TOTAL REVENUES $ 2,453 $ 2,539 -3% -5% $ 2,060 23% 18%

EARNINGS BEFORE INTEREST

AND TAXES $ 809 $ 911 -11% $ 777 17%

Fiscal 2013 Compared to Fiscal 2012

On a currency neutral basis, Greater China revenue decreased in fiscal 2013,

driven by lower futures orders as well as increased discounts, product returns

and proactive cancellation of orders to manage inventory levels at retail. These

downsides were partially offset by 33% growth in our Direct to Consumer

business driven by comparable store sales growth of 13% and the addition of

29 net new factory stores. Fiscal 2013 revenues for most key categories were

lower than in fiscal 2012.

For fiscal 2013, constant currency footwear revenue growth for Greater China

declined, driven by lower sales across most key categories, most notably

Sportswear and Men’s and Women’s Training, and increased reserves for

product discounts and returns. Unit sales decreased 1%, while average

selling price per pair decreased 2%, reflecting a higher mix of close-out sales

and higher discounts.

The decrease in constant currency apparel revenue for fiscal 2013 was driven

by lower revenues in Sportswear and Men’s and Women’s Training, partially

offset by higher revenues in Basketball. Apparel unit sales in fiscal 2013 were

3% lower than the prior year while average selling price per unit was down

6%, reflecting a higher mix of close-out sales and higher discounts.

Fiscal 2013 EBIT for Greater China decreased at a faster rate than revenue,

driven by lower gross margin and selling and administrative expense

deleverage. Fiscal 2013 gross margin decreased 50 basis points due to a

lower average selling price per unit driven by higher discounts and close-out

mix partially offset by favorable standard foreign currency exchange rates.

Selling and administrative expense increased as a percent of revenues, driven

primarily by the increased investment in our Direct to Consumer business and

the decrease in revenues.

Our results in Greater China have been adversely impacted by sluggish

macroeconomic growth and slow product sell-through at retail, leading to

high levels of inventory in the marketplace. Our strategy to return to sustained,

profitable growth in Greater China focuses on extending our brand leadership

position with consumers; expanding the offering of product styles and fits

designed for the Chinese consumer; and working with our retail partners to

create more differentiated, productive, and profitable retail stores.

Despite the challenges we have seen in China, there are indications that our

strategies are taking hold in the marketplace. Comparable store sales are

growing in our NIKE-owned Direct to Consumer doors and our wholesale

customers are reporting comparable store growth and declining inventory

levels. While we are making progress, we will continue to work with our

retailers to optimize inventory, accelerate sell-through, and improve retail

productivity. While China futures orders for the next six months are in line with

last year, we expect revenues for the first half of the fiscal year will be below

last year as we continue to manage the amount of product we ship into the

market. We believe our revenue in China will stabilize around prior year levels

in the second half of this fiscal year.

74