Nike 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

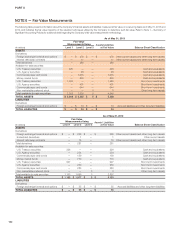

Derivative financial instruments include foreign exchange forwards and

options, embedded derivatives and interest rate swap contracts. The fair

value of derivative contracts is determined using observable market inputs

such as the daily market foreign currency rates, forward pricing curves,

currency volatilities, currency correlations and interest rates, and considers

nonperformance risk of the Company and that of its counterparties.

Adjustments relating to these nonperformance risks were not material at

May 31, 2013 or 2012. Refer to Note 17 — Risk Management and Derivatives

for additional detail.

Available-for-sale securities comprise investments in U.S. Treasury and

Agency securities, money market funds, corporate commercial paper and

bonds. These securities are valued using market prices on both active

markets (Level 1) and less active markets (Level 2). Pricing vendors are utilized

for certain Level 1 or Level 2 investments. These vendors either provide a

quoted market price in an active market or use observable inputs without

applying significant adjustments in their pricing. Observable inputs include

broker quotes, interest rates and yield curves observable at commonly

quoted intervals, volatilities and credit risks. The carrying amounts reflected in

the consolidated balance sheets for short-term investments and cash and

equivalents approximate fair value.

The Company’s Level 3 assets comprise investments in certain non-

marketable preferred stock. These investments are valued using internally

developed models with unobservable inputs. These Level 3 investments are

an immaterial portion of our portfolio. Changes in Level 3 investment assets

were immaterial during the years ended May 31, 2013 and 2012.

No transfers among the levels within the fair value hierarchy occurred during

the years ended May 31, 2013 or 2012.

As of May 31, 2013 and 2012, the Company had no assets or liabilities that

were required to be measured at fair value on a non-recurring basis.

Short-Term Investments

As of May 31, 2013 and 2012, short-term investments consisted of available-

for-sale securities. As of May 31, 2013, the Company held $2,229 million of

available-for-sale securities with maturity dates within one year from the

purchase date and $399 million with maturity dates over one year and less

than five years from the purchase date within short-term investments. As of

May 31, 2012, the Company held $1,129 million of available-for-sale

securities with maturity dates within one year from purchase date and $311

million with maturity dates over one year and less than five years from

purchase date within short-term investments.

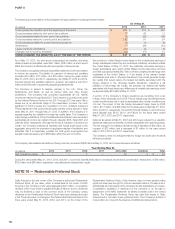

Short-term investments classified as available-for-sale consist of the following at fair value:

As of May 31,

(In millions) 2013 2012

Available-for-sale investments:

U.S. treasury and agencies $ 1,984 $ 1,157

Commercial paper and bonds 644 283

TOTAL AVAILABLE-FOR-SALE INVESTMENTS $ 2,628 $ 1,440

Included in interest (income) expense, net was interest income related to cash

and equivalents and short-term investments of $26 million, $27 million, and

$28 million for the years ended May 31, 2013, 2012, and 2011, respectively.

For fair value information regarding notes payable and long-term debt, refer to

Note 7 — Short-Term Borrowings and Credit Lines and Note 8 — Long-Term

Debt.

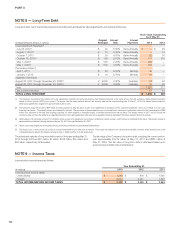

NOTE 7 — Short-Term Borrowings and Credit Lines

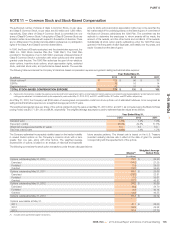

Notes payable and interest-bearing accounts payable to Sojitz Corporation of America (“Sojitz America”) as of May 31, 2013 and 2012, are summarized below:

As of May 31,

2013 2012

(In millions) Borrowings Interest Rate Borrowings Interest Rate

Notes payable:

U.S. operations $ 20 0.00%(1) $ 30 5.50%(1)

Non-U.S. operations 101 4.77%(1) 78 9.46%(1)

TOTAL NOTES PAYABLE $ 121 $ 108

Interest-Bearing Accounts Payable:

Sojitz America $ 55 0.99% $ 75 1.10%

(1) Weighted average interest rate includes non-interest bearing overdrafts.

The carrying amounts reflected in the consolidated balance sheets for notes

payable approximate fair value.

The Company purchases through Sojitz America certain athletic footwear,

apparel and equipment it acquires from non-U.S. suppliers. These purchases

are for the Company’s operations outside of the United States, Europe and

Japan. Accounts payable to Sojitz America are generally due up to 60 days

after shipment of goods from the foreign port. The interest rate on such

accounts payable is the 60-day London Interbank Offered Rate (“LIBOR”) as

of the beginning of the month of the invoice date, plus 0.75%.

As of May 31, 2013 and 2012, the Company had no amounts outstanding

under its commercial paper program.

In November 2011, the Company entered into a committed credit facility

agreement with a syndicate of banks which provides for up to $1 billion of

borrowings pursuant to a revolving credit facility with the option to increase

borrowings to $1.5 billion with lender approval. The facility matures on

November 1, 2016, with a one-year extension option prior to both the second

and third anniversary of the closing date, provided that extensions shall not

extend beyond November 1, 2018. Based on the Company’s current long-

term senior unsecured debt ratings of A+ and A1 from Standard and Poor’s

Corporation and Moody’s Investor Services, respectively, the interest rate

charged on any outstanding borrowings would be the prevailing LIBOR plus

0.56%. The facility fee is 0.065% of the total commitment. Under this

committed credit facility, the Company must maintain, among other things,

certain minimum specified financial ratios with which the Company was in

compliance at May 31, 2013. No amounts were outstanding under this facility

as of May 31, 2013 or 2012.

NIKE, INC. 2013 Annual Report and Notice of Annual Meeting 101

FORM 10-K