Metro PCS 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

On December 1, 2010, we closed on a like-kind spectrum exchange agreement covering licenses in certain

metropolitan areas with the Service Provider. We acquired 10 MHz of AWS spectrum in Orlando in exchange for

10 MHz of PCS spectrum in Ft. Pierce-Vero Beach-Stuart, Florida, 10 MHz of partitioned AWS spectrum in the Salt

Lake City and Portland cellular marketing areas and total cash consideration of $3.0 million. The exchange of

spectrum resulted in a gain on disposal of assets in the amount of $26.6 million.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

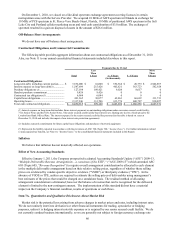

Contractual Obligations and Commercial Commitments

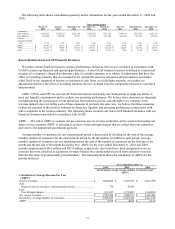

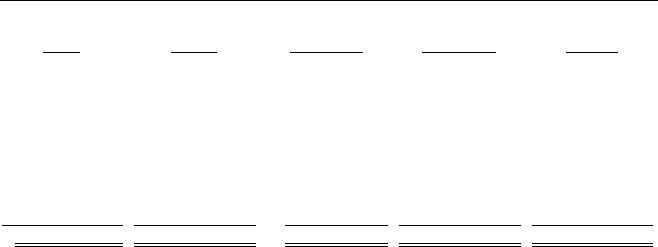

The following table provides aggregate information about our contractual obligations as of December 31, 2010.

Also, see Note 11 to our annual consolidated financial statements included elsewhere in this report.

Pa

y

ments Due b

y

Period

Total

Less

Than

1Year 1-3Years 3 - 5 Years

More

Than

5 Years

(In thousands)

Contractual Obli

g

ations:

Long-term debt, including current portion ........

.

$ 3,532,000 $ 16,000 $ 552,364 $ 20,779 $ 2,942,857

Interest expense on long-term debt(1) ...............

.

1,547,694 215,426 405,621 363,723 562,924

Purchase obligations (2) ....................................

.

127,104 109,421 9,026 8,657 0

Handset purchase commitment .........................

.

9,426 9,426 0 0 0

Contractual tax obligations (3) ..........................

.

6,084 6,084 0 0 0

Capital lease obligations ...................................

.

491,365 30,077 62,863 66,692 331,733

Operating leases ................................................

.

2,337,246 312,706 613,776 600,707 810,057

Total cash contractual obligations ....................

.

$ 8,050,919 $ 699,140 $ 1,643,650 $ 1,060,558 $ 4,647,571

____________________________

(1) Interest expense on long-term debt includes future interest payments on outstanding obligations under our senior secured credit facility,

7Ǭ% Senior Notes and the 6ǫ% Senior Notes. The senior secured credit facility bears interest at a floating rate tied to a fixed spread to the

London Inter Bank Offered Rate. The interest expense for the senior secured credit facility presented in this table is based on rates at

December 31, 2010 and includes the impact of our interest rate protection agreements.

(2) Includes expected commitments for future capital lease obligations and purchases of network equipment.

(3) Represents the liability reported in accordance with the provisions of ASC 740 (Topic 740, “Income Taxes”). For further information related

to unrecognized tax benefits, see Note 14, “Income Taxes,” to the consolidated financial statements included in this Report.

Inflation

We believe that inflation has not materially affected our operations.

Effect of New Accounting Standards

Effective January 1, 2011, the Company prospectively adopted Accounting Standards Update (“ASU”) 2009-13,

“Multiple Deliverable Revenue Arrangements – a consensus of the EITF, “ (“ASU 2009-13”) which amended ASC

605 (Topic 605, “Revenue Recognition”) to require overall arrangement consideration be allocated to each element

in the multiple deliverable arrangement based on their relative selling prices, regardless of whether those selling

prices are evidenced by vendor-specific objective evidence (“VSOE”) or third party evidence (“TPE”). In the

absence of VSOE or TPE, entities are required to estimate the selling prices of deliverables using management’s

best estimates of the prices that would be charged on a standalone basis. The residual method of allocating

arrangement consideration is eliminated; however the balance of revenue that can be recognized for the delivered

element is limited to the non-contingent amount. The implementation of this standard did not have a material

impact on the Company’s financial condition, results of operations or cash flows.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market risk is the potential loss arising from adverse changes in market prices and rates, including interest rates.

We do not routinely enter into derivatives or other financial instruments for trading, speculative or hedging

purposes, unless it is hedging interest rate risk exposure or is required by our senior secured credit facility. We do

not currently conduct business internationally, so we are generally not subject to foreign currency exchange rate