Metro PCS 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-19

x Level 3 - Valuations based on models where significant inputs are not observable. The unobservable

inputs reflect the Company’s own assumptions about the assumptions that market participants would

use.

ASC 820 requires the Company to maximize the use of observable inputs and minimize the use of unobservable

inputs. If a financial instrument uses inputs that fall in different levels of the hierarchy, the instrument will be

categorized based upon the lowest level of input that is significant to the fair value calculation. The Company’s

financial assets and liabilities measured at fair value on a recurring basis include cash and cash equivalents, short

and long-term investments securities and derivative financial instruments.

Included in the Company’s cash and cash equivalents are cash on hand, cash in bank accounts, investments in

money market funds consisting of U.S. Treasury securities with an original maturity of 90 days or less. Included in

the Company’s short-term investments are securities classified as available-for-sale, which are stated at fair value.

The securities include U.S. Treasury securities with an original maturity of over 90 days. Fair value is determined

based on observable quotes from banks and unadjusted quoted market prices from identical or similar securities in

an active market at the reporting date. Significant inputs to the valuation are observable in the active markets and are

classified as Level 1 in the hierarchy.

Included in the Company’s long-term investments securities are certain auction rate securities, some of which

are secured by collateralized debt obligations with a portion of the underlying collateral being mortgage securities or

related to mortgage securities. Due to the lack of availability of observable market quotes on the Company’s

investment portfolio of auction rate securities, the fair value was estimated based on valuation models that rely

exclusively on unobservable Level 3 inputs including those that are based on expected cash flow streams and

collateral values, including assessments of counterparty credit quality, default risk underlying the security, discount

rates and overall capital market liquidity. The valuation of the Company’s investment portfolio is subject to

uncertainties that are difficult to predict. Factors that may impact the Company’s valuation include changes to credit

ratings of the securities as well as the underlying assets supporting those securities, rates of default of the underlying

assets, underlying collateral values, discount rates, counterparty risk and ongoing strength and quality of market

credit and liquidity. Significant inputs to the investments valuation are unobservable in the active markets and are

classified as Level 3 in the hierarchy.

Included in the Company’s derivative financial instruments are interest rate swaps. Derivative financial

instruments are valued in the market using discounted cash flow techniques. These techniques incorporate Level 1

and Level 2 inputs such as interest rates. These market inputs are utilized in the discounted cash flow calculation

considering the instrument’s term, notional amount, discount rate and credit risk. Significant inputs to the derivative

valuation for interest rate swaps are observable in the active markets and are classified as Level 2 in the hierarchy.

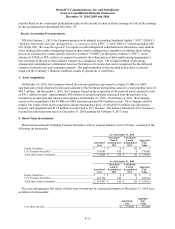

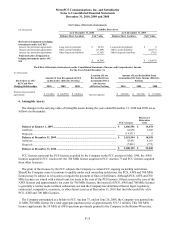

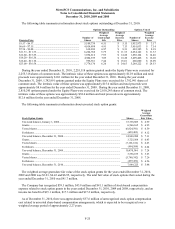

The following table summarizes assets and liabilities measured at fair value on a recurring basis at December 31,

2010, as required by ASC 820 (in thousands):

Fair Value Measurements

Level 1 Level 2 Level 3 Total

Assets

Cash equivalents ........................................................................... $ 787,829 $ 0 $ 0 $ 787,829

Short-term investments ................................................................. 374,862 0 0 374,862

Restricted cash and investments ................................................... 2,876 0 0 2,876

Long-term investments ................................................................. 0 0 6,319 6,319

Derivative assets ........................................................................... 0 10,381 0 10,381

Total assets measured at fair value ...................................................... $1,165,567 $ 10,381 $ 6,319 $1,182,267

Liabilities

Derivative liabilities ..................................................................... $ 0 $ 18,690 $ 0 $ 18,690

Total liabilities measure

d

at fair value ................................................ $ 0 $ 18,690 $ 0 $ 18,690