Metro PCS 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-21

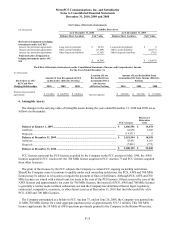

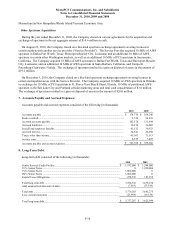

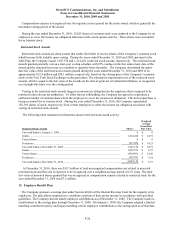

The estimated fair values of the Company’s financial instruments are as follows (in thousands):

December 31, 2010 December 31, 2009

Carrying

Amount Fair Value

Carrying

Amount Fair Value

Senior Secured Credit Facility ...........................................................

.

$ 1,532,000 $ 1,535,059 $ 1,548,000 $ 1,470,600

9¼% Senior Notes .............................................................................

.

0 0 1,950,000 1,979,250

7Ǭ% Senior Notes .............................................................................

.

992,947 1,032,500 0 0

6з% Senior Notes .............................................................................

.

1,000,000 955,000 0 0

Cash flow hedging derivative liabilities ............................................

.

18,690 18,690 24,859 24,859

Cash flow hedging derivative assets ..................................................

.

10,381 10,381 0 0

Short-term investments ......................................................................

.

374,862 374,862 224,932 224,932

Long-term investments ......................................................................

.

6,319 6,319 6,319 6,319

Although the Company has determined the estimated fair value amounts using available market information and

commonly accepted valuation methodologies, considerable judgment is required in interpreting market data to

develop fair value estimates. The fair value estimates are based on information available at December 31, 2010 and

2009 and have not been revalued since those dates. As such, the Company’s estimates are not necessarily indicative

of the amount that the Company, or holders of the instruments, could realize in a current market exchange and

current estimates of fair value could differ significantly.

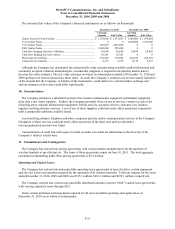

10. Concentrations:

The Company purchases a substantial portion of its wireless infrastructure equipment and handset equipment

from only a few major suppliers. Further, the Company generally relies on one or two key vendors in each of the

following areas: network infrastructure equipment, billing services, payment services, customer care, handset

logistics and long distance services. Loss of any of these suppliers could adversely affect operations temporarily

until a comparable substitute could be found.

Local and long distance telephone and other companies provide certain communication services to the Company.

Disruption of these services could adversely affect operations in the short term until an alternative

telecommunication provider was found.

Concentrations of credit risk with respect to trade accounts receivable are limited due to the diversity of the

Company’s indirect retailer base.

11. Commitments and Contingencies:

The Company has entered into pricing agreements with various handset manufacturers for the purchase of

wireless handsets at specified prices. The terms of these agreements expire on June 30, 2011. The total aggregate

commitment outstanding under these pricing agreements is $9.4 million.

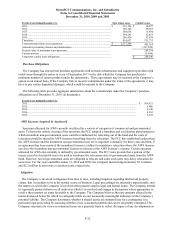

Operating and Capital Leases

The Company has entered into non-cancelable operating lease agreements to lease facilities, certain equipment

and sites for towers and antennas required for the operation of its wireless networks. Total rent expense for the years

ended December 31, 2010, 2009 and 2008 was $325.1 million, $281.2 million and $199.1 million, respectively.

The Company entered into various non-cancelable distributed antenna systems (“DAS”) capital lease agreements,

with varying expiration terms through 2025.

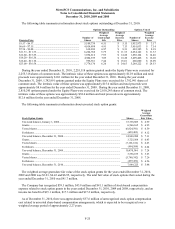

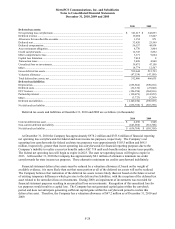

Future annual minimum rental payments required for all non-cancelable operating and capital leases at

December 31, 2010 are as follows (in thousands):