Metro PCS 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-9

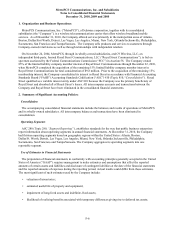

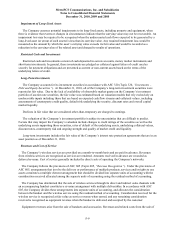

Impairment of Long-Lived Assets

The Company assesses potential impairments to its long-lived assets, including property and equipment, when

there is evidence that events or changes in circumstances indicate that the carrying value may not be recoverable. An

impairment loss may be required to be recognized when the undiscounted cash flows expected to be generated by a

long-lived asset (or group of such assets) is less than its carrying value. Any required impairment loss would be

measured as the amount by which the asset’s carrying value exceeds its fair value and would be recorded as a

reduction in the carrying value of the related asset and charged to results of operations.

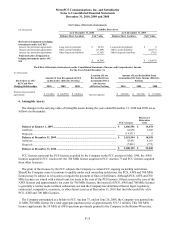

Restricted Cash and Investments

Restricted cash and investments consist of cash deposited in escrow accounts, money market instruments and

short-term investments. In general, these investments are pledged as collateral against letters of credit used as

security for payment obligations and are presented as current or non-current assets based on the terms of the

underlying letters of credit.

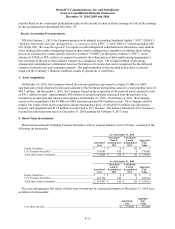

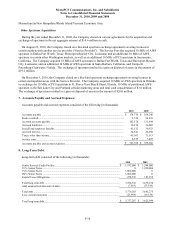

Long-Term Investments

The Company accounts for its investment securities in accordance with ASC 320 (Topic 320, “Investments –

Debt and Equity Securities”). At December 31, 2010, all of the Company’s long-term investment securities were

reported at fair value. Due to the lack of availability of observable market quotes on the Company’s investment

portfolio of auction rate securities, the fair value was estimated based on valuation models that rely exclusively on

unobservable inputs including those that are based on expected cash flow streams and collateral values, including

assessments of counterparty credit quality, default risk underlying the security, discount rates and overall capital

market liquidity.

Declines in fair value that are considered other-than-temporary are charged to earnings.

The valuation of the Company’s investment portfolio is subject to uncertainties that are difficult to predict.

Factors that may impact the Company’s valuation include changes to credit ratings of the securities as well as the

underlying assets supporting those securities, rates of default of the underlying assets, underlying collateral values,

discount rates, counterparty risk and ongoing strength and quality of market credit and liquidity.

Long-term investments includes the fair value of the Company’s interest rate protection agreements that are in an

asset position as of December 31, 2010.

Revenues and Cost of Service

The Company’s wireless services are provided on a month-to-month basis and are paid in advance. Revenues

from wireless services are recognized as services are rendered. Amounts received in advance are recorded as

deferred revenue. Cost of service generally includes the direct costs of operating the Company’s networks.

The Company follows the provisions of ASC 605 (Topic 605, “Revenue Recognition”). Under the provisions of

ASC 605, arrangements that involve the delivery or performance of multiple products, services and/or rights to use

assets constitutes a multiple element arrangement that should be divided into separate units of accounting with the

consideration received allocated among the separate units of accounting using the residual method of accounting.

The Company has determined that the sale of wireless services through its direct and indirect sales channels with

an accompanying handset constitutes a revenue arrangement with multiple deliverables. In accordance with ASC

605, the Company divides these arrangements into separate units of accounting, and allocates the consideration

between the handset and the wireless service using the residual method of accounting. Consideration received for the

wireless service is recognized at fair value as service revenue when earned, and any remaining consideration

received is recognized as equipment revenue when the handset is delivered and accepted by the customer.

Equipment revenues arise from the sale of handsets and accessories. Revenues and related costs from the sale of