Metro PCS 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

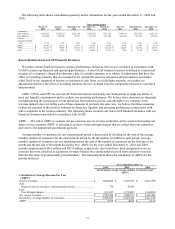

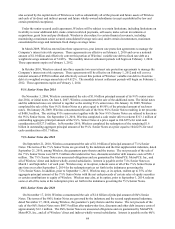

Year Ended December 31,

2010 2009 2008

(In Thousands)

Calculation of Consolidated Ad

j

usted EBITDA:

Net income ............................................................................................................ $ 193,415 $ 176,844 $ 149,438

Adjustments:

Depreciation and amortization............................................................................. 449,732 377,856 255,319

(Gain) loss on disposal of assets .......................................................................... (38,812) (4,683) 18,905

Stoc

k

-

b

ased compensation expense(1) ................................................................ 46,537 47,783 41,142

Interest expense ................................................................................................... 263,125 270,285 179,398

Interest income .................................................................................................... (1,954) (2,870) (22,947)

Other expense, net ............................................................................................... 1,807 1,808 1,035

Impairment loss on investment securities ............................................................

—

2,386 30,857

Loss on extinguishment of debt ........................................................................... 143,626

—

—

Provision for income taxes................................................................................... 118,879 86,835 129,986

Consolidated Ad

j

usted EBITDA ....................................................................... $ 1,176,355 $ 956,244 $ 783,133

_______________________

(1) Represents a non-cash expense, as defined by our senior secured credit facility.

In addition, for further information, the following table reconciles consolidated Adjusted EBITDA, as defined in

our senior secured credit facility, to cash flows from operating activities for the years ended December 31, 2010,

2009 and 2008.

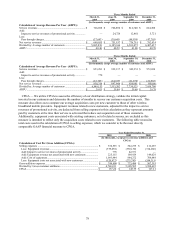

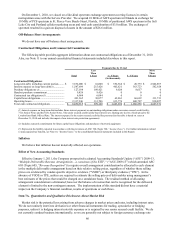

Year Ended December 31,

2010 2009 2008

(In Thousands)

Reconciliation of Net Cash Provided by Operating Activities to

Consolidated Ad

j

usted EBITDA:

Net cash provided by operating activities ............................................................. $ 994,500 $ 899,349 $ 447,490

Adjustments:

Interest expense ................................................................................................... 263,125 270,285 179,398

Non-cash interest expense.................................................................................... (13,264) (11,309) (2,550)

Interest income .................................................................................................... (1,954) (2,870) (22,947)

Other expense, net ............................................................................................... 1,807 1,808 1,035

Other non-cash expense ....................................................................................... (1,929) (1,567) (1,258)

Provision for uncollectible accounts receivable ................................................... (2) (199) (8)

Deferred rent expense .......................................................................................... (21,080) (24,222) (20,646)

Cost of abandoned cell sites ................................................................................. (2,633) (8,286) (8,592)

Accretion of asset retirement obligation .............................................................. (3,063) (5,111) (3,542)

Gain on sale and maturity of investments ............................................................ 566 644

—

Provision for income taxes................................................................................... 118,879 86,835 129,986

Deferred income taxes ......................................................................................... (115,478) (110,161) (124,347)

Changes in working capital .................................................................................. (43,119) (138,952) 209,114

Consolidated Ad

j

usted EBITDA ....................................................................... $ 1,176,355 $ 956,244 $ 783,133

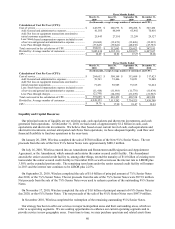

Operating Activities

Cash provided by operating activities increased approximately $95.2 million to $994.5 million during the year

ended December 31, 2010 from $899.3 million for the year ended December 31, 2009. The increase is primarily

attributable to an increase in operating income during the year ended December 31, 2010, partially offset by a

decrease in cash flows provided by changes in working capital during the year ended December 31, 2010 compared

to the same period in 2009.

Cash provided by operating activities increased approximately $451.9 million to approximately $899.3 million

during the year ended December 31, 2009 from $447.5 million for the year ended December 31, 2008. The increase

was primarily attributable to an increase in cash flows from working capital changes and an increase in operating

income during the year ended December 31, 2009 compared to the same period in 2008.

Cash provided by operating activities decreased $141.8 million to $447.5 million during the year ended

December 31, 2008 from $589.3 million for the year ended December 31, 2007. The decrease was primarily

attributable to a decrease in working capital during the year ended December 31, 2008 compared to the same period

in 2007, partially offset by an increase in operating income as a result of the growth experienced over the last twelve

months.