Metro PCS 2010 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-17

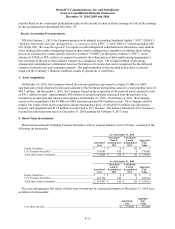

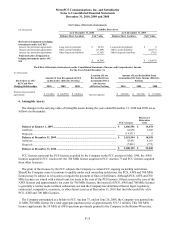

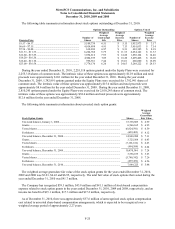

Maturities of the principal amount of long-term debt, excluding capital lease obligations, at face value are as

follows (in thousands):

For the Year Endin

g

December 31,

2011 .................................................................................................................................................................. $ 16,000

2012 .................................................................................................................................................................. 16,000

2013 .................................................................................................................................................................. 536,363

2014 .................................................................................................................................................................. 10,390

2015 .................................................................................................................................................................. 10,390

Thereafte

r

......................................................................................................................................................... 2,942,857

Total ................................................................................................................................................................. $ 3,532,000

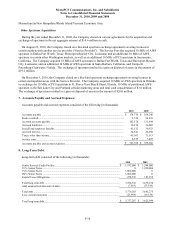

9¼% Senior Notes due 2014

On November 3, 2006, Wireless completed the sale of $1.0 billion of principal amount of 9¼% Senior Notes due

2014, (the “Initial Notes”). On June 6, 2007, Wireless completed the sale of an additional $400.0 million of 91/4%

Senior Notes due 2014 (the “Additional Notes”) under the existing indenture governing the Initial Notes at a price

equal to 105.875% of the principal amount of such Additional Notes. On January 20, 2009, Wireless completed the

sale of an additional $550.0 million of 9¼% Senior Notes due 2014 (the “New 9¼% Senior Notes” and, together

with the Initial Notes and Additional Notes, the “9¼% Senior Notes”) under a new indenture substantially similar to

the indenture governing the Initial Notes at a price equal to 89.50% of the principal amount of such New 9¼%

Senior Notes.

On September 21, 2010, Wireless completed a cash tender offer to purchase $313.1 million of outstanding

aggregate principal amount of the Initial Notes and Additional Notes at a price equal to 104.625% for total cash

consideration of $327.5 million, which resulted in a loss on extinguishment of debt in the amount of $15.6 million.

In November 2010, Wireless completed the redemption of the remaining $1.6 billion in outstanding 9¼% Senior

Notes at a price equal to 104.625% for total cash consideration of $1.7 billion. The redemption resulted in a loss on

extinguishment of debt in the amount of $128.0 million.

7Ǭ% Senior Notes due 2018

On September 21, 2010, Wireless completed the sale of $1.0 billion of principal amount of 7Ǭ% Senior Notes

due 2018 (“7Ǭ% Senior Notes”). The terms of the 7Ǭ% Senior Notes are governed by the indenture and the first

supplemental indenture, dated September 21, 2010, among Wireless, the guarantors party thereto and the trustee.

The net proceeds of the sale of the 7Ǭ% Senior Notes were $973.9 million after underwriter fees, discounts and

other debt issuance costs of $26.1 million.

6з% Senior Notes due 2020

On November 17, 2010, Wireless completed the sale of $1.0 billion of principal amount of 6з% Senior Notes

due 2020 (“6з% Senior Notes”). The terms of the 6з% Senior Notes are governed by the indenture and the second

supplemental indenture, dated November 17, 2010, among Wireless, the guarantors party thereto and the trustee.

The net proceeds of the sale of the 6з% Senior Notes were $987.9 million after underwriter fees, discounts and

other debt issuance costs of approximately $12.1 million.

Senior Secured Credit Facility

Wireless entered into the Senior Secured Credit Facility, as amended, which consists of a $1.6 billion term loan

facility and a $100.0 million revolving credit facility. On November 3, 2006, Wireless borrowed $1.6 billion under

the Senior Secured Credit Facility. The term loan facility is repayable in quarterly installments in annual aggregate

amounts equal to 1% of the initial aggregate principal amount of $1.6 billion. The term loan facility will mature in

November 2013 and the revolving credit facility will mature in November 2011.