Metro PCS 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-16

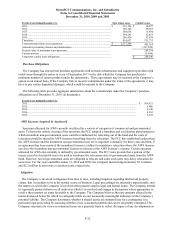

Massachusetts/New Hampshire/Rhode Island/Vermont Economic Area.

Other Spectrum Acquisitions

During the year ended December 31, 2009, the Company closed on various agreements for the acquisition and

exchange of spectrum in the net aggregate amount of $14.6 million in cash.

On August 23, 2010, the Company closed on a like-kind spectrum exchange agreement covering licenses in

certain markets with another service provider (“Service Provider”). The Service Provider acquired 10 MHz of AWS

spectrum in Dallas/Fort Worth, Texas; Shreveport-Bossier City, Louisiana; and an additional 10 MHz of AWS

spectrum in certain other Washington markets, as well as an additional 10 MHz of PCS spectrum in Sacramento,

California. The Company acquired 10 MHz of AWS spectrum in Dallas/Fort Worth, Texas and Shreveport-Bossier

City, Louisiana; and an additional 10 MHz of AWS spectrum in Santa Barbara, California, and Tampa-St.

Petersburg-Clearwater, Florida. The exchange of spectrum resulted in a gain on disposal of assets in the amount of

$19.2 million.

On December 1, 2010, the Company closed on a like-kind spectrum exchange agreement covering licenses in

certain metropolitan areas with the Service Provider. The Company acquired 10 MHz of AWS spectrum in Orlando

in exchange for 10 MHz of PCS spectrum in Ft. Pierce-Vero Beach-Stuart, Florida, 10 MHz of partitioned AWS

spectrum in the Salt Lake City and Portland cellular marketing areas and total cash consideration of $3.0 million.

The exchange of spectrum resulted in a gain on disposal of assets in the amount of $26.6 million.

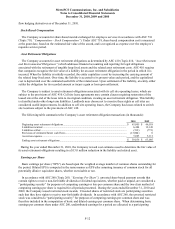

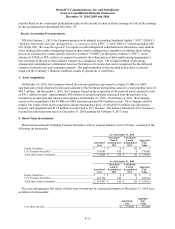

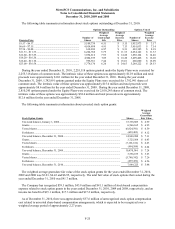

7. Accounts Payable and Accrued Expenses:

Accounts payable and accrued expenses consisted of the following (in thousands):

2010 2009

Accounts payable ..........................................................................................................................

.

$ 174,770 $ 164,246

Book overdraft ...............................................................................................................................

.

1,726 84,438

Accrued accounts payable .............................................................................................................

.

162,378 131,644

Accrued liabilities ..........................................................................................................................

.

30,819 26,009

Payroll and employee benefits .......................................................................................................

.

43,132 30,923

Accrued interest .............................................................................................................................

.

34,541 42,098

Taxes, other than income ...............................................................................................................

.

65,503 71,513

Income taxes ..................................................................................................................................

.

8,919 7,495

Accounts payable and accrued expenses .......................................................................................

.

$ 521,788 $ 558,366

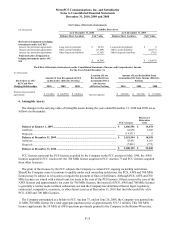

8. Long-Term Debt:

Long-term debt consisted of the following (in thousands):

2010 2009

Senior Secured Credit Facility ................................................................................................

.

$ 1,532,000 $ 1,548,000

9¼% Senior Notes ..................................................................................................................

.

0 1,950,000

7Ǭ% Senior Notes ..................................................................................................................

.

1,000,000 0

6з% Senior Notes ..................................................................................................................

.

1,000,000 0

Capital Lease Obligations .......................................................................................................

.

254,336 181,194

Total long-term debt ...............................................................................................................

.

3,786,336 3,679,194

Add: unamortized discount on debt ........................................................................................

.

(7,053) (33,919)

Total debt ................................................................................................................................

.

3,779,283 3,645,275

Less: current maturities ..........................................................................................................

.

(21,996) (19,326)

Total long-term debt ...............................................................................................................

.

$ 3,757,287 $ 3,625,949