Metro PCS 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-23

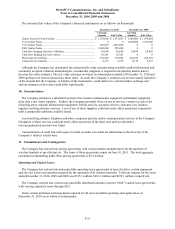

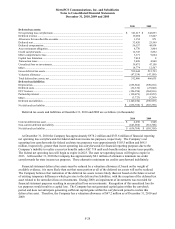

the matters in which it is involved. It is possible, however, that the Company’s business, financial condition and

results of operations in future periods could be materially adversely affected by increased expense, including legal

and litigation expenses, significant settlement costs and/or unfavorable damage awards relating to such matters.

Other than the matter listed below, the Company is not currently party to any pending legal proceedings that it

believes could, individually or in the aggregate, have a material adverse effect on the Company’s financial

condition, results of operations or liquidity.

The Company, certain current officers and a director (collectively, the “Defendants”) have been named as

defendants in a securities class action lawsuit filed on December 15, 2009 in the United States District Court for the

Northern District of Texas, Civil Action No. 3:09-CV-2392. Plaintiff alleges that the defendants violated Section

10(b) of the Exchange Act and Rule 10b-5 thereunder, and Section 20(a) of the Exchange Act. The complaint

alleges that the defendants made false and misleading statements about the Company’s business, prospects and

operations. The claims are based upon various alleged public statements made during the period from February 26,

2009 through November 4, 2009. The lawsuit seeks, among other relief, a determination that the alleged claims may

be asserted on a class-wide basis, unspecified compensatory damages, attorneys’ fees, other expenses, and costs.

Defendants’ filed a motion to dismiss on August 9, 2010. Plaintiff filed its opposition to Defendant’s motion to

dismiss on September 8, 2010, and Defendants’ reply was filed on October 8, 2010. No hearing has been scheduled

on Defendant’s motion to dismiss. Due to the complex nature of the legal and factual issues involved in this action,

the outcome is not presently determinable nor is a loss considered probable or reasonably estimatable. If this matter

were to proceed beyond the pleading stage, the Company could be required to incur substantial costs and expenses

to defend this matter and/or be required to pay substantial damages or settlement costs, which could materially

adversely affect the Company’s business, financial condition and results of operations.

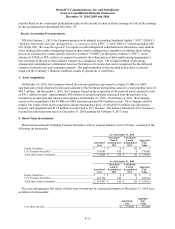

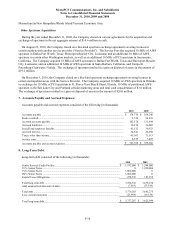

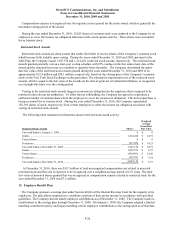

12. Share-Based Payments:

In accordance with ASC 718, the Company recognizes stock-based compensation expense in an amount equal to

the fair value of share-based payments, which includes stock options granted and restricted stock awards to

employees and non-employee members of MetroPCS’ Board of Directors. The Company records stock-based

compensation expense in cost of service and selling, general and administrative expenses. Stock-based

compensation expense was $46.5 million, $47.8 million and $41.1 million for the years ended December 31, 2010,

2009 and 2008, respectively. Cost of service for the years ended December 31, 2010, 2009 and 2008 includes $3.5

million, $4.2 million and $2.9 million, respectively, of stock-based compensation. Selling, general and

administrative expenses for the years ended December 31, 2010, 2009 and 2008 include $43.0 million, $43.6 million

and $38.2 million, respectively, of stock-based compensation.

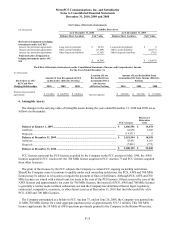

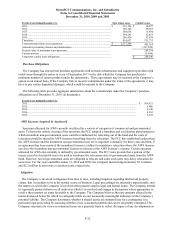

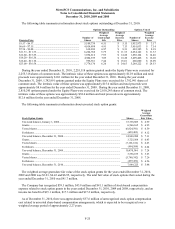

Stock Option Grants

MetroPCS has three equity compensation plans (the “Equity Plans”) under which it grants options to purchase

common stock of MetroPCS: the Second Amended and Restated 1995 Stock Option Plan, as amended (“1995

Plan”), the Amended and Restated 2004 Equity Incentive Compensation Plan (“2004 Plan”), and the MetroPCS

Communications, Inc. 2010 Equity Incentive Compensation Plan (“2010 Plan”). The 1995 Plan was terminated in

November 2005 and no further awards can be made under the 1995 Plan, but all options previously granted will

remain valid in accordance with their original terms. In February 2007, the 2004 Plan was amended to increase the

number of shares of common stock reserved for issuance under the plan from 18,600,000 to a total of

40,500,000 shares. In June 2010, shareholders of MetroPCS Communications, Inc. approved the adoption of the

2010 Plan which authorized a reserve of up to 18,075,825 shares of common stock for issuance under the 2010 Plan.

As of December 31, 2010, the maximum number of shares reserved for the 2004 Plan and the 2010 Plan was

58,575,825 shares. Vesting periods and terms for stock option grants are determined by the plan administrator,

which is MetroPCS’ Board of Directors for the 1995 Plan and the Compensation Committee of the Board of

Directors of MetroPCS for the 2004 Plan and the 2010 Plan. No option granted under the 1995 Plan has a term in

excess of fifteen years and no option granted under the 2004 Plan and the 2010 Plan shall have a term in excess of

ten years. Options granted during the years ended December 31, 2010, 2009 and 2008 have a vesting period of one

to four years and are only exercisable upon vesting.