Metro PCS 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-29

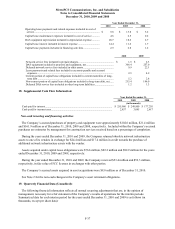

Audits and Uncertain Tax Positions

The Company files income tax returns in the U.S. federal and certain state jurisdictions and is subject to

examinations by the Internal Revenue Service (the “IRS”) and other taxing authorities. These audits can result in

adjustments of taxes due or adjustments of the net operating losses which are available to offset future taxable

income. The Company’s estimate of the potential outcome of any uncertain tax issue prior to audit is subject to

management’s assessment of relevant risks, facts, and circumstances existing at that time. An unfavorable result

under audit may reduce the amount of federal and state net operating losses the Company has available for

carryforward to offset future taxable income, or may increase the amount of tax due for the period under audit,

resulting in an increase to the effective rate in the year of resolution.

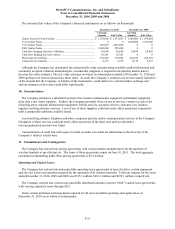

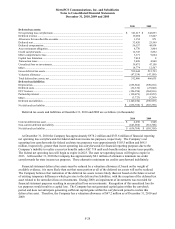

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits are as follows (in

thousands):

2010 2009 2008

Balance at beginning of perio

d

............................................................................... $ 6,084 $ 19,328 $ 19,328

Increases for tax provisions taken during a prior perio

d

......................................... 0 0 0

Increases for tax provisions taken during the current perio

d

.................................. 0 0 0

Decreases relating to settlements ............................................................................ 0 0 0

Decreases resulting from the expiration of the statute of limitations...................... 0 (13,244) 0

Balance at end of perio

d

......................................................................................... $ 6,084 $ 6,084 $ 19,328

The net amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate is $4.0

million and $4.0 million as of December 31, 2010 and 2009, respectively. Additionally, the net interest and

penalties which would affect the effective tax rate is $5.3 million and $5.0 million as of December 31, 2010 and

2009, respectively. The Company continues to recognize both interest and penalties related to unrecognized tax

benefits as a component of income tax expense. The Company recognized gross interest and penalties of $0.4

million, $0.8 million and $2.5 million during the years ended December 31, 2010, 2009 and 2008, respectively.

Accrued gross interest and penalties were $6.9 million and $6.5 million as of December 31, 2010 and 2009,

respectively.

A state examination is currently ongoing and the Company believes it is reasonably possible that the amount of

unrecognized tax benefits could decrease within the next 12 month period. The Company does not anticipate that a

proposed adjustment would result in a material change to the Company’s financial position. The gross unrecognized

tax benefits could change due to settlement with this state in an amount up to $2.8 million. In addition, there is a

state income tax examination currently in progress for the Company and/or certain of its subsidiaries for various tax

years. Management does not believe this examination will have a significant effect on the Company’s tax position.

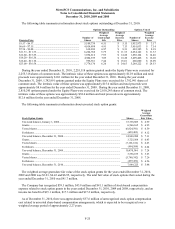

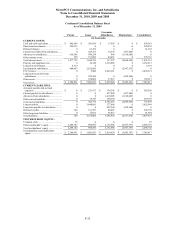

15. Net Income per Common Share:

The following table sets forth the computation of basic and diluted net income per common share for the periods

indicated (in thousands, except share and per share data):