Metro PCS 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-12

flow hedging derivatives as of December 31, 2010.

Stock-Based Compensation

The Company accounts for share-based awards exchanged for employee services in accordance with ASC 718

(Topic 718, “Compensation – Stock Compensation”). Under ASC 718, share-based compensation cost is measured

at the grant date, based on the estimated fair value of the award, and is recognized as expense over the employee’s

requisite service period.

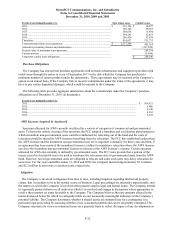

Asset Retirement Obligations

The Company accounts for asset retirement obligations as determined by ASC 410 (Topic 410, “Asset Retirement

and Environmental Obligations”) which addresses financial accounting and reporting for legal obligations

associated with the retirement of tangible long-lived assets and the related asset retirement costs. ASC 410 requires

that companies recognize the fair value of a liability for an asset retirement obligation in the period in which it is

incurred. When the liability is initially recorded, the entity capitalizes a cost by increasing the carrying amount of

the related long-lived asset. Over time, the liability is accreted to its present value each period, and the capitalized

cost is depreciated over the estimated useful life of the related asset. Upon settlement of the liability, an entity either

settles the obligation for its recorded amount or incurs a gain or loss upon settlement.

The Company is subject to asset retirement obligations associated with its cell site operating leases, which are

subject to the provisions of ASC 410. Cell site lease agreements may contain clauses requiring restoration of the

leased site at the end of the lease term to its original condition, creating an asset retirement obligation. This liability

is classified under other long-term liabilities. Landlords may choose not to exercise these rights as cell sites are

considered useful improvements. In addition to cell site operating leases, the Company has leases related to switch

site locations subject to the provisions of ASC 410.

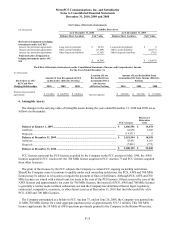

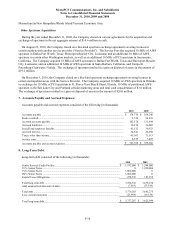

The following table summarizes the Company’s asset retirement obligation transactions (in thousands):

2010 2009

Beginning asset retirement obligations .............................................................................................. $ 63,005 $ 46,518

Liabilities incurre

d

............................................................................................................................ 6,484 12,149

Liabilities settle

d

............................................................................................................................... (512) (773)

Revisions of estimated future cash flows........................................................................................... (13,004) 0

Accretion expense ............................................................................................................................. 3,063 5,111

Ending asset retirement obligations ................................................................................................... $ 59,036 $ 63,005

During the year ended December 31, 2010, the Company revised cost estimates used to determine the fair value of

its asset retirement obligations resulting in a $13.0 million reduction in the liability and related asset.

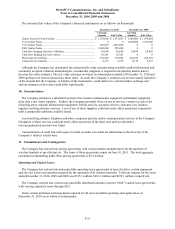

Earnings per Share

Basic earnings per share (“EPS”) are based upon the weighted average number of common shares outstanding for

the period. Diluted EPS is computed in the same manner as EPS after assuming issuance of common stock for all

potentially dilutive equivalent shares, whether exercisable or not.

In accordance with ASC 260 (Topic 260, “Earnings Per Share”), unvested share-based payment awards that

contain rights to receive non-forfeitable dividends or dividend equivalents, whether paid or unpaid, are considered a

“participating security” for purposes of computing earnings or loss per common share and the two-class method of

computing earnings per share is required for all periods presented. During the years ended December 31, 2010 and

2009, the Company issued restricted stock awards. Unvested shares of restricted stock are participating securities

such that they have rights to receive non-forfeitable dividends. In accordance with ASC 260, the unvested restricted

stock was considered a “participating security” for purposes of computing earnings per common share and was

therefore included in the computation of basic and diluted earnings per common share. When determining basic

earnings per common share under ASC 260, undistributed earnings for a period are allocated to a participating