Metro PCS 2010 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-26

Compensation expense is recognized over the requisite service period for the entire award, which is generally the

maximum vesting period of the award.

During the year ended December 31, 2010, 55,625 shares of common stock were tendered to the Company by an

employee to cover the income tax obligation allocation with a stock option exercise. These shares were accounted

for as treasury stock.

Restricted Stock Awards

Restricted stock awards are share awards that entitle the holder to receive shares of the Company’s common stock

which become fully tradable upon vesting. During the years ended December 31, 2010 and 2009, pursuant to the

2004 Plan, the Company issued 1,947,574 and 1,414,410, restricted stock awards, respectively. The restricted stock

awards granted generally vest on a four-year vesting schedule with 25% vesting on the first anniversary date of the

award and the remainder pro-rata on a monthly or quarterly basis thereafter. The Company determined the grant-

date fair value of the restricted stock awards granted during the years ended December 31, 2010 and 2009 to be

approximately $12.8 million and $20.1 million, respectively, based on the closing price of the Company’s common

stock on the New York Stock Exchange on the grant dates. The estimated compensation cost of the restricted stock

awards, which is equal to the fair value of the awards on the date of grant net of estimated forfeitures, is recognized

on a straight-line basis over the vesting period.

Vesting in the restricted stock awards triggers an income tax obligation for the employee that is required to be

remitted to the relevant tax authorities. To effect the tax withholding, the Company has agreed to repurchase a

sufficient number of common shares from the employee to cover the income tax obligation. The stock repurchase is

being accounted for as treasury stock. During the year ended December 31, 2010, the Company repurchased

182,193 shares of stock, respectively, from certain employees to settle the income tax obligation associated with

vesting in restricted stock awards.

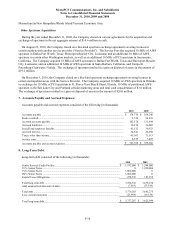

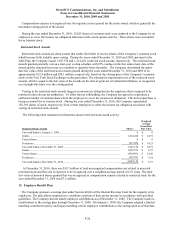

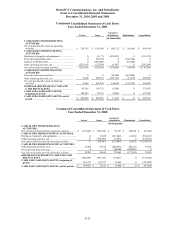

The following table summarizes information about restricted stock award activity:

Restricted Stock Awards Shares

Weighted

Average

Grant-Date

Fair Value

Unvested balance, January 1, 2009 ........................................................................................... 0 $ 0

Grants ....................................................................................................................................... 1,414,410 $ 14.19

Vested shares ............................................................................................................................ 0 $ 0

Forfeitures ................................................................................................................................ (47,240) $ 14.23

Unvested balance, Decembe

r

31, 2009 ..................................................................................... 1,367,170 $ 14.19

Grants ....................................................................................................................................... 1,947,574 $ 6.57

Vested shares ............................................................................................................................ (589,903) $ 14.20

Forfeitures ................................................................................................................................ (59,731) $ 9.34

Unvested balance, Decembe

r

31, 2010 ..................................................................................... 2,665,110 $ 8.73

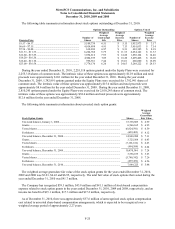

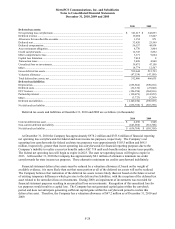

At December 31, 2010, there was $18.7 million of total unrecognized compensation cost related to unvested

restricted stock and that cost is expected to be recognized over a weighted-average period of 2.91 years. The total

fair value of unvested shares granted that was recognized as compensation expense related to restricted stock for the

year ended December 31, 2010 was $7.2 million.

13. Employee Benefit Plan:

The Company sponsors a savings plan under Section 401(k) of the Internal Revenue Code for the majority of its

employees. The plan allows employees to contribute a portion of their pretax income in accordance with specified

guidelines. The Company did not match employee contributions as of December 31, 2008. The Company made no

contributions to the savings plan through December 31, 2008. On January 1, 2009, the Company adopted a limited

matching contribution policy and began matching certain employee contributions to the savings plan as of that date.