Metro PCS 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 67

include, the obligation and resulting costs to relocate existing fixed microwave users of our licensed spectrum if the

use of our spectrum interfered with their systems and/or reimburse other carriers (according to FCC rules) that

relocated prior users if the relocation benefits our system. Accordingly, we incurred costs related to microwave

relocation in constructing our PCS and AWS networks. FCC licenses and microwave relocation costs are recorded

at cost. Although FCC licenses are issued with a stated term, ten years in the case of PCS licenses, fifteen years in

the case of AWS licenses and ten years for 700 MHz licenses, the renewal of PCS, AWS and 700 MHz licenses is

generally a routine matter without substantial cost and we have determined that no legal, regulatory, contractual,

competitive, economic, or other factors exist as of December 31, 2010 that limit the useful life of our PCS, AWS

and 700 MHz licenses.

Our indefinite-lived intangible assets are our PCS, AWS and 700 MHz licenses and microwave relocation costs.

Based on the requirements of ASC 350 (Topic 350, “Intangibles-Goodwill and Other”), we test investments in our

indefinite-lived intangible assets for impairment annually or more frequently if events or changes in circumstances

indicate that the carrying value of our indefinite-lived intangible assets might be impaired. We perform our annual

indefinite-lived intangible assets impairment test as of each September 30th. The impairment test consists of a

comparison of the estimated fair value with the carrying value. An impairment loss would be recorded as a

reduction in the carrying value of the related indefinite-lived intangible assets and charged to results of operations.

We used an income approach, the Greenfield Methodology, to provide an indication of fair value for our

indefinite-lived intangible assets. Such methodology is based on the cash flow generating potential of a hypothetical

start-up operation and assumes that the only assets upon formation are the underlying FCC licenses, and that the

business enterprise does not have any other assets including goodwill or going concern value at the date of

inception. The start-up assumptions include utilization of the asset in its highest and best use and incorporate market

participant assumptions for key factors, such as current and future technology, costs of telecommunications

equipment, and workforce costs, considering the opportunities and constraints of the underlying spectrum as of the

valuation date.

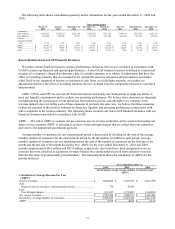

Cash flow projections and assumptions, although subject to a degree of uncertainty, are based on a combination

of our historical performance and trends, our business plans and management’s estimate of future performance,

giving consideration to existing and anticipated competitive economic conditions. Other assumptions include a

weighted average cost of capital and long-term rate of growth for our business. We believe that our estimates are

consistent with assumptions that market participants would use to estimate fair value. For the purpose of performing

the annual impairment test as of September 30, 2010, our indefinite-lived intangible assets were aggregated and

combined into a single unit of accounting. We believe that utilizing our indefinite-lived intangible assets as a group

represents the highest and best use of the assets, and the value of the indefinite-lived intangible assets would not be

significantly impacted by a sale of one or a portion of the indefinite-lived intangible assets, among other factors. No

impairment was recognized as the fair value of our indefinite-lived intangible assets was in excess of their carrying

value as of September 30, 2010.

Historically, we have not experienced significant negative variations between our assumptions and estimates

when compared to actual results. However, if actual results are not consistent with our assumptions and estimates,

we may be required to record an impairment charge associated with indefinite-lived intangible assets. Although we

do not expect our estimates or assumptions to change significantly in the future, the use of different estimates or

assumptions within our discounted cash flow model when determining the fair value of our indefinite-lived

intangible assets or using a methodology other than a discounted cash flow model could result in different values for

our indefinite-lived intangible assets and may affect any related impairment charge. The most significant

assumptions within our discounted cash flow model are the discount rate, our projected growth rate and

management’s future business plans. A one percent decline in annual revenue growth rates, a one percent decline in

annual net cash flows or a one percent increase in discount rate would not result in impairment as of September 30,

2010.

Indefinite-lived intangible assets must be tested between annual tests if events or changes in circumstances

indicate that the asset might be impaired. These events or circumstances could include a significant change in the

business climate, including a significant sustained decline in an entity’s market value, legal factors, operating

performance indicators, competition, sale or disposition of a significant portion of the business, or other factors. We

reviewed changes in the business climate, changes in market capitalization, legal factors, operating performance

indicators and competition, among other factors and their potential impact on our fair value determination. There

have been no significant changes in any of these factors that have adversely affected any of the key assumptions

used in our determination of fair value. Furthermore, if any of our indefinite-lived intangible assets are subsequently