Metro PCS 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-22

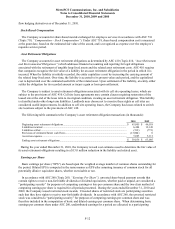

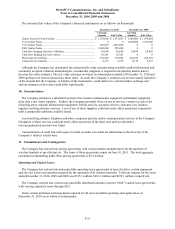

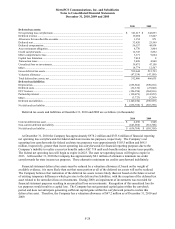

For the Year Ending December 31, Operating Leases Capital Leases

2011 ...........................................................................................................................

.

$ 312,706 $ 30,077

2012 ...........................................................................................................................

.

305,120 30,967

2013 ...........................................................................................................................

.

308,656 31,896

2014 ...........................................................................................................................

.

304,281 32,853

2015 ...........................................................................................................................

.

296,426 33,839

Thereafte

r

..................................................................................................................

.

810,057 331,733

Total minimum future lease payments .......................................................................

.

$ 2,337,246 491,365

Amount representing interest and maintenance .........................................................

.

(237,029)

Present value of minimum lease

p

ayments ................................................................

.

254,336

Current portion ..........................................................................................................

.

(5,996)

Long-term capital lease obligations ...........................................................................

.

$ 248,340

Purchase Obligations

The Company has entered into purchase agreements with network infrastructure and equipment providers with

initial terms through the earlier to occur of September 2013 or the date which the Company has purchased a

minimum number of certain products under the agreements. These agreements may be renewed at the Company’s

option on an annual basis. If the Company fails to meet its commitments under the terms of the agreements, it may

have to pay certain liquidated damages, which would be material to the Company.

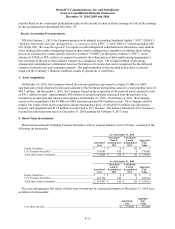

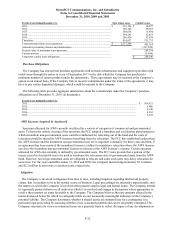

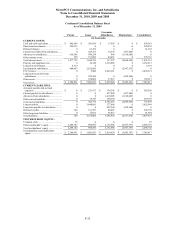

The following table provides aggregate information about the commitments under the Company’s purchase

obligations as of December 31, 2010 (in thousands):

For the Year Endin

g

December 31,

2011 .................................................................................................................................................................. $ 109,421

2012 .................................................................................................................................................................. 4,886

2013 .................................................................................................................................................................. 4,140

2014 .................................................................................................................................................................. 4,265

2015 .................................................................................................................................................................. 4,392

AWS Licenses Acquired in Auction 66

Spectrum allocated for AWS currently is utilized by a variety of categories of commercial and governmental

users. To foster the orderly clearing of the spectrum, the FCC adopted a transition and cost sharing plan pursuant to

which incumbent non-governmental users could be reimbursed for relocating out of the band and the costs of

relocation would be shared by AWS licensees benefiting from the relocation. The FCC has established a plan where

the AWS licensee and the incumbent non-governmental user are to negotiate voluntarily for three years and then, if

no agreement has been reached, the incumbent licensee is subject to mandatory relocation where the AWS licensee

can force the incumbent non-governmental licensee to relocate at the AWS licensee’s expense. Certain spectrum

allocated for AWS also currently is utilized by governmental users. The FCC rules provide that a portion of the

money raised in Auction 66 was to be used to reimburse the relocation costs of governmental users from the AWS

band. However, not all governmental users are obligated to relocate and some such users may delay relocation for

some time. For the years ended December 31, 2010 and 2009, the Company incurred approximately $3.4 million

and $2.2 million in microwave relocation costs, respectively.

Litigation

The Company is involved in litigation from time to time, including litigation regarding intellectual property

claims, that it considers to be in the normal course of business. Legal proceedings are inherently unpredictable, and

the matters in which the Company is involved often present complex legal and factual issues. The Company intends

to vigorously pursue defenses in all matters in which it is involved and engage in discussions where appropriate to

resolve these matters on terms favorable to the Company. The Company believes that any amounts alleged in the

matter discussed below for which it is allegedly liable are not necessarily meaningful indicators of the Company’s

potential liability. The Company determines whether it should accrue an estimated loss for a contingency in a

particular legal proceeding by assessing whether a loss is deemed probable and can be reasonably estimated. The

Company reassesses its views on estimated losses on a quarterly basis to reflect the impact of any developments in